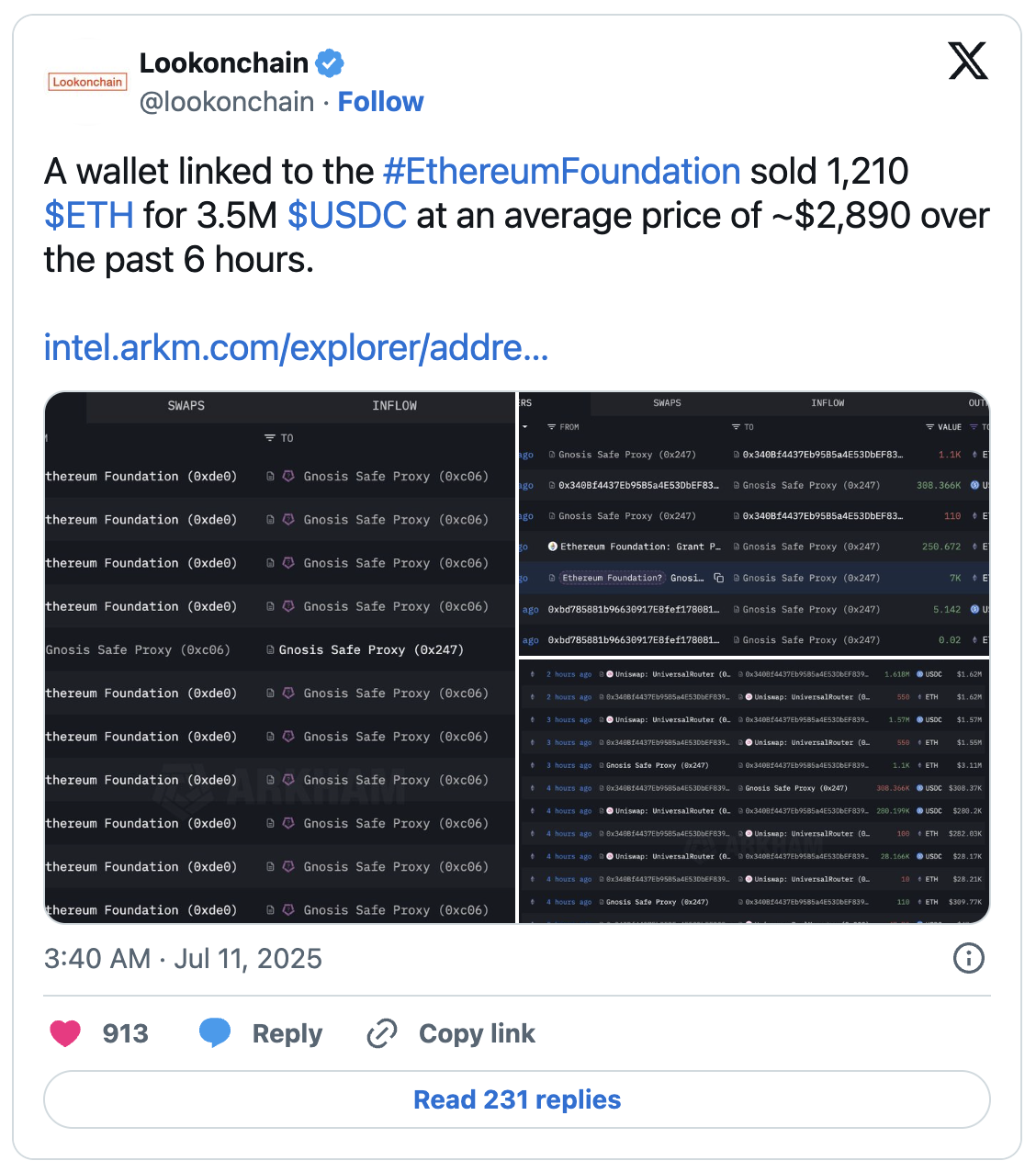

Altcoin Ethereum  $2,780.37The organization behind it Ethereum FoundationOn 11 July 2025, UNİSWAP V4 sold 210 thousand ETHs over an average of 2 thousand 889.50 dollars for about 3.5 million USDC. The process is the last link of the process of transferring 21,000 ETHS, which was collected in the same wallet last month, to different addresses. Today’s sales aim to provide resources for development and ecosystem projects by reflecting the transparent budget policy of the Ethereum Foundation. This consistent sales strategy, which does not disrupt the liquidity of the market, with the instant blockchain data follow -up by Lookonchain confirmed.

$2,780.37The organization behind it Ethereum FoundationOn 11 July 2025, UNİSWAP V4 sold 210 thousand ETHs over an average of 2 thousand 889.50 dollars for about 3.5 million USDC. The process is the last link of the process of transferring 21,000 ETHS, which was collected in the same wallet last month, to different addresses. Today’s sales aim to provide resources for development and ecosystem projects by reflecting the transparent budget policy of the Ethereum Foundation. This consistent sales strategy, which does not disrupt the liquidity of the market, with the instant blockchain data follow -up by Lookonchain confirmed.

The background and timing of asset management

21 thousand pieces collected during last month Eth It was guaranteed in a multi -signed wallet. Then, 7 thousand ETHs distributed to a second address and prepared the ground for the sale today. The Foundation completed the transaction in the Uniswap V4 pool, which provides speed and transparency in the decentralized market. The swap process, where no one puts pressure on the market, was watched instantly by the community thanks to the traceability of the wallet movements.

The aim of the sale is to maintain the balanced treasure management that Ethereum Foundation has long adopted. For the financing of developer grants, research funds and basic operations crypto currencyThis type of swaps made with the institution makes it flexible against uncertain market fluctuations. With this approach, the organization is one of the players who establish confidence in the crypto currency world.

Market response, whale purchases and metrics

ETH’s price for a short period of time to check the 3 thousand dollars of 2 thousand 750 dollars of support found support. Altcoin The king is traded at 3 thousand 5 dollars at the time of the news. While the Ethereum Foundation was selling, corporate and whale wallets have collected $ 358 million in the last 24 hours. This opposite mobility shows the corporate appetite of the market.

In the same period Ethereum networkThe total value of locked assets (TVL) rose from $ 50 billion in three months to $ 73 billion. On the other hand, the transaction fees dropped by 22 percent and reduced the amount of ETH burned. The slow decrease in circulatory supply stands out as one of the reasons for the Ethereum Foundation to be oriented today and ensures liquid resources to meet operational expenses.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.