The story of the 2021 bull is great venture capital of companies in crypto currencies high -risk investments. We experienced a strong bull while borrowing with their 3 -in -hand assets and flowing billions of dollars into subcoins. In this cycle, dozens of public companies borrowing Crypto coins it enters. Moreover, we will see hundreds or even thousands of 3ac diameters.

Semler Scientific Crypto Money Strategy

Michael Saylır’s company Strategy (formerly Microstrategy) Bitcoin of tens of billions of dollars $104,887.63 took it. It has reached more crypto investments than all its 3 -similar companies of 2021 alone. Moreover, there are too many public companies that copy his strategy. The number of them is expected to be in the range of 600-700 before the end of next year.

600 companies that make up Bitcoin and Altcoin reserves in just 1 year mean a new investment of at least $ 50-100 billion. Only Semler Scientific, even by 2027, aims to increase its total presence to 105 thousand with the purchase of 95 thousand additional BTCs.

Today, Semler announced that he appointed Scientific Joe Burnett as Bitcoin Strategy Director. Semler Scientific also announced that it will reach 10 thousand BTC reserves before the end of this year by using revenues from stock and debt finance and operating revenues. The end of the 2026 target was announced as 42 thousand BTC and the end of 2027 as 105 thousand BTC.

“We are very excited that Joe will join our Bitcoin strategy team and to have 105,000 Bitcoin.

Joe is an analytical thought leader for Bitcoin and Bitcoin treasury companies. His expertise will be very important when Bitcoin continues our treasury strategy and aiming to offer long -term value to our shareholders.

Semler Scientific announced the Bitcoin Treasury strategy in May 2024 and we are pleased with the progress recorded to date. Since we adopted the Bitcoin standard, we have achieved approximately 287 %BTC return and $ 177 million BTC earnings until June 3, 2025. We are ready to accelerate our Bitcoin accumulation strategy with our increasing connections with a strong team and Bitcoin community. ” – Semler Scientific Chairman Eric Semler

The future of crypto coins

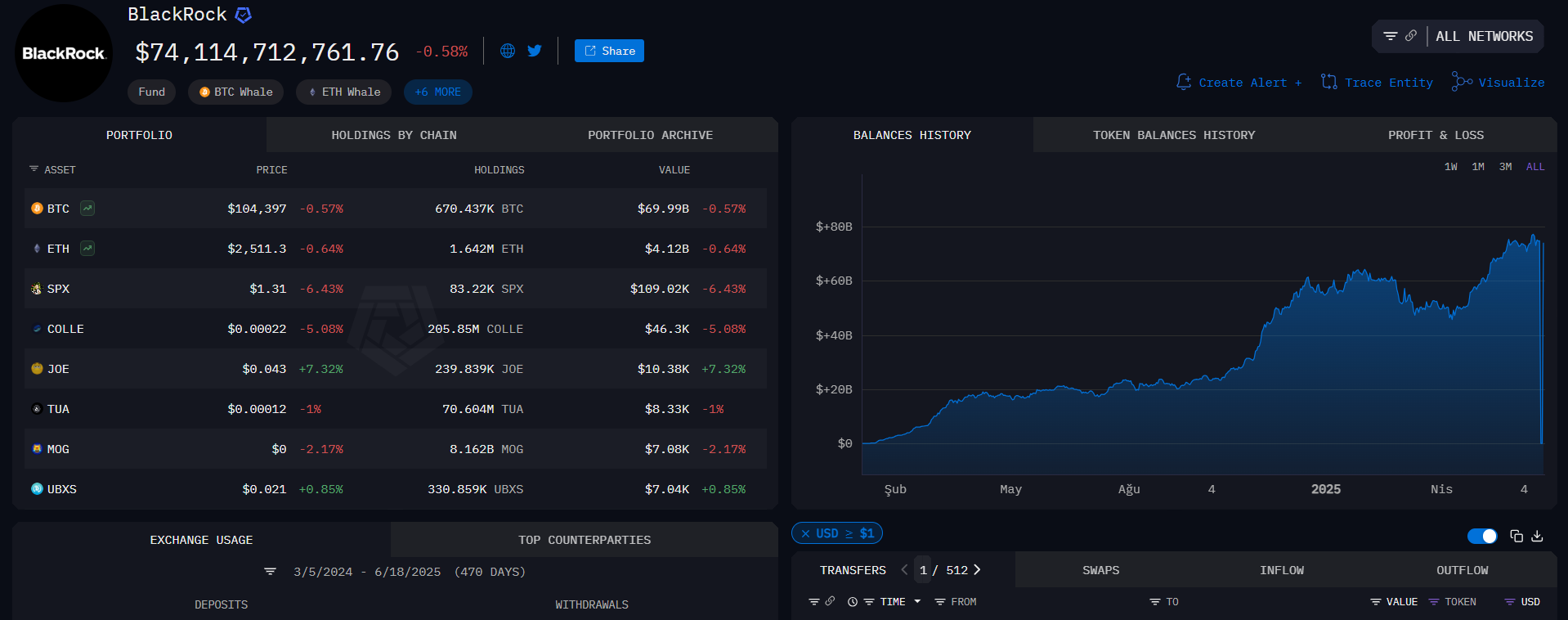

Currently Microstrategy 592.100 BTC It holds, and Blackrock has 670,437 BTC for its customers. Grayscale 185.234, Fideliyt 196264 and many other companies. The total BTC in the hands of governments and companies known to be reserved is 3.45 million. The total reserve of ETF and other funds approached approximately 1.4 million BTC.

It is estimated that when we remove the immobile supply and Nakamoto assets and lost supply for 10 years, it will remain around 13 million BTC, which really circulated in 2030. Miners have removed most of them, and the important part of the supply is still still. 3.45 million of these 13 million supplys have already been stocked. Even if we do not take into account the individual, professional investor savings and long -term goals in the stock markets and in non -central wallets, this means a great scarcity of supply.

The long -term growth expectation of Bitcoin price is fed by the fact that corporate acceptance and the largest launch of ETFs in history.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.