Just as it is prepared for the Iranian ceasefire, we now see that a planned scenario for interest rate cuts has been commissioned. The oil price is decreasing and the concerns about inflation are weakened. Moreover, we will see big tariff agreements on 4 July. All this shows that the Fed is progressing to interest rate cuts. Well BTC and ETH price What are the predictions?

Fed Interest Discounts

3 Fed members said we should see a discount in July and 2 members say it is early for discounts in the last few days. What is decisive for interest rate cuts will be decisive at this point at this point.

Trump He just said;

“We expect customs duties to have a significant impact on inflation in June, July or August.

Interest rates Interest reduction margin is significantly higher than the high levels and interest rates are low. ”

However, in the last few hours, FT threw an important headline. Allegedly, the European Union, like Trump, will announce the retaliation customs duties that he is ready to step back to strengthen his hand. This is a morale because it will be an agreement until September and the deadline of July 9 has shifted a few weeks ago. Trump may say that there is no more rest and say there is no agreement.

Will come on Friday PCE data And next Friday will be decisively decisive tariff news until Friday, July 4th. BTC is in 105.900 dollars.

BTC and ETH price estimate

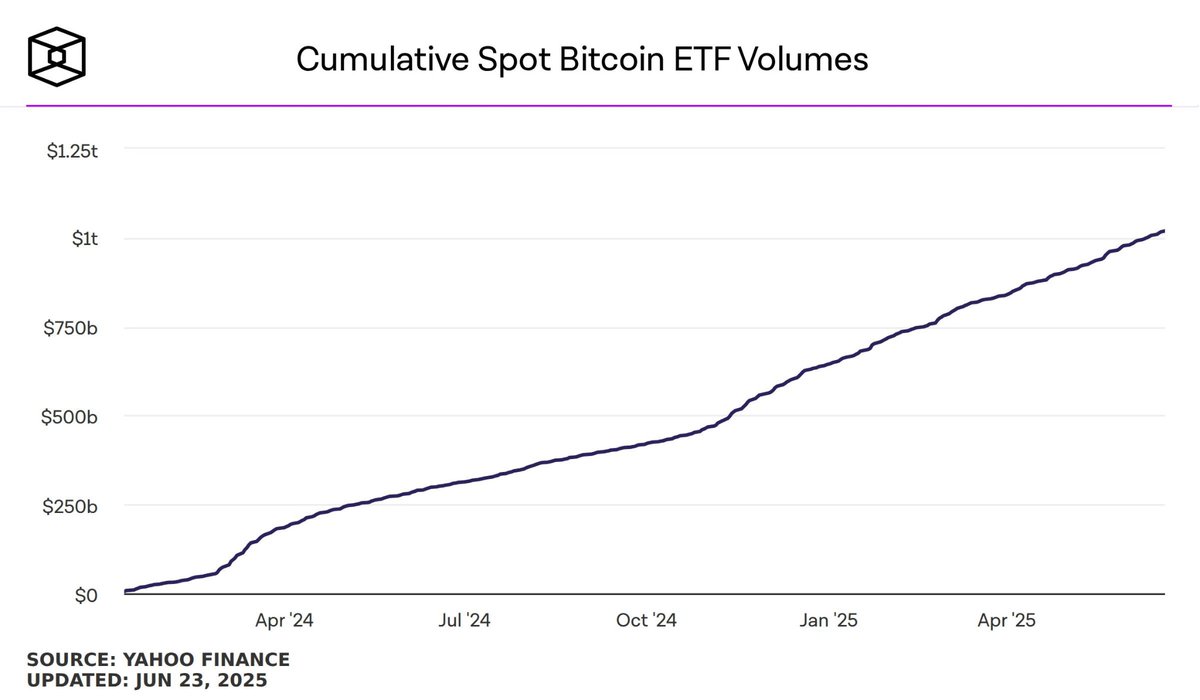

Corporate demand continues strongly and Spot BTC ETF‘s in less than 18 months in a cumulative volume of 1 trillion dollars exceeded the threshold. Bitcoin, which makes a more exciting start than Gold’s ETF launch $105,439.51 ETFs can keep BTC as much as the largest central exchanges if they continue to grow at this speed.

Daancrypto shared his assessment for Bitcoin price;

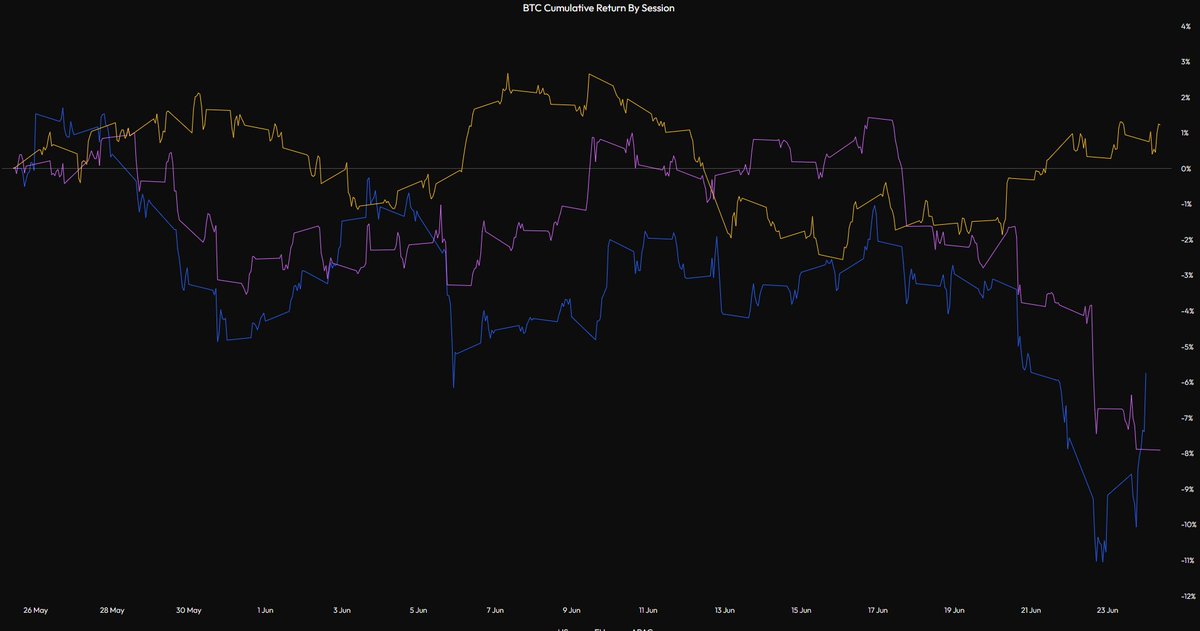

“BTC last month, while the US and EU sessions exhibited the worst performance, the Asian session was quite horizontal.

Momentum generally stopped in higher time periods, and last month, a clear direction was not clear.

During this time, we have seen large ETF entrances, so a general sale in the US sessions shows how much supply is in this price range.

In the end, the price will exceed this level, but as we can see, this will take time. ”

ETH price He shared Cryptonoach assessment for.

Stating that $ 2,450 should be protected by support, the analyst foresees a decline in a demand zone of $ 2,100-2,150 again in a possible shock decline. It is relatively positive because it is satisfied with ETF flows. If Eth succeeds, he can quickly return to the range of $ 2,750 and $ 3,000, that is, the levels before the war. For this, the continuation of the positive atmosphere is essential.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.