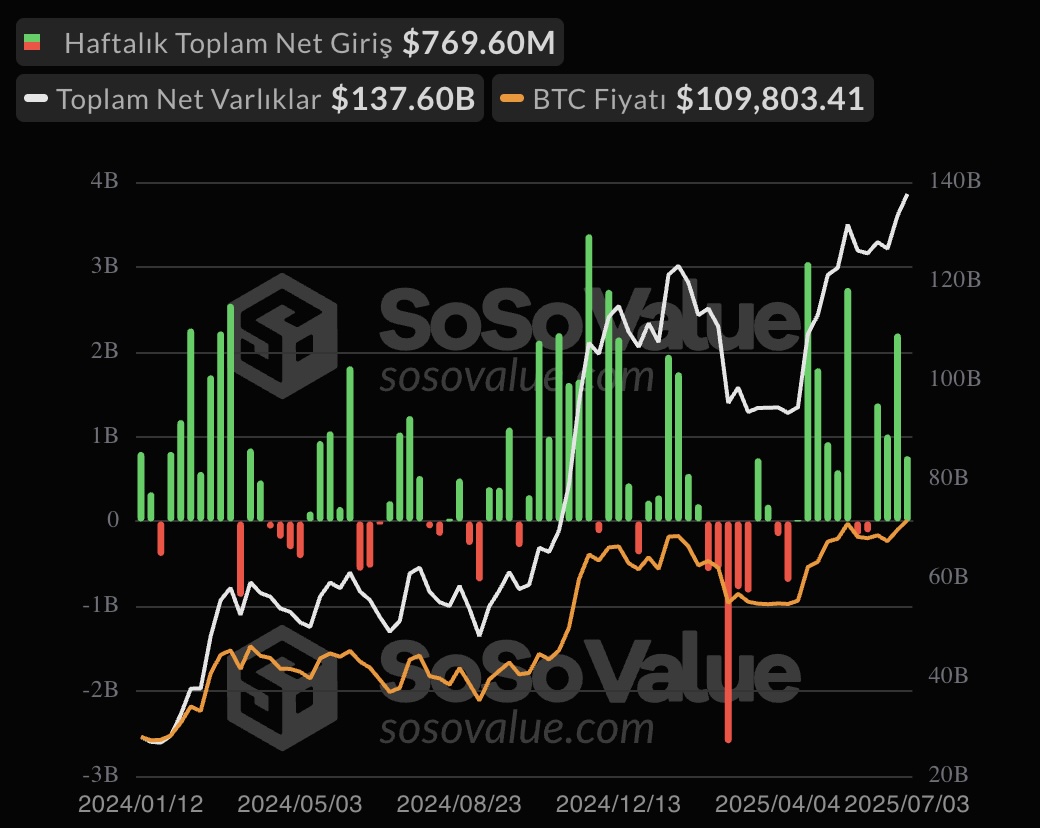

USA Spot Bitcoin $109,127.98 ETFOn July 2-3, 2025, the overlapping 407.8 million and 601.8 million dollars of net inputs exceeded $ 1 billion in two days. Thus, the output of $ 342.2 million on Tuesday was reversed. Total net entries ETFSince the opening of the transactions to $ 50 billion since the opening, the managed asset size was based on 128 billion dollars.

1 billion dollars flowed to ETFs in the last two days

To Sosovalue’s data according to Wednesday and Thursday, a fresh $ 1 billion entrance 15 days in a row of $ 4.7 billion dollars of previous positive flow is the continuation of the continuation. Fidelity’s FBTC The fund took over 184 million and $ 237.1 million, respectively, respectively.

The volumes on Thursday have increased to the highest level since May, to 5.3 billion dollars. 4.1 billion dollars of this Blackrock IBIT ETF. The total transaction volume of Spot ETFs is thus exceeding $ 1 trillion, Spot Bitcoin marketThe share in the level rose to 28 percent.

Blackrock takes the race ahead

IBIT, which reached a $ 73.6 billion asset, has suffered a net loss for only one month since its opening to transactions in January 2024, and brought more than S&P 500 ETF revenue to Blackrock and settled in third place in the company’s thousand 197 funds.

On Thursday, the fresh entrance of $ 224.5 million broke the stagnation of the fund at the beginning of July and left a distance of $ 9 billion to the summit.

Altcoins can pass to attack

On the other hand Spot Ethereum  $2,555.51 ETF148.5 million dollars, the newly opened Solana Stinging ETF was $ 11.4 million entry. BRN Analyst Valentin FournierBitcoin’s dominance on the market climbed 64.6 percent, and these levels historically seen before the Altcoin rally.

$2,555.51 ETF148.5 million dollars, the newly opened Solana Stinging ETF was $ 11.4 million entry. BRN Analyst Valentin FournierBitcoin’s dominance on the market climbed 64.6 percent, and these levels historically seen before the Altcoin rally.

If the price of analyst Bitcoin remains horizontally around the summit, the attention of the market altcoincrypto currency investors by expressing that he could shift to the s.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.