Bitcoin (BTC) price has continued to glide higher in the weekly and monthly timeframes despite the consolidations and choppy markets in the hourly chart. The flagship coin has been forming a bullish continuation pattern after being rejected at its all-time high of around $111,900, which was set around May 22, 2025.

Since June 9, 2025, BTC price has experienced a significant resistance level of around $110,500, thus resulting in a 2-3 percent drop to date. The drop below $108k in the past 24 hours has created a palpable fear of further short-term correction.

Here are Major Factors to kickstart FOMO and Bullish Sentiment for Bitcoin Soon

Technical Aspect

BTC price has traded above a crucial weekly support level around $104,354 in the past five weeks. In the past three weeks, BTC price has been retesting the bullish breakout, signaling a parabolic rally soon.

In the 1-hour timeframe, BTC price has been retesting a bullish breakout from a falling logarithmic trend. Although a solid base for the ongoing market correction has not been established, a major rebound is on the horizon.

Weakening U.S.Dollar Amid Crypto Regulatory Clarity

Despite the historical attempts by the Donald Trump administration to strengthen the U.S. dollar, the DXY, which measures the value of the U.S dollar against other major currencies, has been declining. The Chinese Yuan and other currencies have been strengthening against the U.S. dollar.

With Bitcoin mostly traded against the U.S. dollar, the underlying value will skyrocket in the near future. Meanwhile, U.S. regulators have been making strategic moves to help the U.S. dollar remain dominant globally.

For instance, the country intends to use stablecoins by enacting clear regulations. Consequently, crypto liquidity will increase significantly in tandem with the global money supply (M2).

Heightened Demand from Institutional Investors

According to aggregate data from BitcoinTreasuries, the entities holding Bitcoin in their treasuries has surged by 21 firms in the past 30 days, thus increasing the BTC holdings by 3.28 percent to 3.41 million. More institutional investors, led by GameStop, have been following in the footsteps of Strategy to leverage the global equity markets to strengthen their Bitcoin holdings.

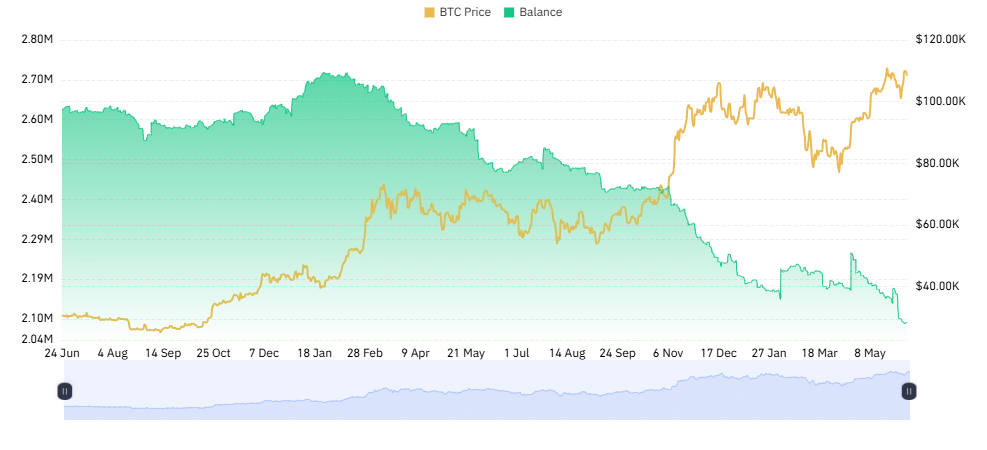

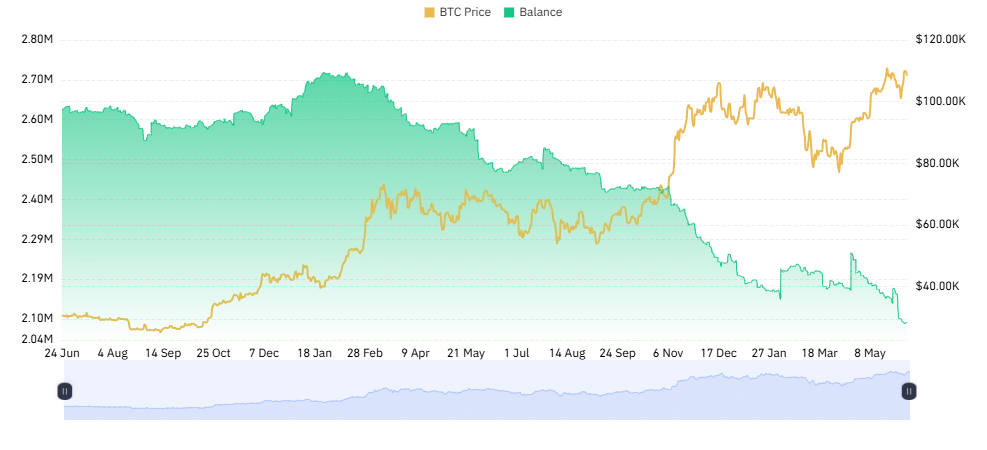

The U.S. spot Bitcoin ETFs, led by BlackRock’s IBIT, have continued to relentlessly accumulate more BTCs in the past year. As a result, the balance of Bitcoin on centralized exchanges has exponentially declined to a multi-year low of about 2.09 million coins, thus confirming a major supply vs demand shock.