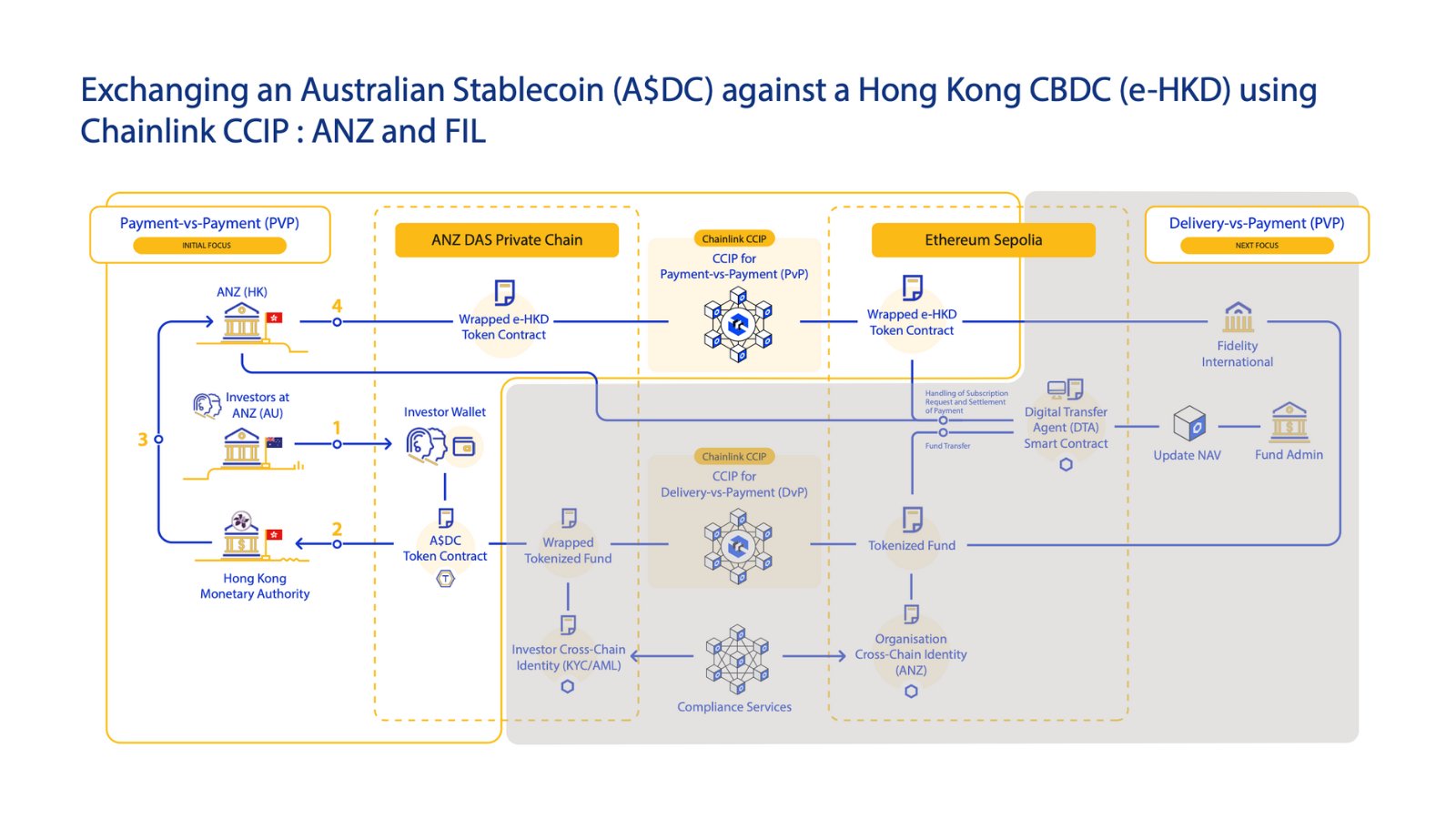

In the second stage of the E-HKD+ Pilot Program of Hong Kong Monetary Authority, Altcoin Chainlink $13.91 (LINK), Hong Kong’s Central Bank digital currency E-HKD and Anz Bank’s Australian dollar stablecoin A $ DC made a safe exchange between A $ DC. Visa, AnzChina Amc and the other participants of the Fidelity International transaction. The test reduced two currencies to seconds by changing atomic payment to seconds. The transaction also drew attention in the global financial world. While the process is carried out by Chainlink’s Blockchain CCIP protocol, the pilot program is still ongoing.

PLACE OF BORDER IN THE PILOT PROGRAM

In experiment E-HKD And A $ DC ‘Payment-Karşı-Ödeme’ fiction was replaced by co-excited. The procedure was started at Anz’s on leave Daschain and Ethereum  $2,541.90 The test network was terminated. Thus, private and open blockchains were running with coordination and real -time, global exchange possibilities were shown.

$2,541.90 The test network was terminated. Thus, private and open blockchains were running with coordination and real -time, global exchange possibilities were shown.

The report published in relation to the study reveals that this model, which resulted in seconds, has removed the risk of agreement, reduces the cost of transaction and makes its background movements seven days a week.

China amc And Fidelity International In the scope of the trial, Hong Kong watched the post -trade processes for the tokenized money market fund units and evaluated the results.

How did Visa and Anz involved in the process?

Visa, TOKEYED Asset Platform (VTAP) with the name of the APIs offered digital money printing, burning and transfer automated. Smart contracts provided fund delivery at the same time with money transfer. This approach allowed the transaction to progress uninterruptedly by eliminating the need for manual reconciliation.

Anz transformed the customer’s Australian dollar into A $ DC, Hong Kong Monetary AuthorityE-HKD and directed the exchange difference and recorded all reserve verification in his own Daschain environment. Thus, a multi -currency bridge was established in the Bank’s arrangement -compatible hybrid blockchain infrastructure.

In the future, the two institutions plan to test live transfer and licensed assets in the main network of Ethereum.

Chainlink CCIP and Blockchain bridge was established

To connect different standards specific to blockchain altcoin Chainlink’s CCIP protocol was used. The Oracle network carried both data and value between two blockchain processes between Daschain and Ethereum. This method reached the level of corporate security by transparent verification that prevented Coin’s double spending.

Participants evaluate CCIP will form a critical standard that can reduce the market division in the Blockchain -Blockchain -Blockchain -Blockchain. The fact that CCIP has been selected for the study indicates that the participants want to adapt the decentralized Oracle -based communication models to the traditional financial world.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.