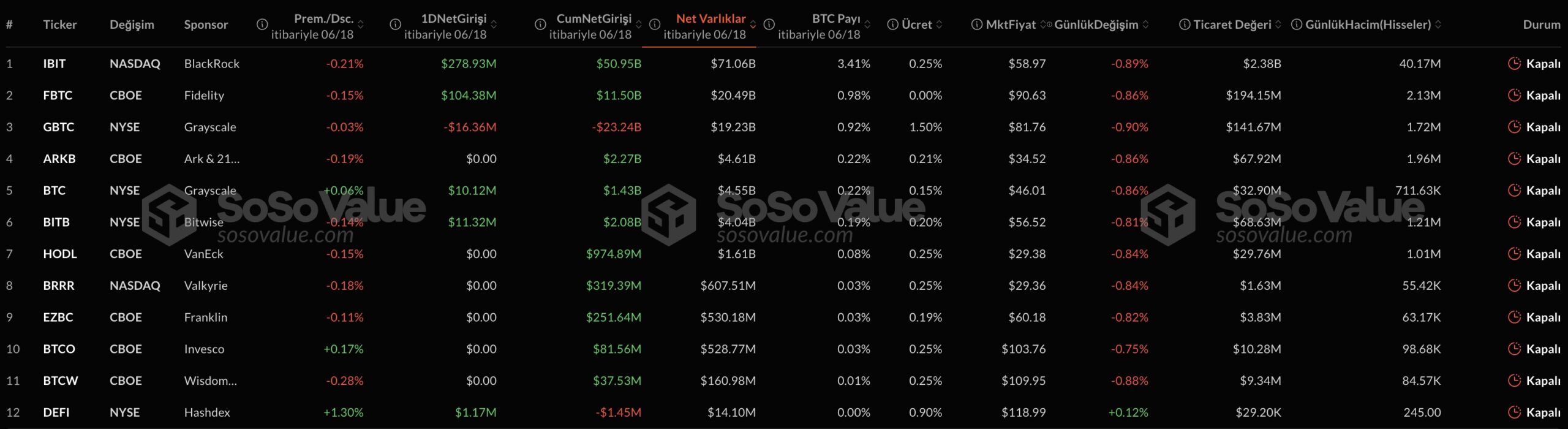

In the USA Spot Bitcoin $104,887.63 ETF‘s on Wednesday, leaving behind the eighth consecutive net day, leaving a total of $ 2.4 billion in this process. Blackrock’s IBIT While Fidelity, Fidelity FBTC104.4 million dollars entered. Grayscale’s GBTC The fund was the only product living in an output of $ 16.4 million. In contrast, Spot Ethereum  $2,532.40 The recovery process of ETFs gave a sign of slowing. The net entrance of Wednesday was quite limited to only 19.1 million dollars. Experts attribute the low acceleration in Ethereum to a lack of macroeconomic uncertainties and catalysts with the ongoing demand in Bitcoin ETFs.

$2,532.40 The recovery process of ETFs gave a sign of slowing. The net entrance of Wednesday was quite limited to only 19.1 million dollars. Experts attribute the low acceleration in Ethereum to a lack of macroeconomic uncertainties and catalysts with the ongoing demand in Bitcoin ETFs.

Under the leadership of Blackrock, the growth in Bitcoin ETFs continues

Eight -day net entrance series Bitcoin It shows that ETFs have a sustainable attraction for corporate investors. Blackrock’s IBIT’s IBIT was incredibly $ 2.3 billion (approximately 96 percent of the inputs) of a total net entry of $ 2.4 billion in this period. Fidelity’s FBTC was also among the remarkable funds.

The continuous entry series captured indicates that the sector has attracted approximately 11.5 billion dollars in total since the beginning of the year. Since they started to be traded in January 2024, Spot Bitcoin in the USA ETF‘s a total of 46.9 billion dollars of a net entrance. The total asset under the management of the funds reached approximately $ 125 billion in parallel with the rise in the price of Bitcoin. This performance is initially a strong response to the criticism of “low demand”.

Ethereum ETFs have a slowdown

In the USA Spot Ethereum ETF‘s Bitcoin’in remain in the shadow. Following the 19 -day record of 1.4 billion dollars of a net introduction series that ended last week, the flow to the ETFs slowed down. Most of the net entrance of 19.1 million dollars on Wednesday (15.1 million dollars) again Blackrock ETHA He pulled the fund. At the end of July 2024, the total net entry of Ethereum ETFs, which was opened to transactions, is now at $ 3.9 billion.

BRN Chief Analyst Valentin FournierHe stated that corporates maintain a positive view of the medium -term potential of crypto currency, but Ethereum’s “compensation” period ended. “Despite the increase in institutional flows, Momentum continues to remain soft, despite the increase in institutional flows, Momentum continues to remain soft,” Fournier added. This stagnation became even more pronounced when Bitcoin ETFs withdrew over $ 3.8 billion in the same 19 -day period.

Although the Federal Open Market Committee (FOMC) keeps its interest rates constant as expected, the Hawk tone in President Jerome Powell’s press release and the ongoing geopolitical tensions suppress the market mood. Bitcoin is traded at 0.3 percent in the last 24 hours and 2.5 percent in the last week and is traded for 104 thousand 810 dollars. Ethereum decreased by 8.3 percent to 2 thousand 527 dollars in the same period. Fournier, Bitcoin is trying to hold over 100 thousand dollars, but the resistance to overcome the resistance and acceleration if he gained acceleration, the likelihood of testing the support of 102 thousand dollars, he said. He proposed a cautious approach due to macroeconomic uncertainties and short -term catalyst lack.

21shares Crypto Money Investment Specialist David Hernandez presented a more optimistic perspective. Hernandez said, “The confidence in the perfect ‘soft descent ve and the global financial currents differ, while Bitcoin’s famine, decentralization and impartiality, the basic features such as impartiality, make it an increasingly relevant and attractive asset for investors in an uncertain future.” “Bitcoin also positions itself strongly over $ 100,000 and shows the wide adoption of the resistance against geopolitical shocks and its developing investment thesis.” made the addition.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.