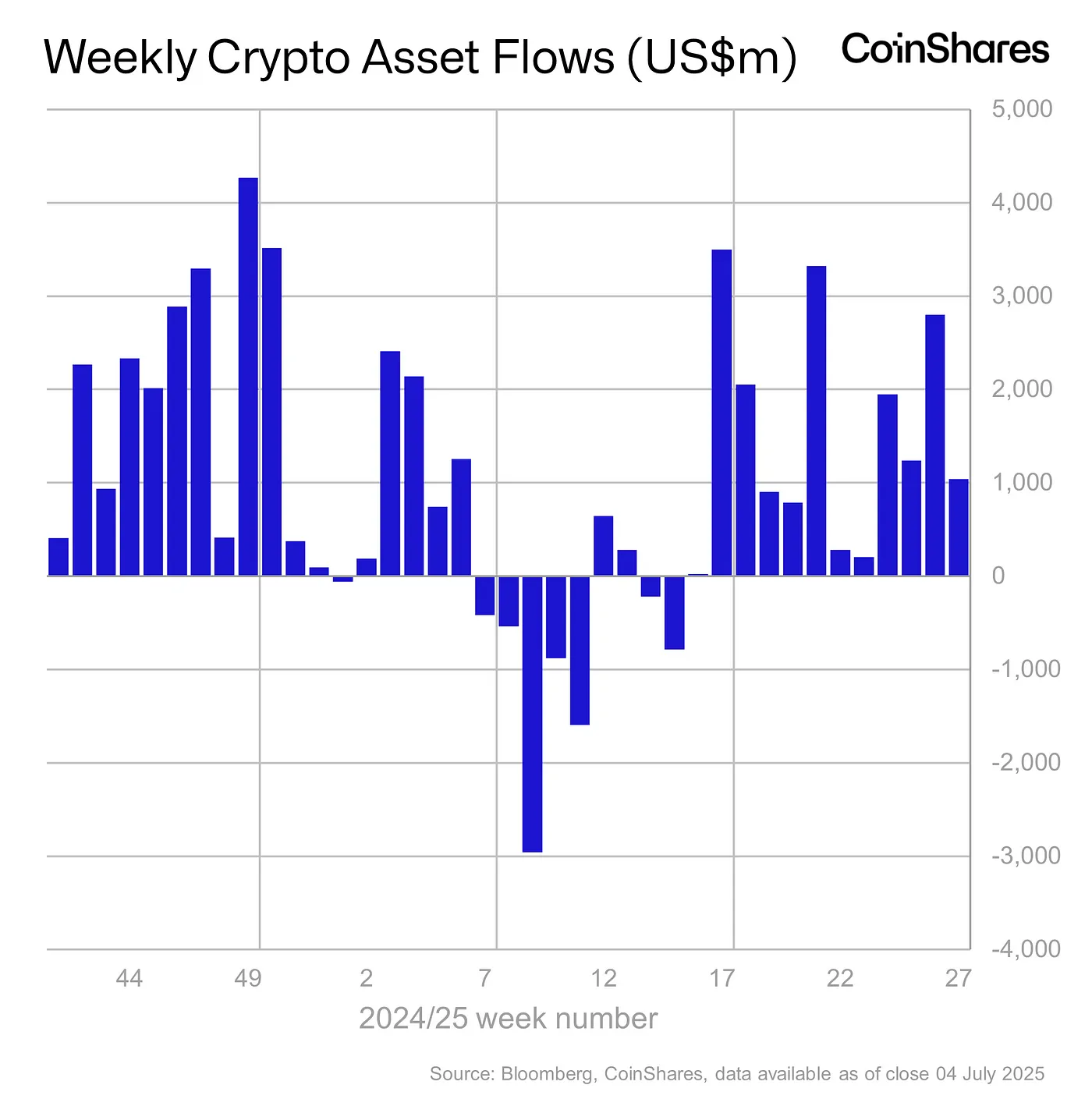

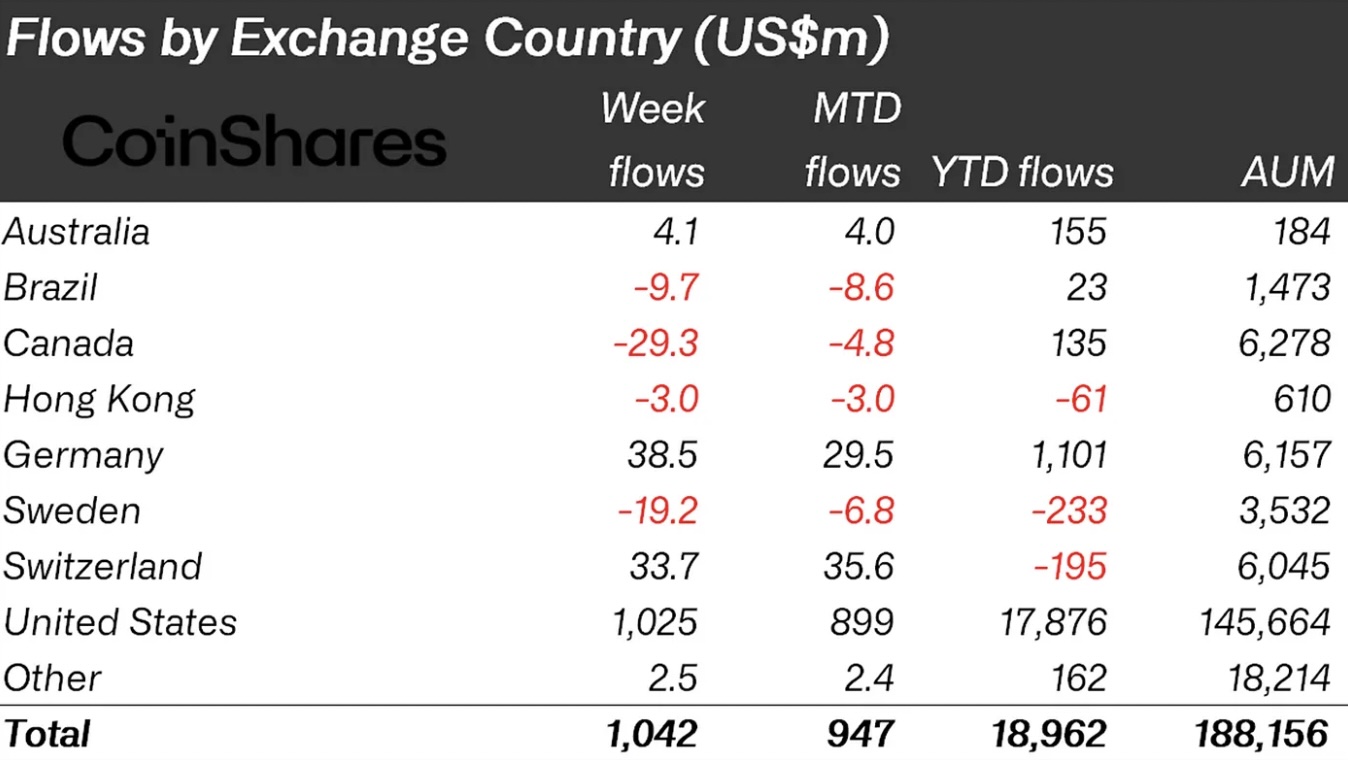

Crypto currency Based investment products last week with a net input of 1.04 billion dollars and continued the entrance series that lasted for 12 weeks. Thus, the value of the total assets (AUM) reached a record level with 188 billion dollars. To Coinshares’s report on July 7 according to During the strong acceleration that has been caught since April, entrances increased to $ 18 billion. The weekly transaction volume remained at $ 16.3 billion and maintained the year average. Blackrock, Fidelity, Ark 21shares US -based Spot Bitcoin offered by giants  $108,775.42 ETFs undertake almost all of the entrances with $ 1 billion, while Germany contributed to 38.5 million dollars and Switzerland 33.7 million dollars. However, $ 29.3 million in Canada and $ 9.7 million in Brazil.

$108,775.42 ETFs undertake almost all of the entrances with $ 1 billion, while Germany contributed to 38.5 million dollars and Switzerland 33.7 million dollars. However, $ 29.3 million in Canada and $ 9.7 million in Brazil.

The 12 -week entry series brought a record in AUM

Bitcoin Based investment products have closed the fourth week in a row and attracted $ 790 million. However, the entrances fell behind the previous three -week entry average $ 1.5 billion, and showed that the demand cools down as the price approached the summit.

Coinshares Research Head James Butterfill“Bitcoin approaches the highest level of all time, the slowdown in the entrances indicates that investors move cautiously,” he evaluated the current situation. The weekly trading volume of $ 16.3 billion confirmed that the investor interest continues, while the risk -facing risks were not ignored.

The largest subcoin Ethereum  $2,560.98 Based investment products have closed the 11th week in a row with a new entry of 226 million dollars. During this period, weekly entries corresponding to 1.6 percent of AUM, Bitcoin -based investment products reached twice the ratio of 0.8 percent. The data is gradually the largest of the investor preference altcoinshows you shifting to.

$2,560.98 Based investment products have closed the 11th week in a row with a new entry of 226 million dollars. During this period, weekly entries corresponding to 1.6 percent of AUM, Bitcoin -based investment products reached twice the ratio of 0.8 percent. The data is gradually the largest of the investor preference altcoinshows you shifting to.

The prominent leadership of the US continues in investor preferences

The geographical distribution clearly demonstrates that the center of the global appetite is still the USA. According to Coinshares data, 96 percent of the total entries came directly from the USA. Europe’s locomotive Germany And Switzerland While making limited but stable contributions, Canada with BrazilThere were exits due to differences in regional risk perception. Regulatory clarity and fund diversity stand out as the main triggers of flows to the US market.

On the basis of assets Solana And XRP Altcoin -based investment products such as, albeit small amounts, while entering, multiple asset baskets were slightly output. This picture reflects that investors prefer certain crypto currency -based investment products and prefer to avoid basket -based products. A total of $ 18 billion input, which has been uninterrupted for 12 weeks, shows that corporate interest remains strong in the crypto currency market, but its distribution has become increasingly selective.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.