The Bitcoin price has once again seized the spotlight by marking new levels in its price discovery phase, breaking past the key $120K level within the last 24 hours.

This top crypto has advanced 3.7% intraday, 14% in the past week, and nearly 25% over the last 30 days.

However, even as short-term momentum remains strong, yet, key on-chain indicators are beginning to flash caution. These conditions hint further upside in the short term but also build a dangerous situation where a sell-off-led price downturn could trigger a swift correction.

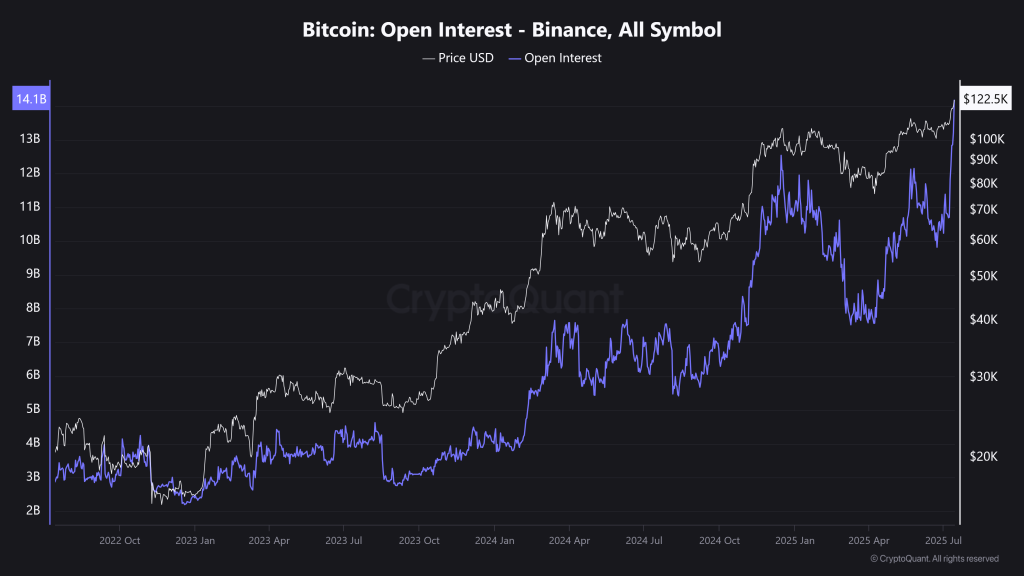

Binance Record OI Hints Rising Traders’ Appetite For Bitcoin

On Binance, the advancement in Bitcoin’s open interest has reached an all-time high of $14.1 billion, marking one of the most notable developments. Per the data from CryptoQuant, it is the largest OI ever recorded, revealing a massive influx of capital into BTC derivatives.

It clearly shows that both retail and institutional traders have heightened risk appetite.

Historically, it is evident that OI build-ups during bullish breakouts can fuel further upside in any asset; that’s what’s repeating in BTC.

Yet, there is also history that suggests these times of high OI build up also heighten the risk of sudden volatility. Because, giant pile of capital is tied up in leveraged contracts, any unexpected price movement can trigger a chain reaction of liquidations, often resulting in swift and unpredictable price swings.

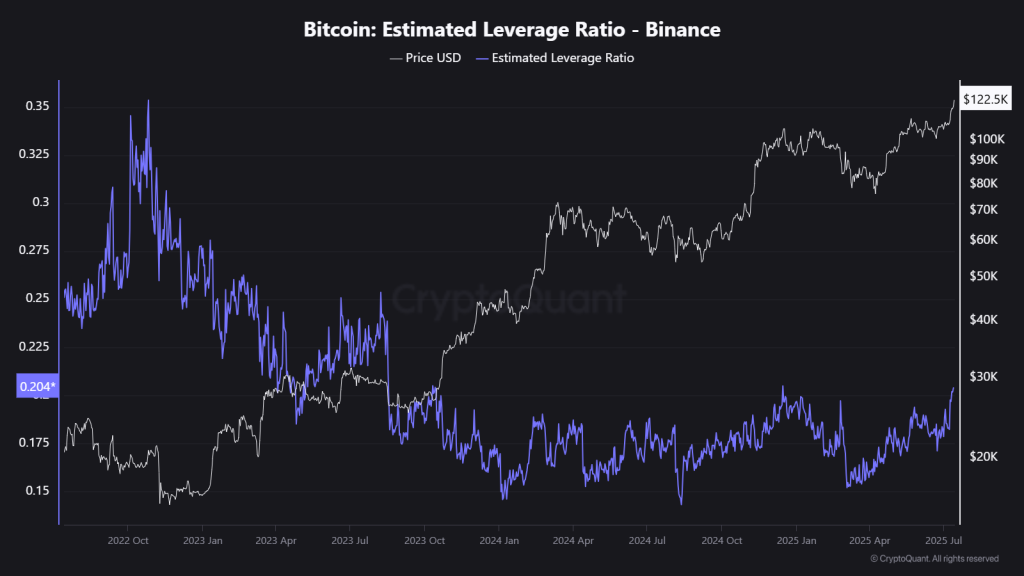

Elevated Leverage Ratio Raises Volatility Risk In BTC’s Momentum

Alongside the surge in open interest on Binance, the estimated leverage ratio on Binance now stands at 0.204, which seems to be approaching levels last seen in August 2023.

This metric is critical as it reveals that a large portion of current open positions of traders are being held with high leverage and are on the rise.

This may sound good from this distance, but elevated leverage could be fearsome and can act like a double-edged sword.

On one hand, it amplifies gains during strong uptrends, which we are already seeing now on BTC price, with the price being in price discovery mode.

On the other hand, it magnifies downside risks significantly, because in such an overheated market, even a slight sell-off could trigger a domino effect with cascading liquidations, intensifying downward momentum.

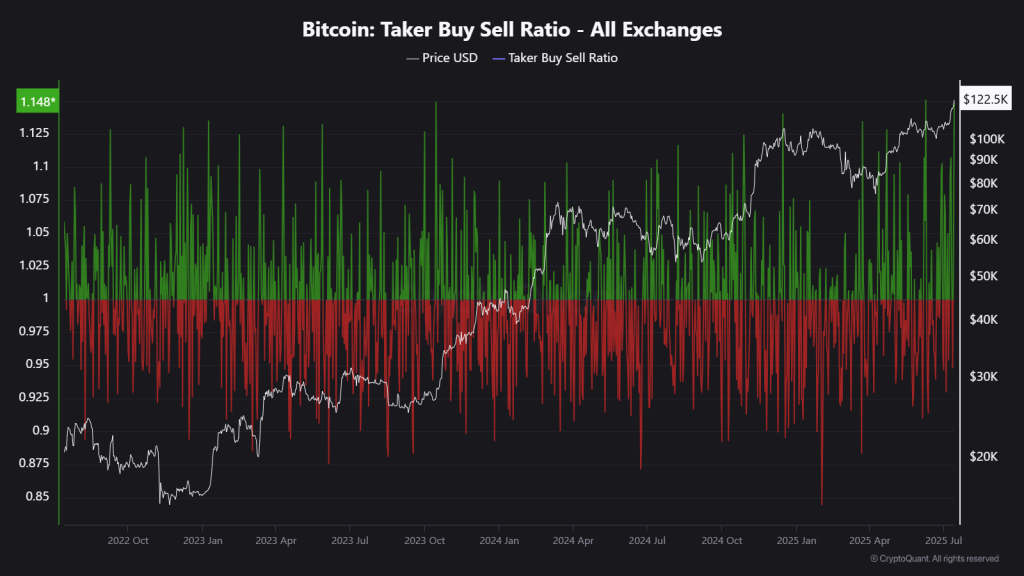

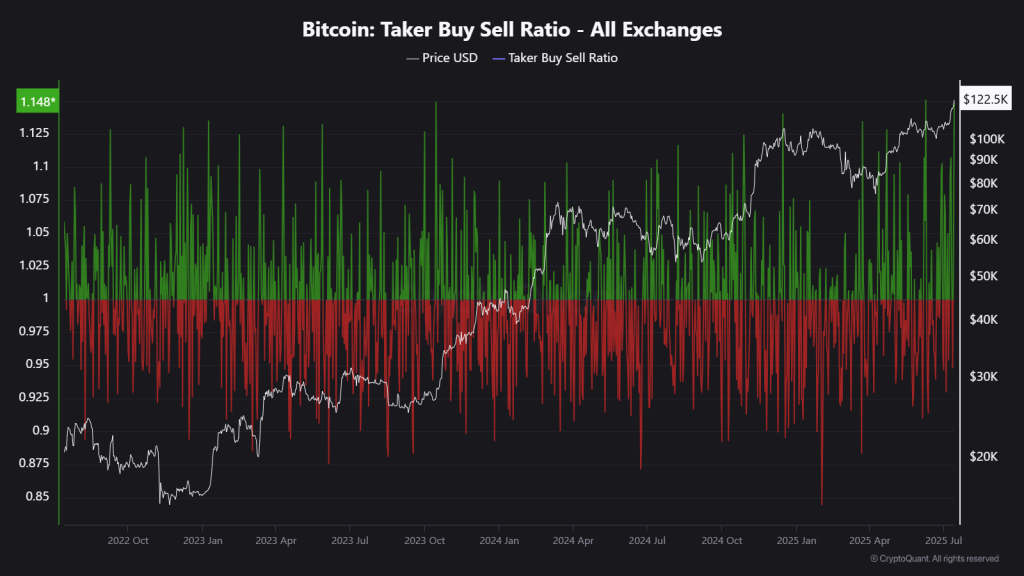

Bitcoin Price Faces Downside Risk: TBSR Ratio Reflects Overheated Sentiment

Adding to the overheated narrative is the taker buy/sell ratio (TBSR), which is now at a multi-month high of 1.14, as revealed on CryptoQuant’s chart.

This ratio, combined with record leverage and open interest, worrisome market conditions, and overheated sentiment, is worrisome.

This kind of bullish dominance could form local tops, as traders unknowingly expect continued gains, unaware that the odds of market sentiment turning bearish can erode gains heavily.

Also, it is worth noting that this ratio has not reached such levels in months, and its at 1.14 is a clear hint towards caution.

Chart Signals Support Rally In Bitcoin Price, but Caution Creeps In

From a technical standpoint, the daily chart of the Bitcoin price remains firmly bullish and has displayed no such shakeouts yet. Also, the recent breakout above $120K confirms that BTC crypto is in a price discovery phase.

Even key momentum indicators on its daily chart, such as MACD and AO, continue to show strength, suggesting that the rally could extend in the short term.

However, some signs of exhaustion are beginning to appear, like RSI has now entered the overheated territory at 78, hinting at an overbought market.

While the CMF has begun to curve downward slightly at 0.23, suggesting that capital inflows are slowing, which is a potential hint to profit-taking events.

If Bitcoin price begins to correct, key support zones lie at $120,000, $116,000, and a more critical level at $110,000. These will be crucial in determining whether BTC consolidates or enters a deeper pullback.