Hyperliquid The latest development on the platform created a shock effect on the crypto currency market. According to Lookonchain’s data, a big whale level is a big investor Bitcoin $101,295.16As a result of the sudden rise in the price of (BTC), he saw the liquidation of the open Short position worth $ 111 million. This high leverage position opened on Monday when Bitcoin watched at the levels of $ 101 thousand crypto currencyWith the rapid rise of the rise, it became unsustainable. Although the whale made a profit of $ 3.41 million for a short time, the net damaged $ 3.51 million.

The leap in Bitcoin price brought the liquidation

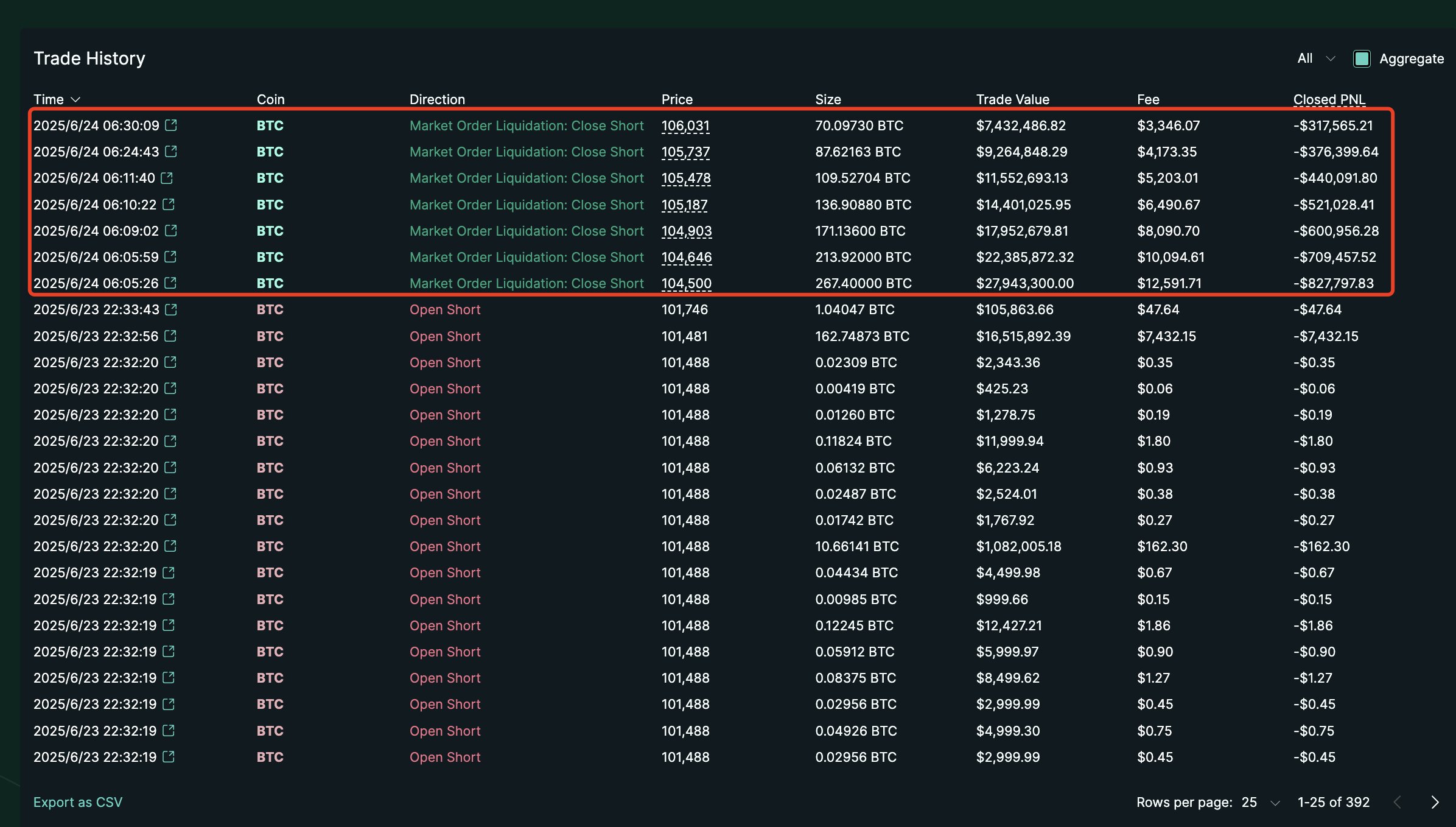

Chain of events that started on Monday BitcoinIt resulted in the unexpected acceleration of the price of the price. The open positions of the whale were liquidated by climbing the price of the largest crypto currency from 104 thousand 500 dollars to approximately 106 thousand dollars. The sudden jump in the price was fatal for positions used in a high amount of leverage.

Hyperliquid’s risk mechanisms automatically closed the whale’s positions. This brought about a huge liquidation of $ 111 million. Process Crypto currency derivative marketsHe once again revealed how devastating such large -scale liquidations could be.

LAST SITUATION IN Bitcoin

Crypto Data Platform CoinMarketcapCurrent data of Bitcoin is currently trading around 106 thousand dollars. The largest crypto currency has gained a remarkable rate in the last 24 hours, 3.6 percent. The highest price level in the day was recorded for 106 thousand 82 dollars.

This rise strengthens the likelihood that Bitcoin reached last month and the highest level of all time (ATH) will re -test $ 111,814. There is only about 5 percent difference between the current price level and this record. The market closely follows whether the biggest crypto money can force this psychological limit again.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.