Bitcoin  $117,784.11The price of 118 thousand 404 dollars on July 11, 2025, reassured the record again. Fund flows from corporates, the fall of the supply in the stock exchanges and the US national Bitcoin reserve discussions crypto currencyIncreased the acceleration of the rise. While the transaction volume produced by corporates increased, ETF flows reached billion dollars. This created a strong procurement pressure that disrupts the supply-demand balance. The weakening of the dollar and the increase in the Fed interest rate reduction expectations highlighted Bitcoin as a shelter. Relative power indexAnalysts consider that the analysts are the next target price because the (RSI) still does not enter the extreme purchase zone.

$117,784.11The price of 118 thousand 404 dollars on July 11, 2025, reassured the record again. Fund flows from corporates, the fall of the supply in the stock exchanges and the US national Bitcoin reserve discussions crypto currencyIncreased the acceleration of the rise. While the transaction volume produced by corporates increased, ETF flows reached billion dollars. This created a strong procurement pressure that disrupts the supply-demand balance. The weakening of the dollar and the increase in the Fed interest rate reduction expectations highlighted Bitcoin as a shelter. Relative power indexAnalysts consider that the analysts are the next target price because the (RSI) still does not enter the extreme purchase zone.

Corporate demand rapidly narrows the supply

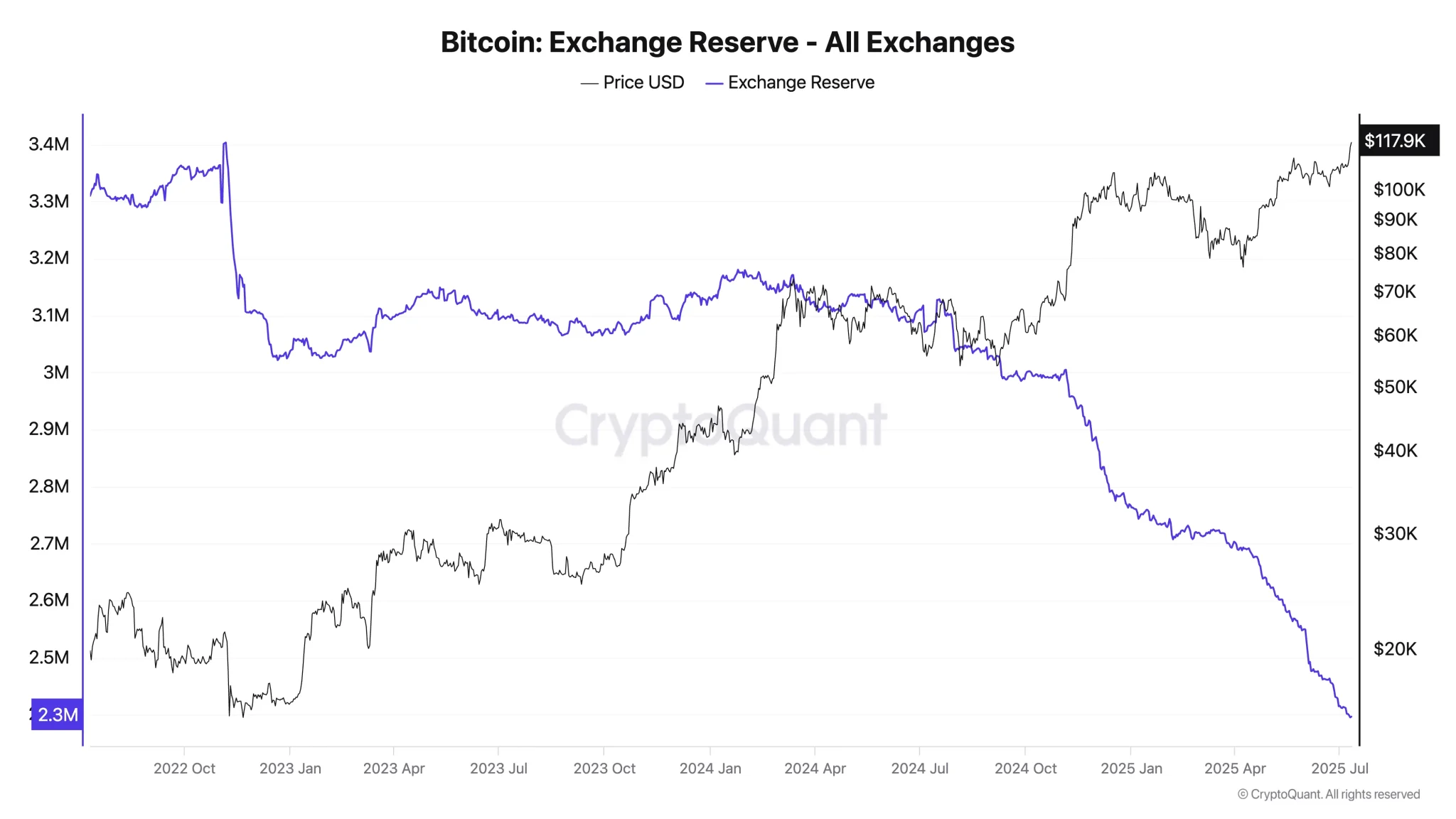

In recent weeks Blackrock, Fidelity And Vaneck Billions of dollars flowed to Spot Bitcoin ETFs of large asset management companies, especially. Moreover, Blockchain presented by Cryptoquant data EXPERIENCE BTC It shows that its quantity has climbed regularly, that is, it reduces sales pressure by moving its assets to cold wallets. For the time being, professional funds and individual investors are on the purchase side at the same time and dry Bitcoin’s circulating supply.

Institutional Fomo While the impact gains strength, Bitcoin’s “digital value storage tool” identity is especially widely accepted in long -term portfolios. While the additional demand created by ETFs absorbs the current supply, the short -relevant Short position liquids accelerate the rise. While the amount of BTC traded in global markets increases, the decrease in the amount of stock exchanges makes Bitcoin more rare as a basis.

Macro winds and technical signals are progressing in parallel

Especially Fed Interest Discount His expectation and the weak dollar has folded the largest crypto money by giving Bitcoin a “safe port” label. Short but powerful price attacks enabled the old resistance to support around 108 thousand dollars. This level now stands out as a critical defense threshold.

Technically, the fact that RSI has not reached the level of procurement indicates that the “hill değil has not yet been seen in the rise. If the price of Bitcoin finds permanence over $ 120,000, analysts envisage a new price reconnaissance zone up to $ 130,000. If this scenario does not occur and if it is seen under 107 thousand dollars, fatigue signals may come to the fore. Nevertheless, the current macro table offers a powerful floor that supports recovery.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.