Bitcoin (BTC) $107,521.22 And Crypto Money MarketThe rest of the Federal Open Market Committee (FOMC) on June 18 is cautious before the meeting. The largest crypto currency holds over 108,000 dollars, while the total market value is at $ 3.38 trillion. CME Fedwatch data shows that the interest rate cut that investors have been waiting for a long time will not come at this meeting. The fact that employment remains alive and the fact that inflation wandered above the Fed’s target led to the policy -makers to be tied. European Central Bank (ECB) makes a 25 basis point discount and demands a hard relaxation of 100 base points, but the FED is preparing to leave the interest in the 425–450 base score band constant. In this uncertain equation, investors point to a gradual transition to alternative assets such as gold and crypto currencies, while the “shoulder head and shoulder” formation appearing on Bitcoin’s graph points to a potential withdrawal to a potential $ 92 thousand.

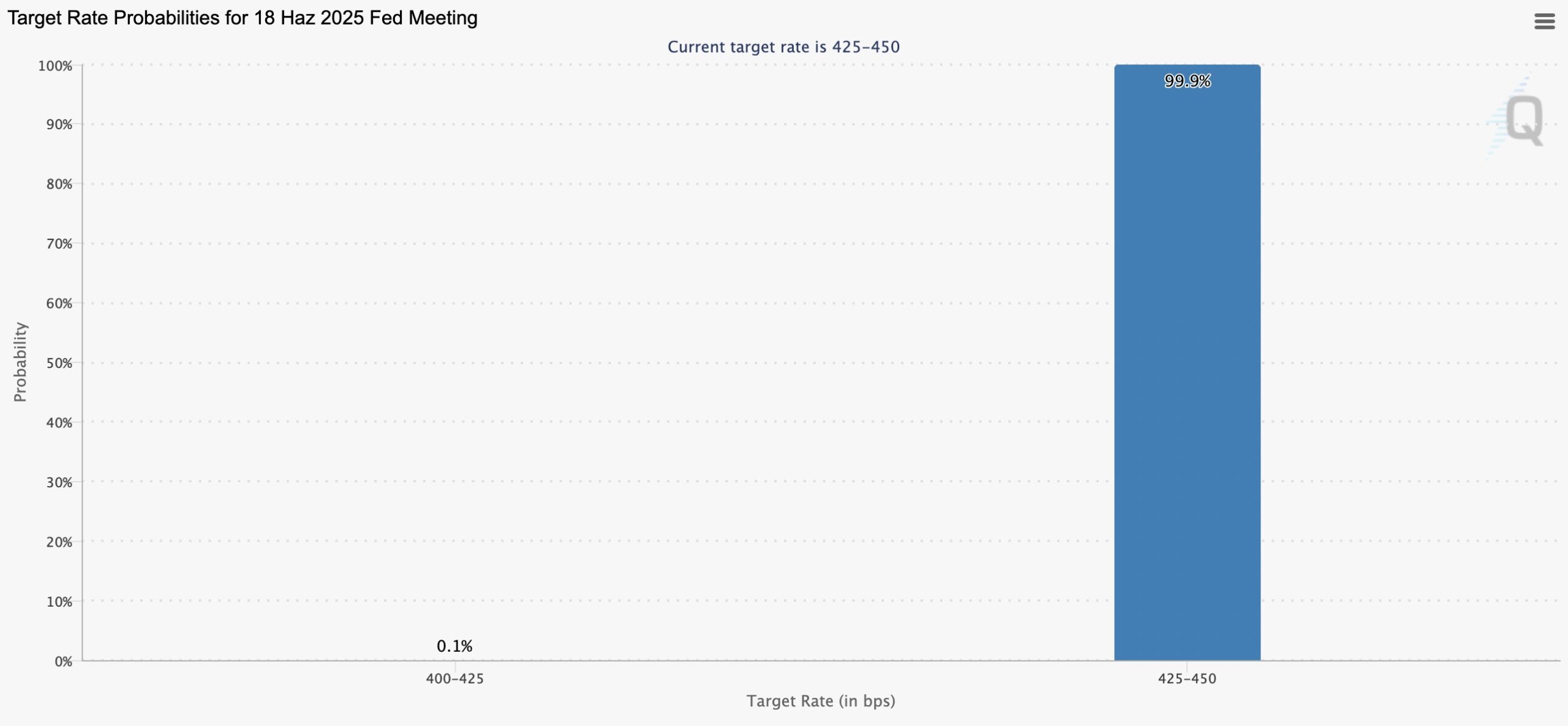

The Fed is expected to keep the interest rate fixed by 99.9 percent.

CME Fedwatch ToolAt the FOMC meeting on June 18, the probability of fixed interest rates is 99.9 percent shows. Only 0.1 percent of a segment of a 25 basis point -point mini discount pricing the possibility of a discount. Even in the appearance of July, the probability of rating interest rates has fallen to 14.5 percent.

While these possibilities last month are much higher, strong employment data and stubborn inflation forecasts radically changed investor psychology. Fed Authorities do not want to give a signal of softening without measuring the secondary effects of customs tariffs and price prints in the economy.

On the other hand, the 100 base -point reduction that ECB wanted by ECB’s 25 basis points and Trump’s “rocket fuel to the economy” was not enough to convince the decision makers in Washington for now. Powell management choosing to stay patient, the FED Presidency change and a possible Kevin Warsh The rumors of assignment make the policy continuity even more complexity.

The shoulder in the Bitcoin graph scares the head shoulder formation

Despite the increasing uncertainty, market actors did not completely abandon the risk appetite. Bitcoin While gaining more than 2 percent value in the last 24 hours, gold attracts the funds looking for safe harbor. Some investors are in search of returns and reduce the US dollar positions and grow crypto money baskets. Youoveler Analyst Sergei taskHe says that this orientation holds Bitcoin strong.

On the other hand, the same analyst warned that global interest does not give a clear signal, and that the possibility of withdrawing back to $ 92,000 should not be ignored if the shoulder head and shoulder formation on Bitcoin’s graph should be ignored. Market participants will carefully monitor both inflation data and Fed’s tone after the meeting.

Fragile optimism prevails among analysts

Crypto currency commentators remind that most of the ascension is based on the assumption of “interest rate reduction is coming”. If this expectation is shifted, prices are likely to have a volatil correction. However, the Fed’s premature relaxation as “extended positive interest rate yield, arguments argues that corporate Bitcoin ETF entrances may last without slowing down. Although it is possible to cruise in a wavy band in the short term, the medium-term narrative is shaped around the high interest-high demand dilemma.

On the other hand, policy risks are on the table. Trump’s harsh criticisms increase the pressure on Powell, while potential customs duties may re -exacerbate inflation.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.