Shown as XRP’s most powerful rival Stellar $0.248984The presence of the main network of XLM is faced with a harsh decline in recent weeks. Altcoin is currently trading at $ 0.249 and has lost 7 percent in the last 24 hours. Since the mid -May, the XLM, which has lost more than a quarter of the total market value, is currently moving within the falling wedge formation. The price that goes below $ 0.26, which is an important level of support, is under pressure due to increasing geopolitical uncertainties and uneasiness throughout the market.

Survival in Social Media and Derivative Market Surprise: Optimism is increasing

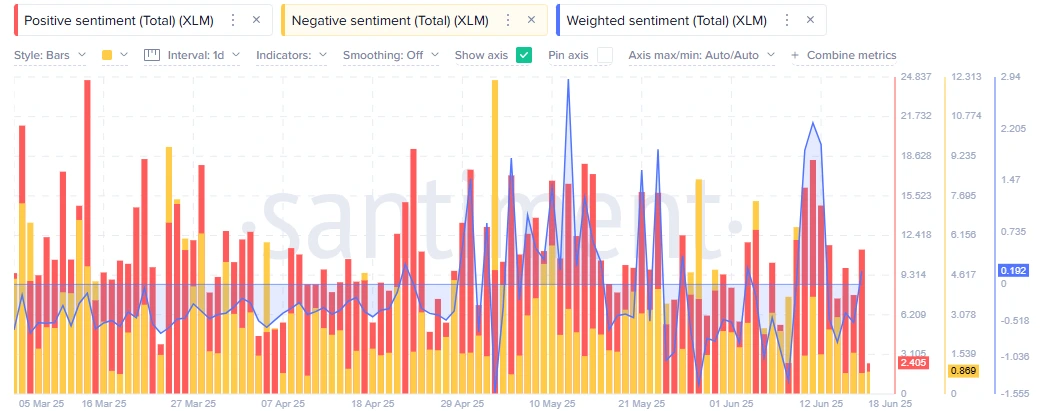

The latest data show that the negative atmosphere in the XLM community gradually left its replacement to a positive expectation. CentimeterAccording to the data received from the total weighted feeling for XLM this week from -0.775 to +0.192 rose. Particularly on June 17, the positive social media messages, which reached 11.31 levels, left behind negative messages with only 0.81 difference. The figures indicate that there is a significant optimism in social media speeches for Altcoin.

There is a similar signal of recovery in the derivative markets. XLM Weighted funding rates for open positions recorded a remarkable improvement during the last week. The funding rates, which were about -0,378 percent on May 13, are currently +0,0029 percent. Behind this positive tendency PaypalIntegrated into the Stellar network of ‘s Pyusd Stablecoin, attempting to offer cost -effective payments suitable for SMEs and Easya and developments like clues about a possible cooperation. However, these positive developments are yet XLM Coin It was not reflected in the price as a significant upward movement.

Lock factors and risks that can trigger the price rise

Liquidity is one of the biggest obstacles to the rise of the price of XLM. Current liquidity heat map altcoinshows that the price of the liquidity pool is currently located. If the price makes a further breakdown, this may lead to a long squeeeze and may draw the XLM to even deeper bottom levels. This technical risk poses an important threat to the short -term future of Altcoin.

On the other hand, there is also the potential to heal under conditions throughout the market. Especially in geopolitical tensions, which print markets such as Iran-Israel tension, there may be a softening in line with the consequences of Donald Trump’s ultimatum to Iran. If the dose of increasing geopolitical voltage in the Middle East is decreased, the price of the XLM may have the opportunity to rise by finding support from the liquidity set of around $ 0.25.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.