To the Fed Meeting Hours left and the US is officially involved in the war. It is extremely critical for crypto currencies for the next 24 hours. Crypto has declined this year with the influence of constant surprise developments. When the tariffs are fully solved, the results of the hot war concern are pulling crypto currencies down.

The future of crypto coins

Iran’s largest oil exporters and large facilities were shot. Although almost all of the sale is made to China due to the embargo, the coup of global oil exports, the risk of growth of the war is raising oil price. The increase in oil price is a multiplier effect for global inflation, which is already about to swell due to tariffs. This suppresses the possibility of interest reduction in the US and other central banks.

Turning around and coming to the fall of crypto coins again. The uncertainty is not good for him, as crypto currencies that are affected by the indirect decrease are still treated as a technology share. In the short term, the risk is great and the FED interest rate decision, which will be announced tomorrow at this time, the FED’s 1-3-year-old interest projections and Powell‘s statements also nurture uneasiness.

Quinten argues that short -term panic is the opportunity to purchase.

“COVID COLLECTION (March 2020): Bitcoin $105,662.15 It fell to $ 3,850.

Russia-Ukraine occupation (February 2022): Bitcoin fell to $ 34,300.

Israel-Palestine (7 October 2023): Bitcoin fell to $ 27,500.

Short -term panic = long -term opportunity. ”

Poppe argues that the decline should be considered as normal because it remains a little time for the Fed meeting rather than the war.

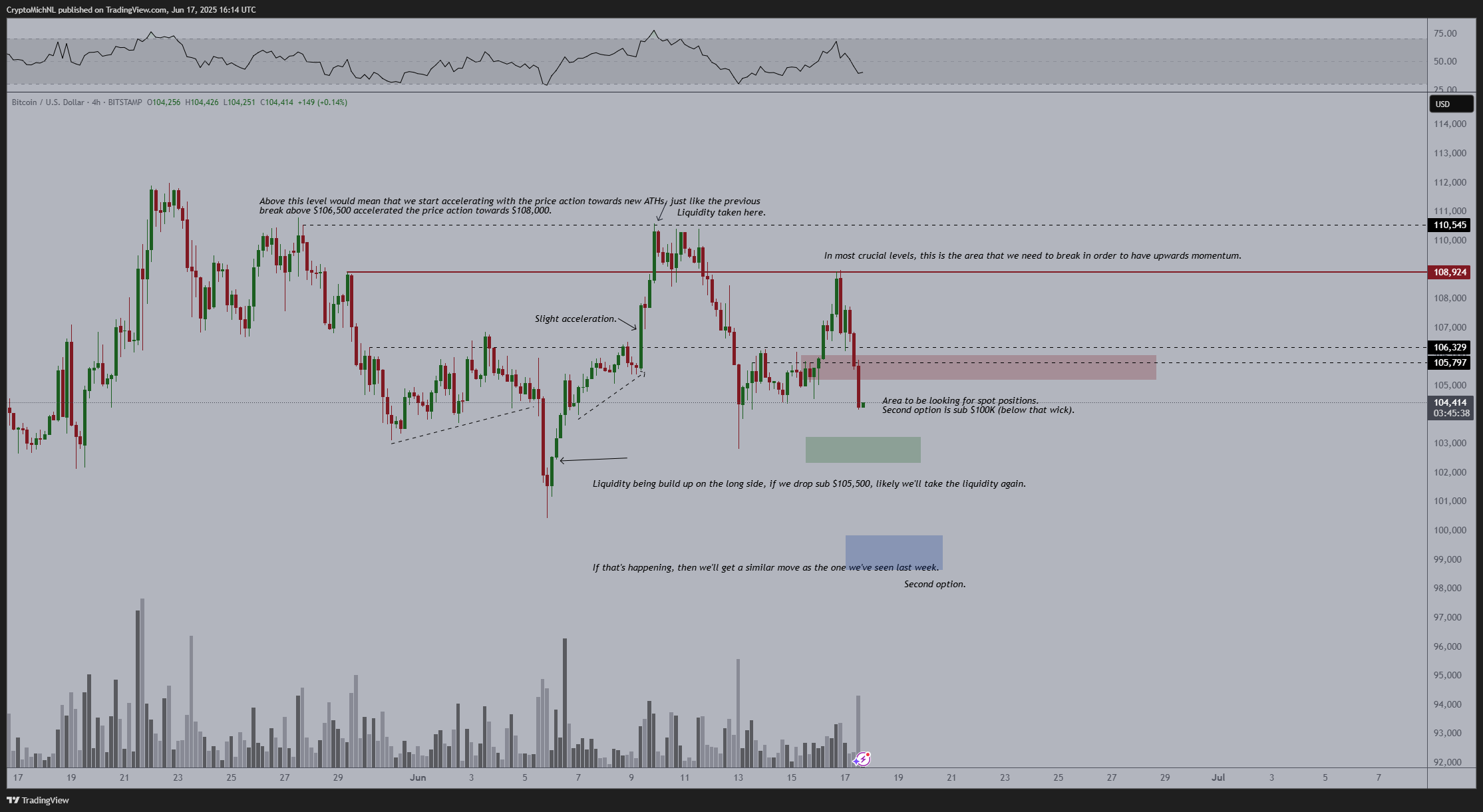

“The liquidity begins to be taken from these regions, so we are very likely to go a little further. However, this is the area you want to take care of, because this is where the liquidity comes for the real reverse return.

FOMC Tomorrow -> usually makes a bottom the day before. “

Tariff Crisis and Expectations

One of the most important agenda items of crypto currency investors is tariffs. The minutes of the Central Bank of Canada have just been published and there are details that reflect the expectations that the tariff crisis will not grow. BTC price After the minutes, he took 104 thousand dollars back.

“Before the interest rate decision of the Central Bank of Canada on June 4, the Board of Directors received courage from the growth of strong business investments in the 1st quarter, but admitted that it could be temporary.

Members of the Board agree that the possibility of a long -term and violent global trade war has decreased.

Members expect the rapid decrease in the increase in export increase due to customs duties and continuing uncertainty. He said that basic inflationary pressures may continue for a long time in the process of adapting to the restructuring of global trade by consumers and enterprises.

Although the members agreed that cost increases caused by their disruptions may play a role in inflation in goods prices, the direct impact of retaliation customs duties is not evident. ”

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.