Traded in the USA Spot Bitcoin  $109,122.26 ETF‘s July 9, 2025 Wednesday for the first time in total net entrances exceeded the $ 50 billion threshold. The data provider Sosovalue reported that it has carried the new net cumulative inputs of $ 218.04 million from 12 funds to $ 50.16 billion. On the same day Bitcoin 112 thousand 152 dollars renewed the record. Analysts are united in the view that this milestone is the turning point in the institutionalization of the largest crypto currency.

$109,122.26 ETF‘s July 9, 2025 Wednesday for the first time in total net entrances exceeded the $ 50 billion threshold. The data provider Sosovalue reported that it has carried the new net cumulative inputs of $ 218.04 million from 12 funds to $ 50.16 billion. On the same day Bitcoin 112 thousand 152 dollars renewed the record. Analysts are united in the view that this milestone is the turning point in the institutionalization of the largest crypto currency.

Spot Bitcoin ETFs flowing capital broke a record

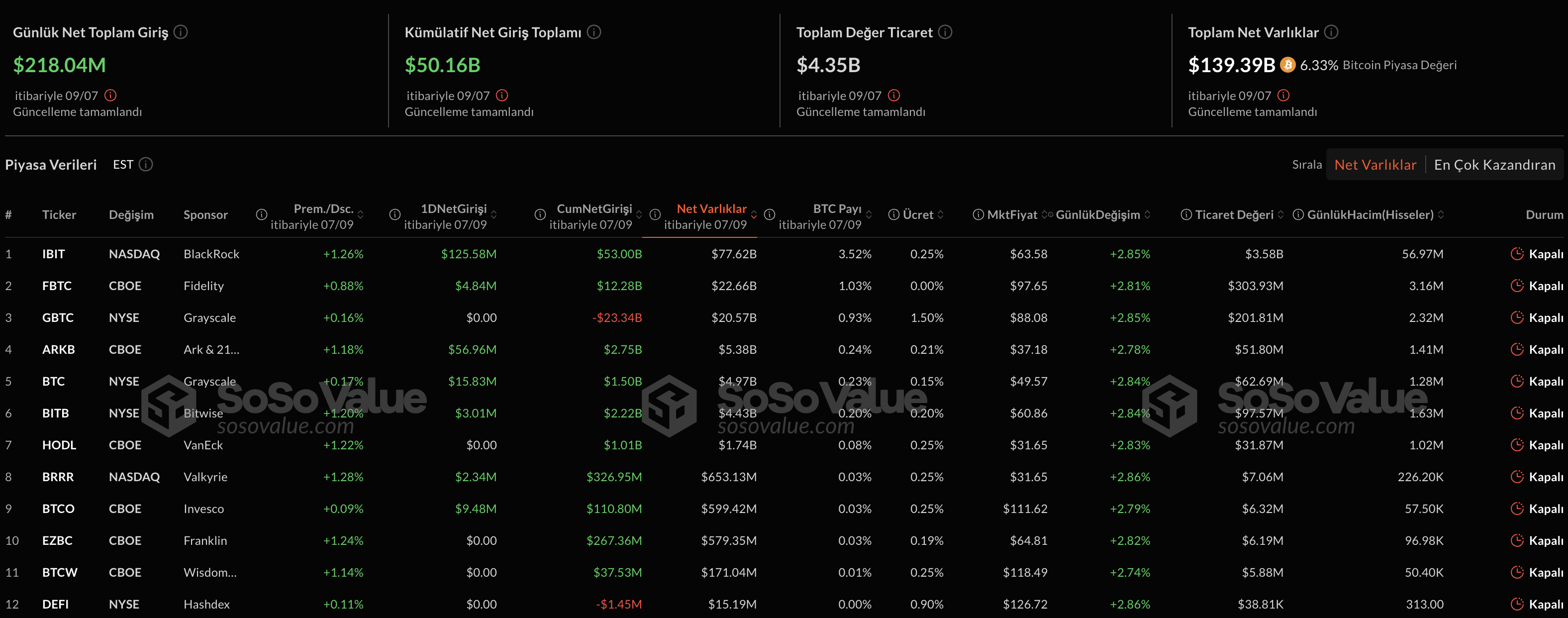

On Wednesday, a positive movement was observed in seven Bitcoin ETF. Blackrock with 125.58 million dollars IBITwhile the head of Ark & 21shares ARKB‘s 56.96 million dollars, Grayscale’s Mini Bitcoin Trust15.83 million dollars of net entry recorded. Fidelity, Bitwise, Valkyrie and Invesco’s ETFs also contributed to this positive picture. This figure, which follows billions of dollars in succession during April, May and June Bitcoin ETFHe confirmed the capacity of their regular, high -volume investment with their. Sosovalue’s data is that only three months of flow exceeded $ 12 billion. shows.

BTC Markets Analyst Rachael Lucas“This level reflects a controlled capital line flowing through asset managers, company crates and wealthy individuals rather than individual excitement,” he said. According to Lucas, geopolitical tensions and US President Donald Trumpdefending aggressive interest rate cuts increased demand for risky assets. ETFs regulated ETFs make interests permanent by offering crypto money access through the same channels with stocks and bond infrastructure.

Corporate capital looks at Bitcoin long -term

Lucas stressed that Bitcoin, which stands out with its fixed supply and global liquidity, has become a long -term macro -asset identity. “This is no longer a sudden rise like 2021, we see a balance sheet allocation, Analyst said the analyst said, regulatory clarity has increased and corporate players take a long -term perspective. Spot ETF The fact that the model offers ease of transparency, protection and reporting attracts great attention with the reduction of the entry barrier of traditional background managers.

$[mcrypto coin=”ETH” currency=”USD”] ETFs 9 July 2025 figures

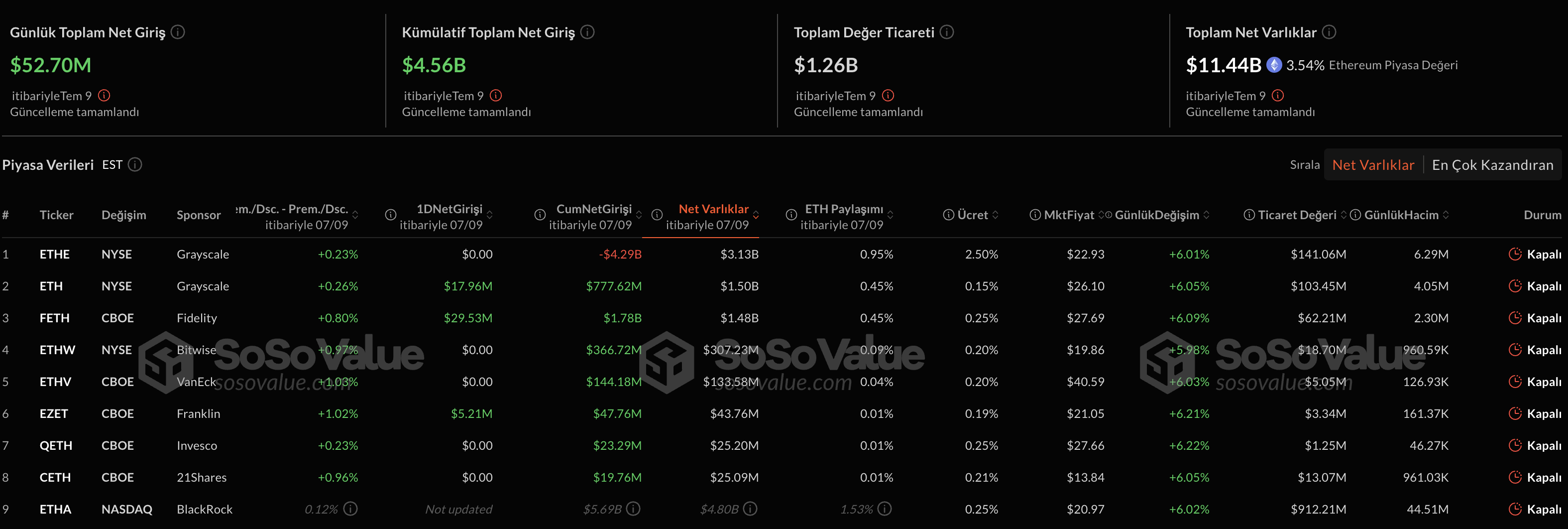

$[mcrypto coin=”ETH” currency=”USD”] ETFs 9 July 2025 figuresMoreover, investor interest is not limited to Bitcoin. Again to Sosovalue’s data according to Spot Ethereum ETF‘s on Wednesday with a capital of 52.70 million dollars to the total net entries to $ 4.56 billion. On the one hand, interest rate cuts expectations in the US, on the other hand, supported the demand for crypto currency, while the decline in geopolitical tension, Bitcoin’s record renewal further accelerated the wave of institutional procurement. Although analysts give volatility warning in the short term, the direction of the fund flows does not seem to have changed for now.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.