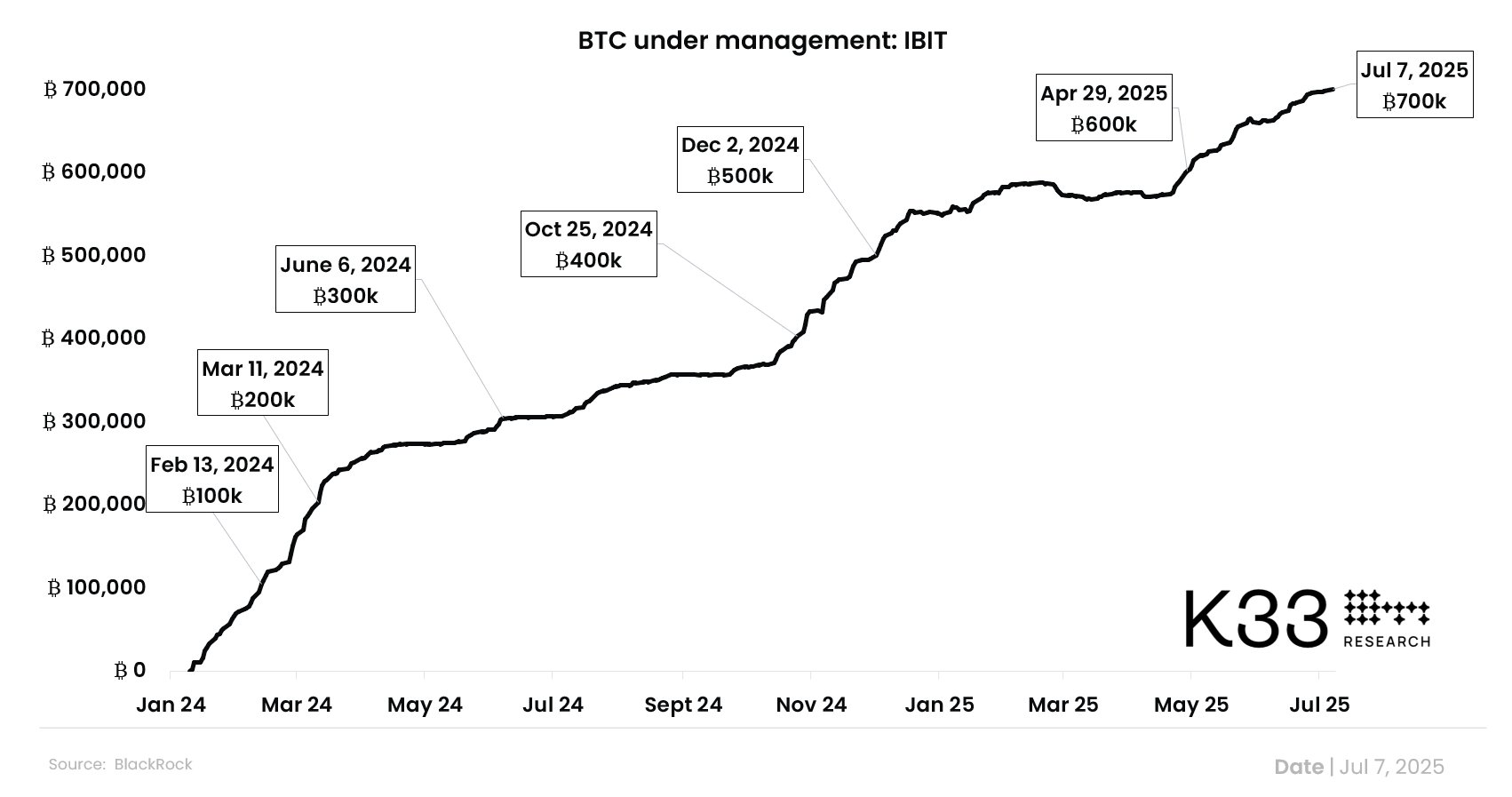

Blackrock’s Spot Bitcoin  $108,926.68 Stock Exchange Investment Fund ishares bitcoin trust (IBIT), on July 8, 2025 Monday, exceeding 700 thousand BTC thresholds, reaching an asset of approximately 76 billion dollars. The fund, which was opened to transactions in the United States in January 2024, gathered in only 18 months to 698 thousand 919 BTC on July 7, added to a thousand 510 BTC net entrance to the historical level. According to the data of Bloomberg and K33 IBITIn Blackrock’s thousand 197 ETF, it rose to the third place in terms of income. The highest income producing ETF remained only 9 billion dollars. This performance points to a magnitude of Novadius Wealth Management President Nate Gerraci, “700,000 BTCs in 18 months”.

$108,926.68 Stock Exchange Investment Fund ishares bitcoin trust (IBIT), on July 8, 2025 Monday, exceeding 700 thousand BTC thresholds, reaching an asset of approximately 76 billion dollars. The fund, which was opened to transactions in the United States in January 2024, gathered in only 18 months to 698 thousand 919 BTC on July 7, added to a thousand 510 BTC net entrance to the historical level. According to the data of Bloomberg and K33 IBITIn Blackrock’s thousand 197 ETF, it rose to the third place in terms of income. The highest income producing ETF remained only 9 billion dollars. This performance points to a magnitude of Novadius Wealth Management President Nate Gerraci, “700,000 BTCs in 18 months”.

IBIT’s eye -catching performance

To Sosovalue data according to IBIT, GrayscaleHe reinforced his leadership by leaving the high -cost GBTC fund behind the size of assets last year. Total US -centered today Spot Bitcoin ETF It keeps 56 percent of its assets alone.

597 thousand 325 BTC StrategyThe fund, even over, shaped the liquidity in the market by producing approximately 80 percent of the total transaction volume of $ 2.9 billion per day. The rapid rise of the fund has put almost 6 percent of the Bitcoin supply limited with 21 million units in the market under ETFs under corporate storing. Analysts, especially the low cost structure and Blackrock He states that his brand has attracted the corporate demand to this side.

On the other hand Fidelity‘s FBTC product has exceeded 200 thousand BTC dams and GBTC’yi second place. After the transformation of GBTC to ETF, the balance of 619 thousand 220 units decreased from BTC to 184 thousand 226 units, while the net output of 23.3 billion dollars was balanced with more than $ 50 billion in other funds. Thus, the total money entering Spot Bitcoin ETFs in the USA exceeded $ 50 billion and Crypto Money MarketIt formed a regular institutional base.

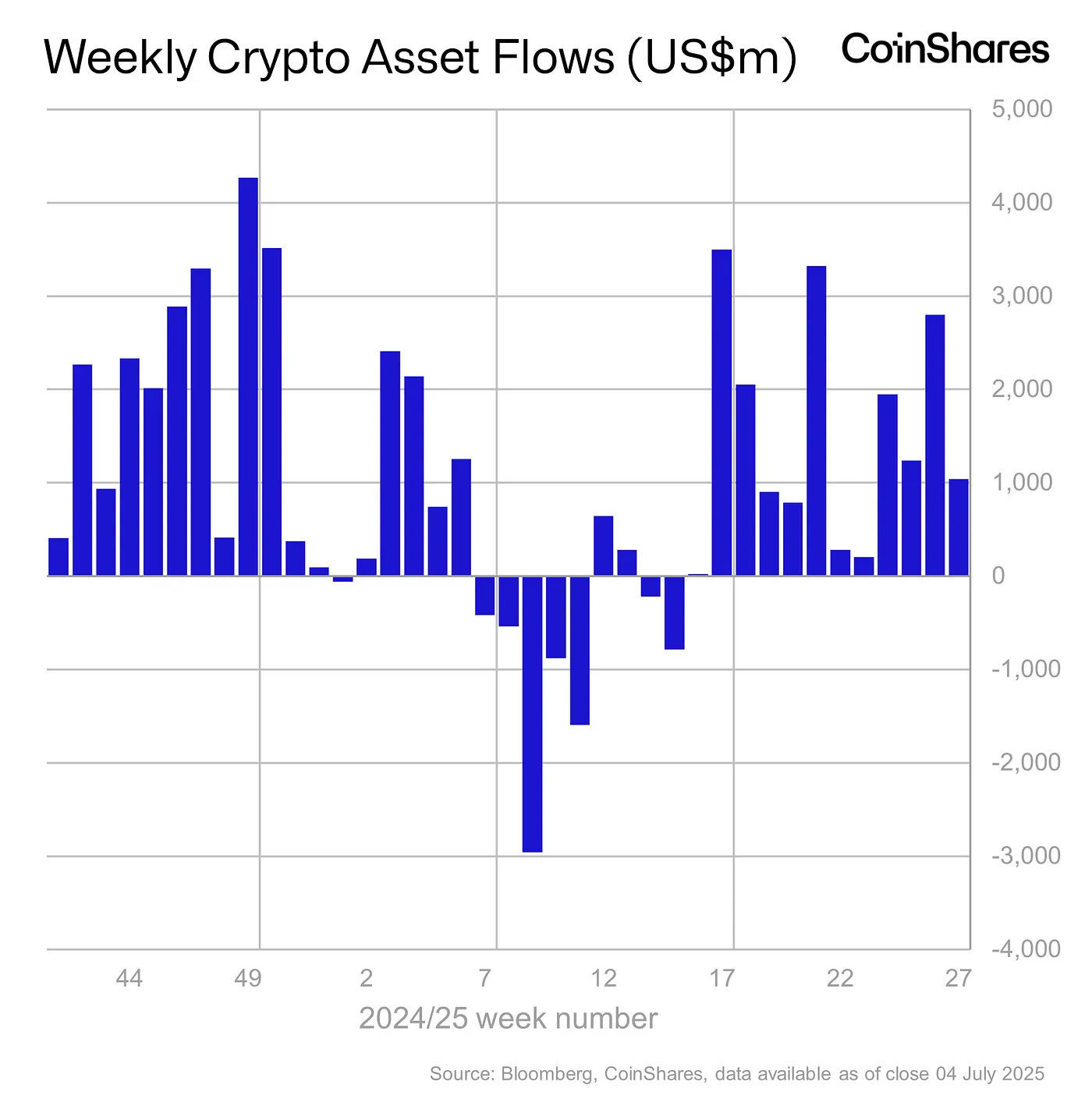

Fund flow continues to the Spot ETFs in the USA without slowing down

To Coinshares’ last weekly report according to US -based spot Bitcoin ETFIn his last week, when he closed with his independence day holiday, it reached $ 52.9 billion at total entries by withdrawing $ 1.2 billion on only three trading days. According to the data, this latest fund wave intensified under the leadership of low -commission giants such as Blackrock and Fidelity. These streams alleviated the pressure of ongoing exits from GBTC. Fund managers position Bitcoin as digital gold in the face of regulatory clarity and increasing macro uncertainties.

Another reason behind the investor interest, ETF The structure of the structure directly eliminates the risk of safety and storage in crypto currency exchanges. This structure, which provides balance especially in corporate portfolios, offers a return potential that decomposes from classical asset classes. Analyst Vetle lunde“IBIT’in the slow -down demand shows the bridge between the traditional finance and crypto currency world,” he commented. Experts emphasize that long -term upward pressure on the price due to the limited Bitcoin supply, although total ETF assets increase.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.