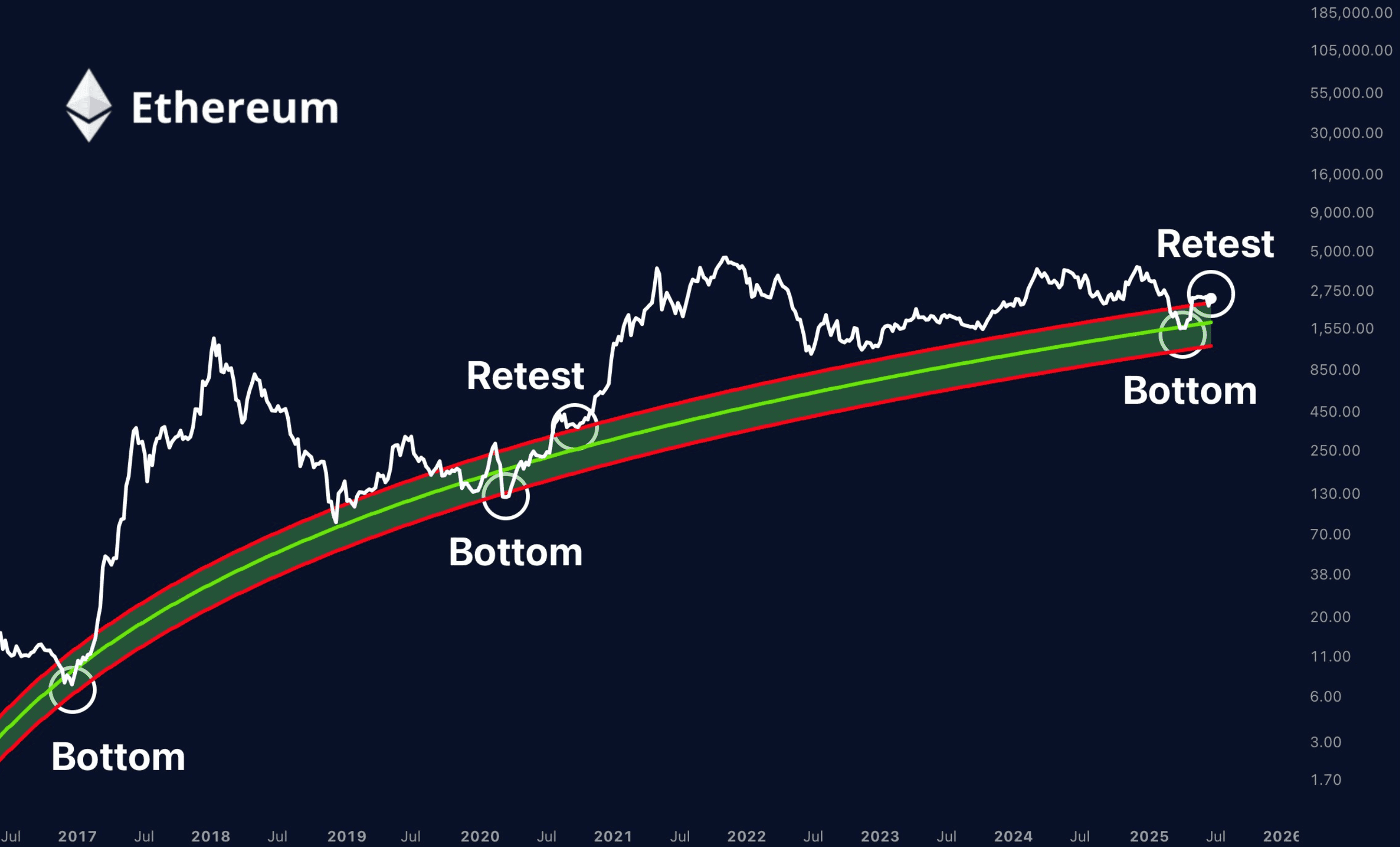

The largest subcoin Ethereum (ETH)  $2,525.50Closing June with a decrease of 2 percent on June 30 fell below the level of 2 thousand 800 dollars. The main feeders of this decline were global tariff tensions and the uncertain approach of the US Federal Reserve (FED) on interest rates caused a cautious atmosphere in the market. Nevertheless, ETH has four powerful signals that can carry the price up during and after this month. Analysts point to a significant recovery potential in Altcoin in the third quarter of the year.

$2,525.50Closing June with a decrease of 2 percent on June 30 fell below the level of 2 thousand 800 dollars. The main feeders of this decline were global tariff tensions and the uncertain approach of the US Federal Reserve (FED) on interest rates caused a cautious atmosphere in the market. Nevertheless, ETH has four powerful signals that can carry the price up during and after this month. Analysts point to a significant recovery potential in Altcoin in the third quarter of the year.

The wage race in the Layer-2s determines Ethereum’s fate

As the data of L2 confirmed, it was commissioned on March 13, 2024. Dencun update Layer-2 applications to the main blockchain collective transaction data to write the cost of writing sharply lowered. As a matter of fact, Ethereum’s base blockchain revenue fell from $ 30 million annually to 500 thousand dollars in the first quarter.

Reduction of Stinging’s return is also some investors altcoin away from the giant. However, the funds turned to opponent networks, but to the Ethereum -based scaling coins such as Optimism, Arbitrum and Mantle.

Although this table seems to be weakness on the surface, it reveals that the total economic activity in the ecosystem still feeds Ethereum infrastructure. According to analysts Layer-2When the wage race in the s is concluded, the intensity of use will be collected around a single standard and the Ethereum blockchain’s ability to capture value will increase again. Experts underlined that this long -term signal of the market has not yet fully pricing.

Corporate purchases add strength to price

On the corporate front Sharplink Gaming30 million dollars of ETH purchase at the end of May output. Wall Street, the company’s treasure strategy Bitcoin  $108,246.30 He likened his pioneer Strategy to 20 times in eight days. The purchase of $ 39 million recorded on June 22 also gave a similar confidence vote and reduced ETH supply on the stock markets.

$108,246.30 He likened his pioneer Strategy to 20 times in eight days. The purchase of $ 39 million recorded on June 22 also gave a similar confidence vote and reduced ETH supply on the stock markets.

Finally, New York based Bit DigitalOn June 25, he announced that he would sell Bitcoin of $ 34 million and move to Ethereum. The management aims to access Layer-2 returns by staking the purchased coins. Three consecutive demands show that investors want to get a share of the potential of Ethereum in July and after.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.