Coinbase Institutealthe crypto money market will be in a positive course in the second half of the year. This optimistic view is based on the improvement in economic growth expectations in the United States, possible FED interest rate cuts, increasing company Treasury and a clearer regulatory framework. Head of Global Research David Duong‘s Thursday, June 12 reportAccording to the dawn of the return curve and the compulsory sales pressure from the public crypto currency vehicles, risks are now seen as managed. However, the leveraged Bitcoin of the companies (BTC) $104,786.02 There is also a warning that investment strategies can create “systemic risks ..

Bitcoin strategies of companies

To the balance sheets of public companies crypto currency Adding is increasing rapidly. Galaxy DigitalAccording to data, 228 companies are currently holding a total of 820 thousand BTC. Approximately 20 of them and Eth, LEFT or XRP some other companies that hold StrategyHe uses the leverage financing model, led by his formerly Microstrategy). This mobility follows a significant accounting change that came into force in December 2024. As you can remember Financial Accounting Standards Board (Fascin), allowing companies to report their crypto currencies on real value US generally accepted accounting principles (GAAP) had only removed the restriction of showing low value.

However, Duong warned that although the adoption has increased, the public crypto currency vehicles, which only aim to accumulate assets, bring “systemic risks .. Because most of these companies crypto currency It increases capital with a convertible debt to buy. This causes them to be open to compulsory sales in the moments of market stress or to guided voluntary sales that may scare investors. Duong also added, “It is not possible that the downward pressure, which these risks could lead to the past failed crypto currency projects in the past”.

Economic and regulatory developments support optimism

Technical in the USA recession The concerns decreased after trade disruptions at the beginning of the year and a slight first quarter contraction. Duong, Atlanta Fed‘s GDPNOW estimation of the forest of 3.8 percent as of June 5 points to the more powerful growth acceleration, he said. Therefore, serious recession is not expected. Instead, a slight recession or continuous expansion is expected.

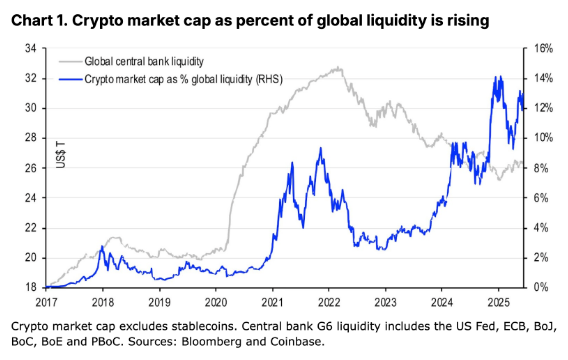

Increasing global liquidity and decreasing customs tariff effects, as well as limited decline in asset prices is seen. This is Coinbase Bitcoin strengthens the expectation of rise in the rest of the year.

2025 is also a candidate to be an important regulatory change in the USA. Contrary to the previous administration’s “arrangement by execution” approach stablecoin A two -party support has been formed to define the law and the structure of the crypto currency market. Genius And Stable The laws are expected to be combined before the August holiday and the basic rules for reserves, compatibility and consumer protection will be established. Moreover CLARYTY With the law Selection And CFTCIt is aimed to clarify the audit roles of the audit.

On the other hand, SEC, multiple asset funds, stake -possible investment products and Solana, XRP, Litecoin  $83.80, Dogcoin

$83.80, Dogcoin  $0.174737 It is busy examining about 80 ETF applications, including Mardan ETFs for Altcoins. Altcoin ETF decisions are expected to come between July and October.

$0.174737 It is busy examining about 80 ETF applications, including Mardan ETFs for Altcoins. Altcoin ETF decisions are expected to come between July and October.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.