Bitcoin $107,778.07 price He returned over 107,500 dollars, and everyone is bored of the restorations related to tariffs. If Trump draws rest to the EU or others as the continuation of Japan in the coming hours, it may not have such great consequences. Jelle Your crypto coins He says it’s 14 hours.

Bitcoin rise

Decreasing up to 105.100 dollars BTC He triggered new decreases in subcoins. Although the BTC is back, the Altcoins do not follow him yet. Many Altcoin continues to rise below 1 percent. We finally reached the end of the process related to tariffs. Next week, the uncertainty will probably have been significantly reduced and markets will confirm a direction depending on permanent tariff rates.

Jelle mentioned that BTC can make an important confirmation for rise within 14 hours in its assessment.

“BitcoinThe 3 -day rise flag broke and successfully tested! It is less than 14 hours to approve – it says we are ready for ascension. Are you ready? “

If he is right, the BTC may take action for the record level of all new time over $ 112,000. If the uncertainty about tariffs disappears, this triggers a larger series of earnings.

Liquidity and crypto coins

Fed It may not be reduced to interest rates, but global liquidity is increasing. Many central banks, including ECB, made significant discounts. It aims to continue discounts before the end of the year. Although Trump wants Fed to follow the same path, Powell wants to see the effect of tariffs on inflation. The pioneering data on the employment front alarm, and when the net figures arrive tomorrow, each evil will become a little clearer.

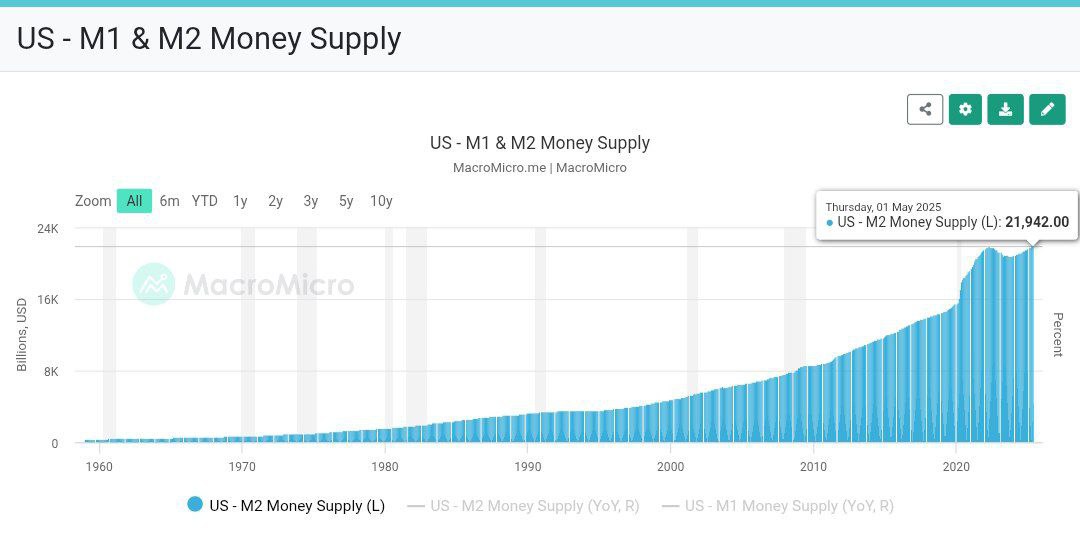

In his assessment of liquidity, Kyle M2 draws attention to the money supply.

“Wait… Is liquidity increased or decreased?

Okay, the fed net liquidity fell from $ 6.2 trillion to 5.84 trillion dollars. However, M2 money supply reached a record level with 21.94 trillion dollars. Basically, money exists on the market… It does not only flow to risky assets yet. Your crypto coins It needs more than good signals to rise. “

What is expected for the rise in risk markets is the elimination of the “worst scenario risk and the uncertainty of this” brought by tariffs as mentioned above.

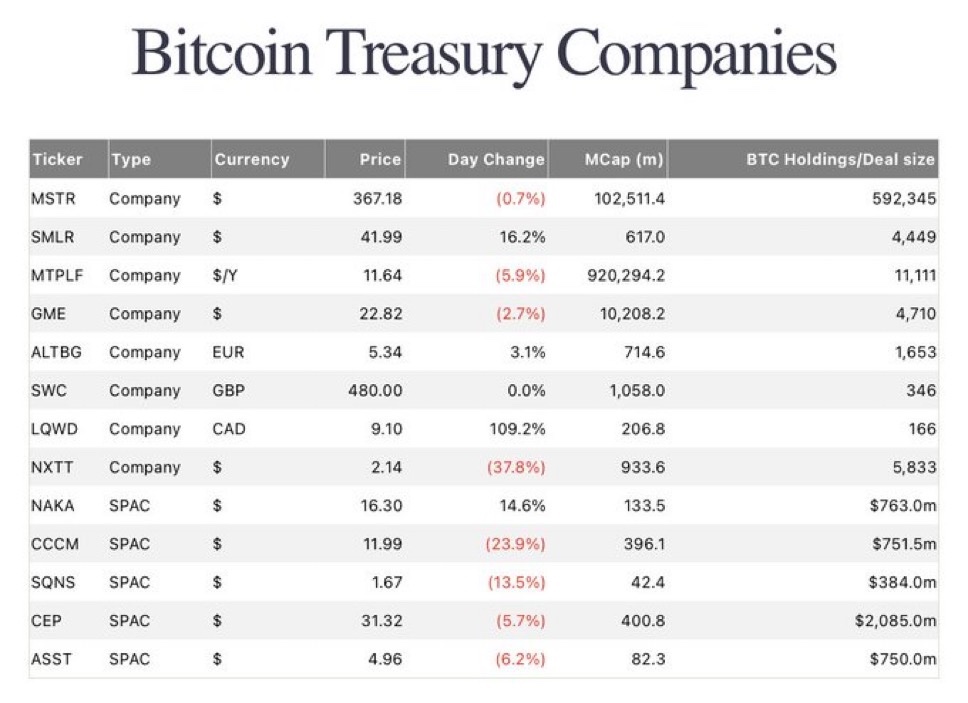

Corporates continue to accumulate BTC. MstrSMLR and others have already made huge investments. The number of such companies has exceeded 60 and is expected to reach 600 next year. Only these companies do not sell BTC supply scarcity and thus the relevant rise.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.