King turned the direction of the crypto currency again and we are waiting to see explanations about the agreements on tariffs at the upcoming G7 summit. BTC finds buyers for $ 107,600. AVAX, altcoins such as island continues with losses based on 5 percent. Alright crypto currency What’s the latest situation in ETFs?

Crypto coins guess

Today, we will start the day with successive statements of the European Central Bank officials. The potential we will see here emphasizes can be effective on prices. In the afternoon, US manufacturer inflation data will come and 2.6 %for headline ÜFE is expected. The expected increase compared to the previous month’s 2.4 %may be a negative signal for personal consumption expenditures to be announced at the end of the month, as the US market opening may fall before the opening of the market.

There is no big improvement tomorrow. 15-17 June G7 Summit and USA and the countries that strive for a tariff agreement are likely to use the opportunities for the meeting here to complete the agreement. Since the problem was solved with China, everyone began to think that they could compromise with the US and this is quite positive.

Later in the day BTC The price of $ 107,800 may continue to close more losses in subcoins. In the Middle East, there is a mobility whose details have not yet become clear, and the fear of the crypto may be dispersed/increased by US officials’ concerns ”.

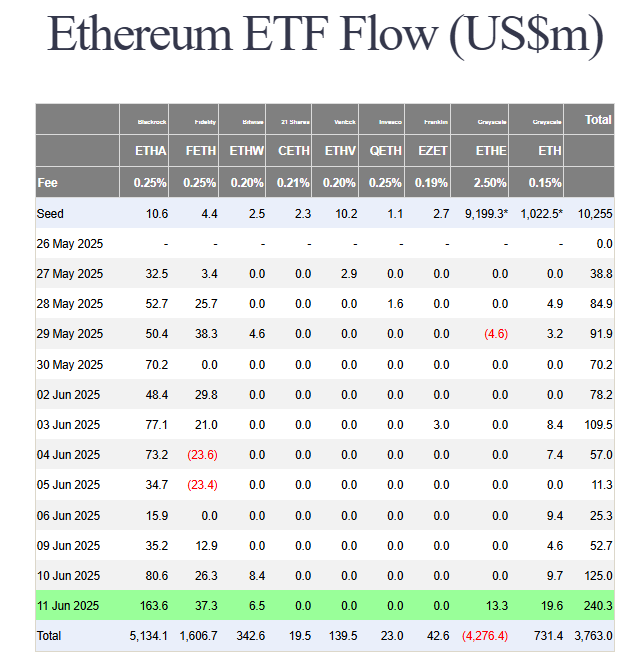

Crypto Money ETF data

From the exits of June 5 BTC ETF Their entrances continue steadily. Yesterday, we saw a net introduction of $ 164.6 million with the confirmation of the Chinese compromise by Trump and the positive CPI data. This week’s net entries approached $ 1 billion. However, with the opening of today’s market, there is a risk of triggering outputs of concerns caused by geopolitical tension. If such a negativity occurs, we can see that losses increase in daily closing.

ETH ETF‘s long -time net entries have been experiencing. Moreover, the entrances are increasing exponentially. The price movement exceeding $ 2,800 yesterday brought a net entrance of $ 240 million on ETF channel. Ethereum  $2,765.16 The biggest entrance came from Blackrock customers, leaving the entrances behind. Both BTC and ETH interest are very strong on the Blackrock side and motivating for this market general.

$2,765.16 The biggest entrance came from Blackrock customers, leaving the entrances behind. Both BTC and ETH interest are very strong on the Blackrock side and motivating for this market general.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.