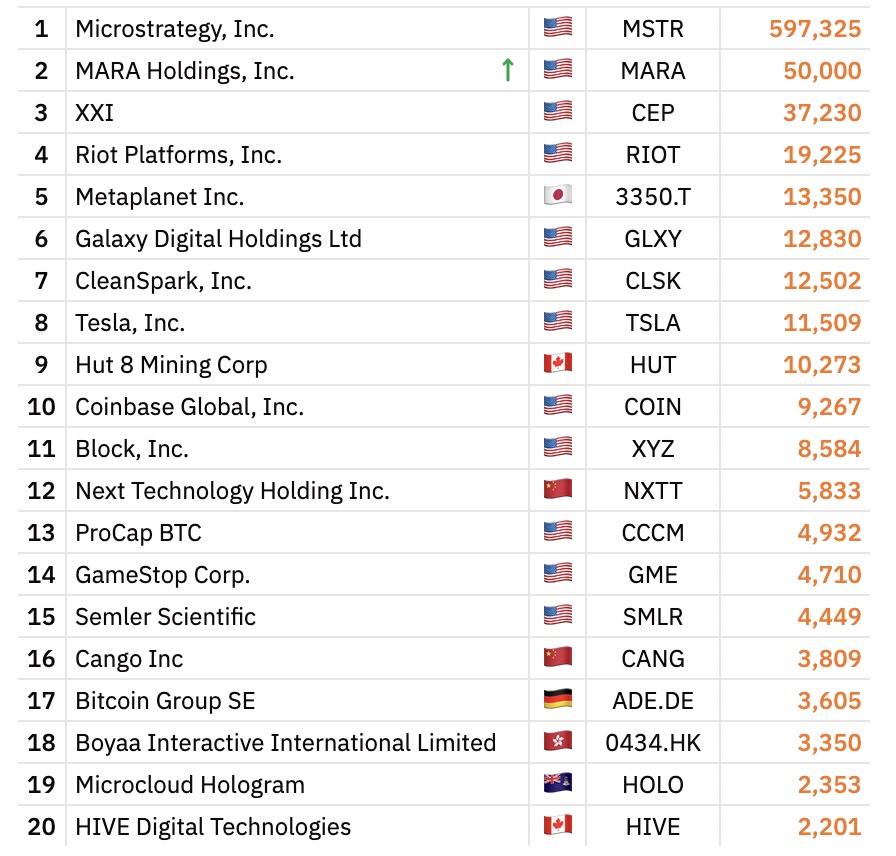

Japan -based investment company Metaplanet2 thousand 205 BTC last Bitcoin on Monday  $108,045.48 announced its purchase. The company spent $ 238.7 million and increased its total Bitcoin presence to 15 thousand 555 BTCs. According to the data of BitcoinTreasuries.net, Metaplanet is the fifth largest corporate on a global scale Bitcoin He became an investor. The company’s purchase cost is 108 thousand 237 dollars per BTC, while CEO Simon Gerovichthat the existing table reinforces the vision of a sustainable, scalable and operational efficient Bitcoin standard. explained. Company shares rose 13.9 percent in the last month and 339 percent since the beginning of the year.

$108,045.48 announced its purchase. The company spent $ 238.7 million and increased its total Bitcoin presence to 15 thousand 555 BTCs. According to the data of BitcoinTreasuries.net, Metaplanet is the fifth largest corporate on a global scale Bitcoin He became an investor. The company’s purchase cost is 108 thousand 237 dollars per BTC, while CEO Simon Gerovichthat the existing table reinforces the vision of a sustainable, scalable and operational efficient Bitcoin standard. explained. Company shares rose 13.9 percent in the last month and 339 percent since the beginning of the year.

Metaplanet’s latest purchase of the total Bitcoin existence of 15 thousand 555 BTC Strategy (597 thousand 325 BTC) after giants such as moved to the top five. For investors, this figure is only in the company’s balance sheet. crypto currency It is a clear indication that strategic growth makes it the main engine. In a message that Gerovich shared in X, he stressed that the company accelerated Bitcoin -based capital allocation.

Although the company’s shares are slightly in the day of day, they draw attention with their long -term positive performance. The latest purchase confirms Metaplanet’s aggressive growth plans in the market, while the company’s fifth position is a flare for future large purchases. The ranking rise in the list of BitcoinTreasuries.net is corporate Bitcoin InvestmentIt reunited the competition in case.

Target 210 thousand BTCs in 2027

Metaplanet, 210 thousand units until the end of 2027 in his update at the beginning of July BTC announced that it aims to keep it. This ambitious plan is supported by an increase of 1.1 billion ($ 7.6 million) revenue from Bitcoin -oriented activities in the second quarter of the year. The company attributed a new paradigm in its corporate approach by connecting the income flow directly to Bitcoin.

According to Gerovich’s statement last week, the growth acceleration is accelerating thanks to Operational Efficiency built on the Bitcoin standard ”. The company’s regular purchases are continuing gradually in order to approach the targeted Bitcoin portfolio and to support the price of their shares. Metaplanet’s position in the current ranking is a clear reference to investors who will closely monitor the impact of the moves on the market on the market.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.