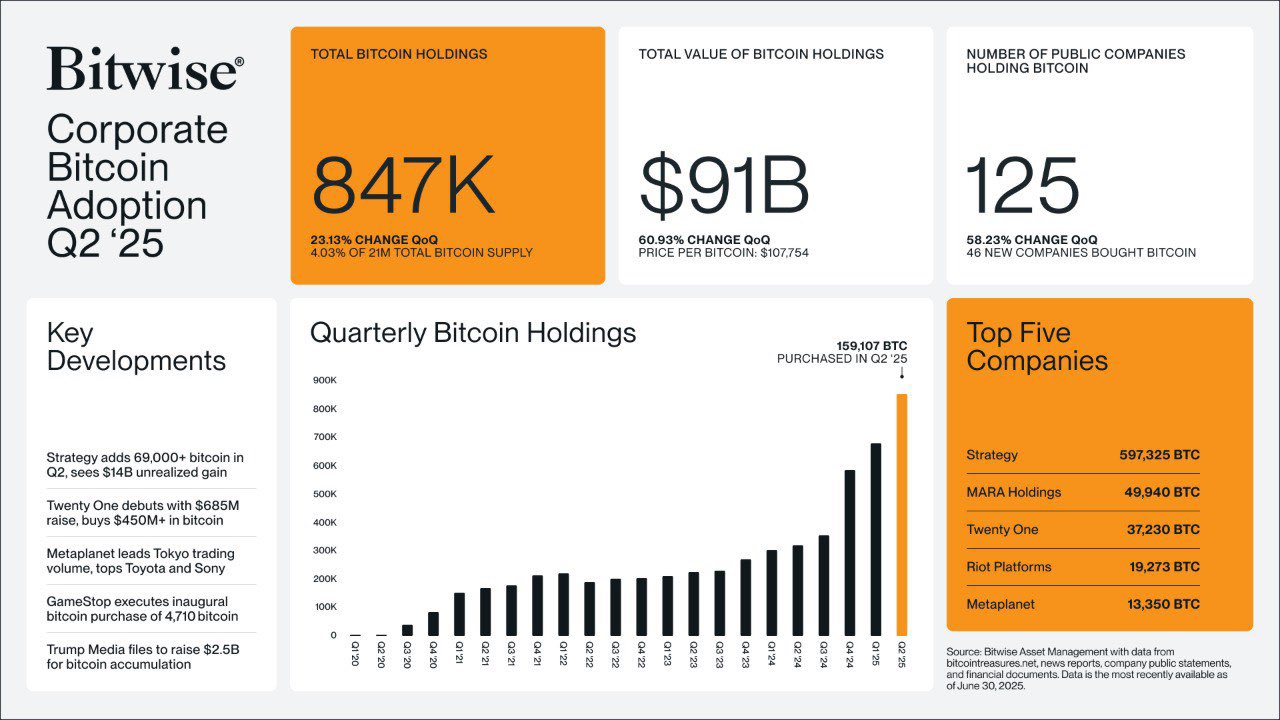

Global companies in the second quarter of the year Bitcoin  $111,190.80 He left behind a new threshold in the competition race. According to Bitwise’s data, they purchased 159 thousand 107 BTCs in only three months and the total institutional Bitcoin Soku increased to 847 thousand BTC. Thus, the presence of BTC in the company’s balance sheets rose to about 4 percent of the total supply. The corporate purchases indicate that there is a 23 percent increase compared to the previous quarter.

$111,190.80 He left behind a new threshold in the competition race. According to Bitwise’s data, they purchased 159 thousand 107 BTCs in only three months and the total institutional Bitcoin Soku increased to 847 thousand BTC. Thus, the presence of BTC in the company’s balance sheets rose to about 4 percent of the total supply. The corporate purchases indicate that there is a 23 percent increase compared to the previous quarter.

Corporate Bitcoin demand at the new summit in the second quarter

Bitwise‘of according to the report The value of Bitcoin in the balance sheet of global companies rose to $ 91 billion. This amount corresponds to a growth of 61 percent in a quarter basis with the price of the price above the $ 100 thousand threshold. The number of companies adding Bitcoin to the balance sheet increased to 125 with a strong increase. It was decisive to include 46 new public companies on this rise.

159 thousand 107 units purchased for a quarter BTC The highest three -month collective purchase has been registered as the highest three -month collective purchase. Explosion in corporate demand crypto currency While showing that the tendency to hold is strengthened, corporate investors point to Bitcoin as long -term value protection against inflation and uncertainties.

Bitcoin Carnet by companies

Leadership, with 597 thousand 325 BTC Strategy While holding it, Mara Holdings 49 thousand 940 BTC and Twenty One 37 thousand 230 BTC’yle BTC’yle took the top of the list. Riot platforms19 thousand 273 BTC and Japan -based Metaplanet13 thousand 350 BTC complement the first five. Out of the list GamestopBitcoin is locked with 4 thousand 710 BTC purchase. Trump Media The potential Bitcoin investment plan of $ 2.5 billion draws attention.

The purchase of companies other than finance and technology shows that Bitcoin is no longer a limited investment tool for crypto money market actors. Executives continue to see Bitcoin as a strategic reserve item, diversifying cash assets and adding more value to their shareholders.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.