Altcoin XRPincreased over 3.5 percent in the last 24 hours. The derivative exchange Deribit’te July 25 maturity finite 3 and $ 4 call options and September 28 -maturity finite finite $ 2.80 call option drew attention to intense purchase. Since July 1, 2 million contract buyers in the $ 3 option has found, and open positions have increased in parallel. Bloomberg analysts Eric Balchunas and James Seyffart, the US Securities and Stock Exchange Commission (SEC) increased the possibility of a spot XRP ETF to 95 percent increased expectations in Altcoin. Moreover Ripple $2.19On Wednesday, July 2, he announced that he has applied for a national bank license to the US Monetary Control Office. All these developments reinforce market confidence that the price can exceed the $ 3 threshold.

Strong rise indicators in the XRP option market

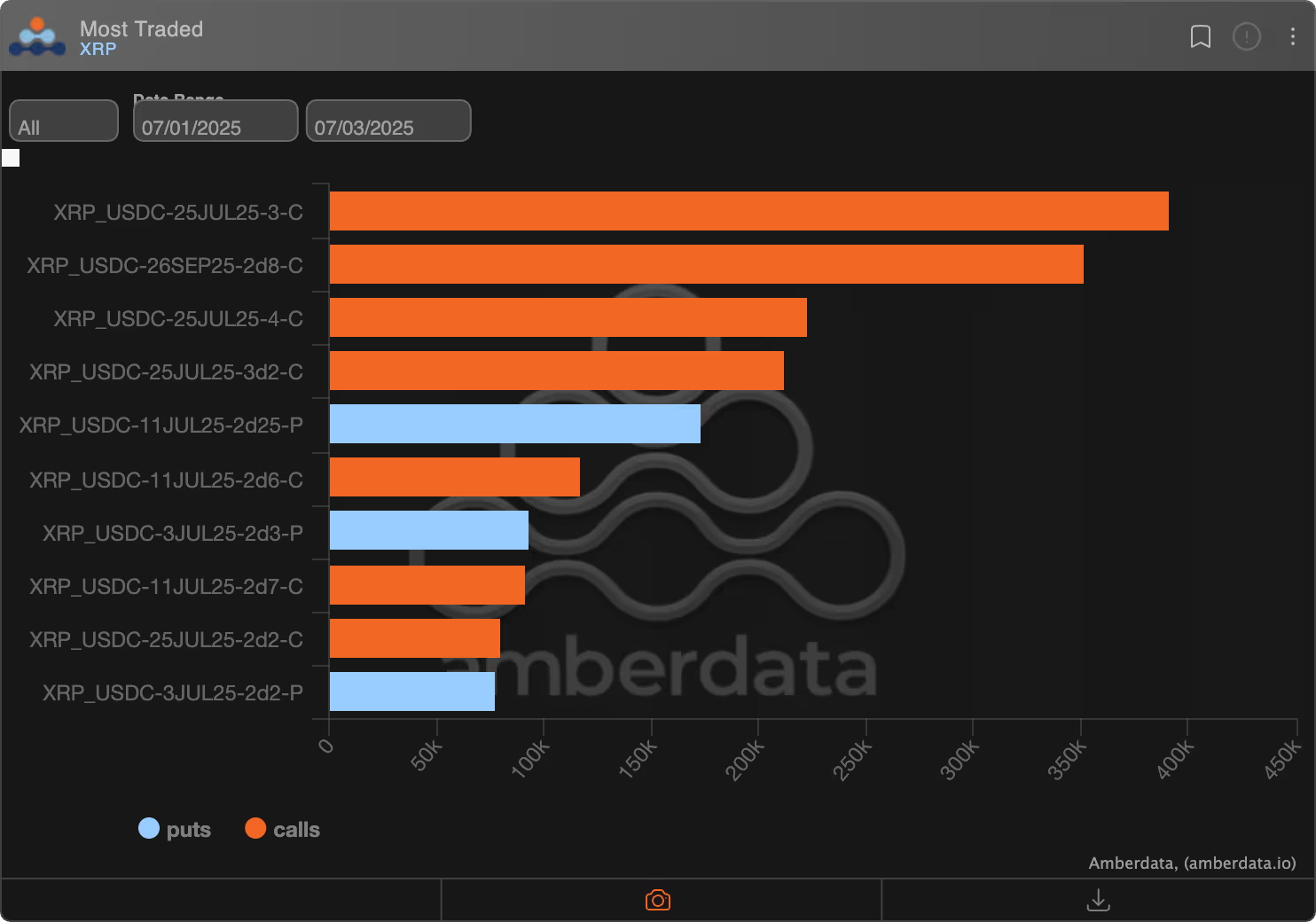

Data provider Amberdata3 dollar call options are the most traded contracts since July 1 reported. Investors made aggressive purchases for an exit over $ 3, while market makers were located on the opposite side. If the 3 dollar level is exceeded until July 25, which is the end of the maturity, the buyers will pass. On the other hand, in the call option of $ 2,80, sellers are mostly active. This strengthens the belief that the price turns to higher targets in the short term.

The increase in interest in options coincides with estimates that the Spot XRP ETF will almost be accepted. 95 percent possibility of analysts gives rise to the expectation that corporate demand may grow rapidly.

Ripple’s application for a national bank license also supports corporate confidence. CEO Brad Garlinghousein case of approval, the company will give both the state (NYDFS) and federal audit. stablecoin marketstressed that they aim for a unique confidence bar. Market participants of this audit framework XRP Coin‘s will expand its usage areas.

Current view of XRP/BTC parity

Binance XRP/BTC ParityWith a falling wedge formation that has been going on with a narrowing of a narrowing of the ongoing correction was limited. The price of the formation of the price of July 2 with the attack of the upper trend line of the sellers have lost the power of the sellers and the market returns in favor of buyers again. The falling wedge is usually the harbinger of the rise. The breakdown of XRP Bitcoin  $107,778.07 He has paved the way for him to turn to higher values.

$107,778.07 He has paved the way for him to turn to higher values.

However, the simple moving averages of 50 and 100 days are still below the 200 -day average and downward. At this point, it is necessary to note that the moving averages are delayed indicators. For this reason, the signal from the formation is considered to be a priority than the negative intersection in the averages. The market supports the upward potential by pricing technical breakage and ETF approval and Ripple license process together.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.