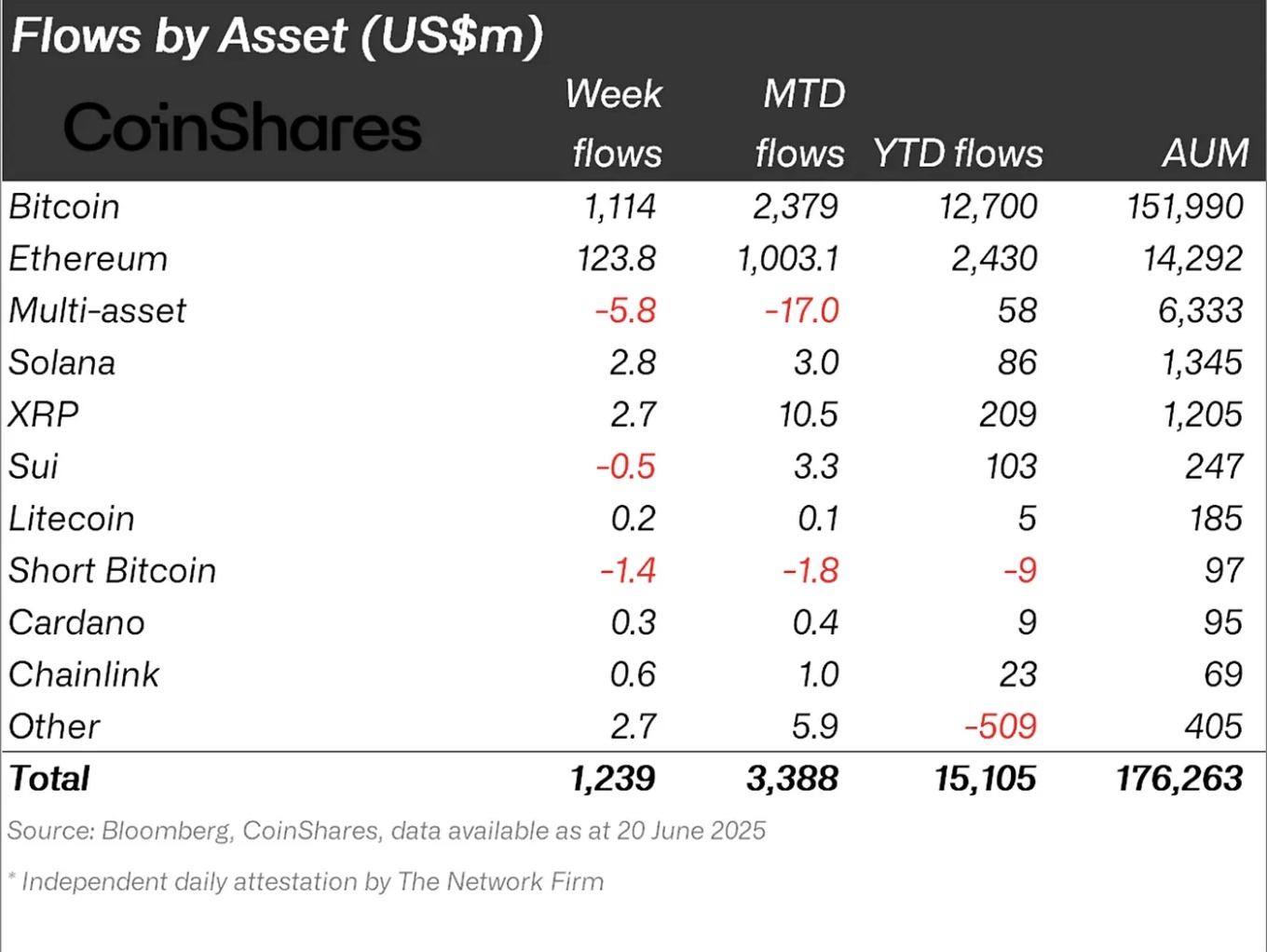

According to Coinshares’ weekly data, large asset management companies such as Blackrock, Fidelity and Grayscale crypto currency Based investment products drew a global net $ 1.24 billion funds last week. Thus, in the tenth week, there was a net entry to the funds. Total net fund entry in the ten -week period reached 14.1 billion dollars. Since the beginning of the year, net entries have reached a new summit with $ 15.1 billion. From Coinshares James Butterfillannounced that the total asset size in the sector increased to 176 billion dollars. He also added that the intense activity at the beginning of the week has slowed down towards the weekend due to the Juneteenth holiday in the United States and the news that the US will be involved in the Iranian conflict.

10 weeks of entry series of crypto currency -based investment products

James Butterfill, despite increasing geopolitical uncertainty, investors’ crypto currency based Investment Productsstressed what confidence continues. In the regional distribution of net entrances USA by far he was ahead. Only US -based investment products attracted a net entry of 1.25 billion dollars last week.

Canada And Germany He followed the US with a net entry of $ 20.9 million and 10.9 million dollars respectively. Part of this positive flow Hong Kong32.6 million dollars of the products in Switzerland7.7 million dollars from a net output from 7.7 million. Spot Bitcoin in the USA  $101,295.16 Stock Exchange Investment Funds (ETFs) attracted $ 1.02 billion on their own by forming a large part of the total fund inputs in the country.

$101,295.16 Stock Exchange Investment Funds (ETFs) attracted $ 1.02 billion on their own by forming a large part of the total fund inputs in the country.

Investor interest in Bitcoin and Ethereum continues

Bitcoin Despite the decrease in the price, based investment products saw a net entry into the second week and enabled $ 1.1 billion. Butterfill commented that investors have made “low prices”. Short Bitcoin products are relatively small as $ 1.4 million, but the exit also supports this view.

Ethereum  $2,247.23 In the ninth week, it was a net entry to the based investment products and attracted another $ 124 million. This entry series carried the total entrance to $ 2.2 billion. Butterfill pointed out that this entrance series has been the longest entrance series seen since the mid -2021 and reflects its powerful investor interest in assets. But in the USA Spot Ethereum ETF‘s only $ 40.3 million of this entrance. The real entrance was Ethereum -based products in other regions.

$2,247.23 In the ninth week, it was a net entry to the based investment products and attracted another $ 124 million. This entry series carried the total entrance to $ 2.2 billion. Butterfill pointed out that this entrance series has been the longest entrance series seen since the mid -2021 and reflects its powerful investor interest in assets. But in the USA Spot Ethereum ETF‘s only $ 40.3 million of this entrance. The real entrance was Ethereum -based products in other regions.

Looking at the price performance, Bitcoin lost 4.7 percent in the last week and traded at $ 101 thousand 660 dollars and Ethereum loses 13.7 percent and 2 thousand 255 dollars. BRN Chief Analyst Valentin FournierTexas Province and Metaplanet companies as a strategic reserve of Bitcoin as a strategic reserve, the uncertainty decreases the ground for recovery, he said. Fournier, Bitcoin’s positive opinion on the durability, while Solana can perform better in recovery, and Ethereum’s short -term loss of corporate support despite the loss of volatility, he added that it has the potential to recover.

On the other hand Solana, XRP, Chainlink  $11.80, CARDANO

$11.80, CARDANO  $0.541309 And Litecoin

$0.541309 And Litecoin  $80.62 2.8 million dollars, 2.7 million dollars, 600 thousand dollars, 300 thousand dollars and 200 thousand dollars entrance to the based investment products, respectively. Altcoin Sui One of the based investment products was 500 thousand dollars output.

$80.62 2.8 million dollars, 2.7 million dollars, 600 thousand dollars, 300 thousand dollars and 200 thousand dollars entrance to the based investment products, respectively. Altcoin Sui One of the based investment products was 500 thousand dollars output.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.