In crypto coins It is very easy to lose, but there is a stable strategy that has been experienced for years, which is now quite popular. Today, we will discuss the strategy that investors should stay away from. At least before you reset your savings, you need to know it and shape your strategies accordingly.

The most stupid crypto deposit

4 days ago, a whale panic for $ 2,200 Eth He sold it. Concerns about war, fear of tariffs, and much more, drowned the markets 4-5 days ago. Today, the same whale bought ETH again over $ 2,500. The strategy in crypto currencies is to take it back from the higher again after it sells it when it falls from the height.

So isn’t there any way to get rid of it? You should pay attention to a few important things to get rid of it. Advice to Crypto Money Investors;

- Do not invest with debt. The investment you will make with credit usually brings you more loss of high interest rates in the short term than earnings.

- Funded by debt crypto currency Their investments cause investors to be much more timid and anxious.

- If you are not sure that you are investing in the right project, depending on the news flow, you tend to take it from high prices in price fluctuations and sell it when it falls and then get it back again.

- When investing, you need to determine how much time you can expect maximum damage and how many percentage you will sell.

- Apart from short -term purchase and sale, taking on long -term strategies, taking on the stops, usually causes the money to decrease the money in your hand because the market is liquidity hunter, and forces you to sell it from a height and to sell it from the low.

- By separating your short -term and long -term investment budgets, you can ensure that your long -term positions are guaranteed against possible sudden elevations while taking transactions in short -term fluctuations. For example, you have 1 year term investment and you have sold your short -term budget with panic. When the market falls, you can wait to make purchases at lower levels. This way you motivate yourself. On the rise, you will have the opportunity to wait for possible retreats as short -term entry opportunities as your long -term portfolio will bring you profit.

- It is not possible to detect the bottom or hills continuously. Imagine the possibility that you can make wrong decisions while selling and taking lower or taking it from a lower.

- Do not allow different analyst assessments of your psychology to change suddenly with sudden developing events. If in crypto coins If you have spent long enough, your experiences will tell you that “great rise after very big decreases” or the opposite is many times.

- Set risk scores for your investments. For example, 100 million dollars in the market of a valuable subco you can take to the loss of the potential earnings you expect from there.

- Feel free to allocate space in your portfolio for less volatility assets. In 2017, everyone used to buy Altcoin to increase the amount of BTC. Investors would act in this direction with the expectation that the price would reach the ACH point at the loop summit.

- The fact that the remarkable part of your basket consists of less fluctuating assets such as BTC and ETH gives you the opportunity to reduce the cost of the projects you believe while reducing your total loss.

- Finally, don’t marry any Altcoin. As you fall, take the risk of continuously falling of the projects you collect at lower levels in your first investment. Determine things like your maximum investment target, the maximum time you expect, the maximum damage rate you can tolerate.

In addition, you can not see the future of anyone, including the author who wrote the article you are currently reading, can be mistaken in their recommendations, can make wrong readings about the market, and you will be responsible for yourself at the point of earnings and losses. No analyst wants to pay for x sharing when you earn from you. Or does not pay you when you are damaged by sharing X.

Crypto Coins Comment

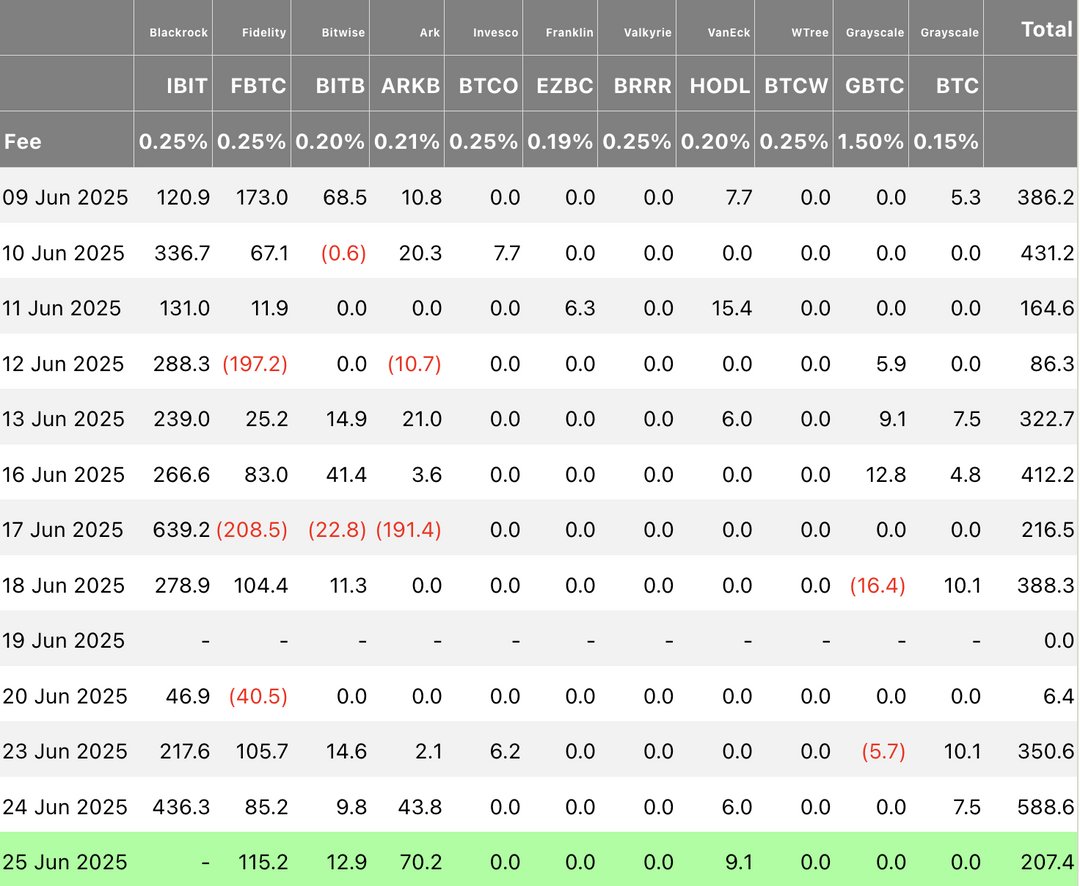

Yesterday ETF investors BTC He continued to accumulate. The last 2 -day entrances are around almost 800 million dollars. Moreover, in the ETF channel representing professional and corporate investors, the demand is strong despite all the negativities. So they expect more rise. US stock markets may not be unjust when running to new ACT levels.

Nic has posed a question to those who recently sell BTC in today’s evaluation.

“Lately Bitcoin

$107,254.55 Did you sell it? Whales thank you. In the last few months, the existence of small investors decreased, while the balance of large investors has increased. On-Chain Return transfer in front of our eyes. ”

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.