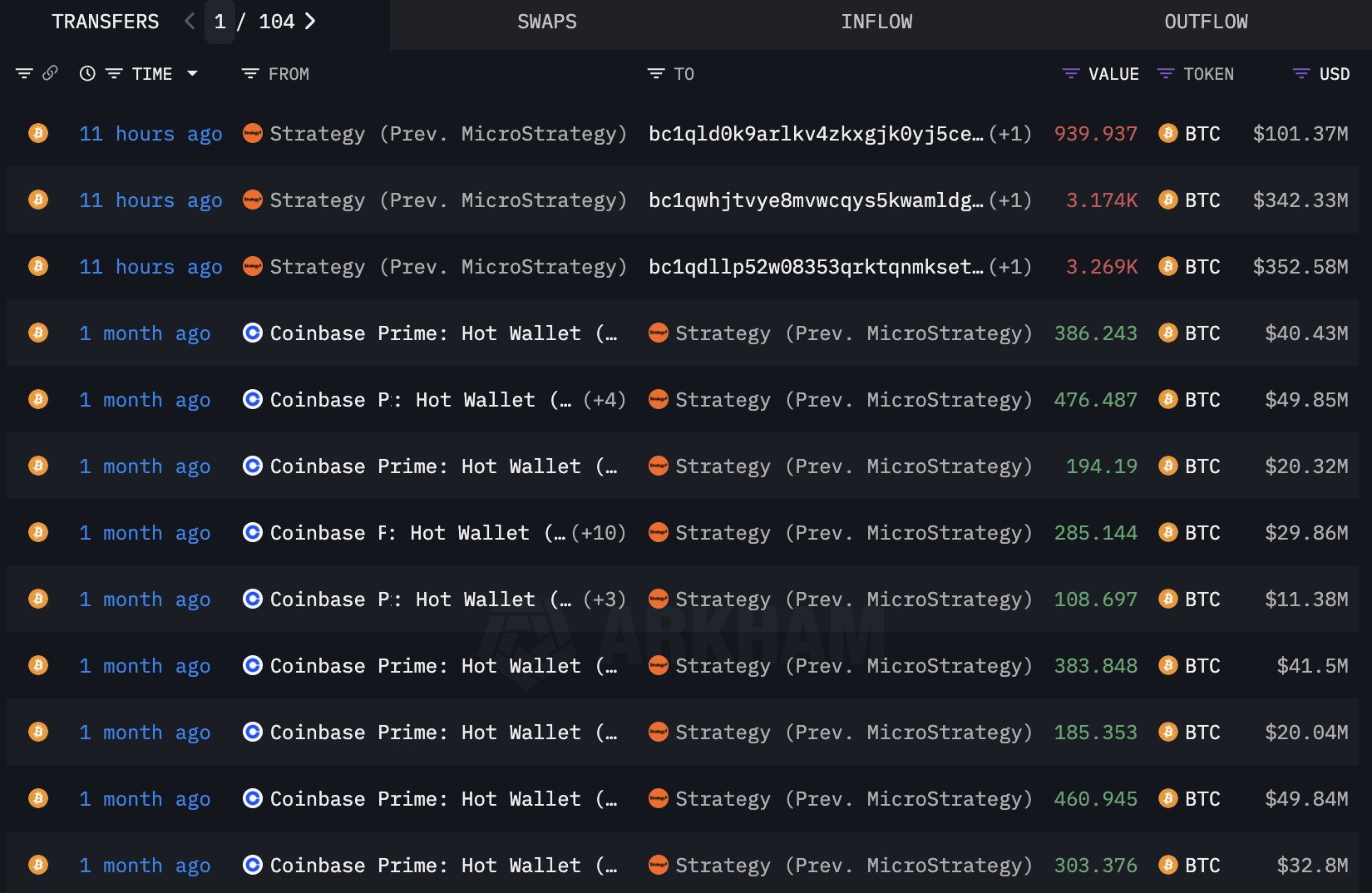

According to the data compiled by the crypto analysis platform Looks Strategy (formerly Microstrategy) Bitcoin worth $ 796 million on Sunday $108,194.45He carried three new wallets. The company’s Bitcoin transfers caused discussion. Experts commented that this mobility was made for the purpose of improving the security and management of Assets. Under the control of Strategy, the amount of Bitcoin is based on 600,000 BTCs. Last week, the company had received a relatively low amount of Bitcoin of 26 million dollars.

What do Strategy’s Bitcoin transfers mean?

Lookonchain‘s data show that the transfer took place on Monday (June 30th). The company carried a very high amount of Bitcoin to three new wallets. Such high -volume transfers are usually made by corporate investors to increase or reorganize the safety of assets.

Strategy’s Bitcoin portfolio He is constantly growing with regular purchases. The last purchase was made last week with 26 million dollars. With this last purchase, the company’s total Bitcoin stock was based on 600 thousand BTC thresholds. This figure makes Strategy one of the largest corporate Bitcoin investors in the world.

The company’s Bitcoin sales policy and the only exception in history

Strategy’s founding partner Michael SaylorHe repeatedly opposed the idea of selling Bitcoin. Saylor, one of the leading Bitcoin maximalists, sees the largest crypto currency as a “output plan .. Saylor, sales of the world of crypto currency will be irreversible to damage the trust of the world. According to him, such a situation can make Bitcoin supporters crazy.

Historically, it is remarkable that Strategy has only sold BTC once so far. 704 units on 22 December 2022 in order to harvest the tax loss of the company. BTC He sold it. However, Strategy, just two days after this sale, purchased 810 BTC for about $ 13.6 million and retracted more to the safe.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.