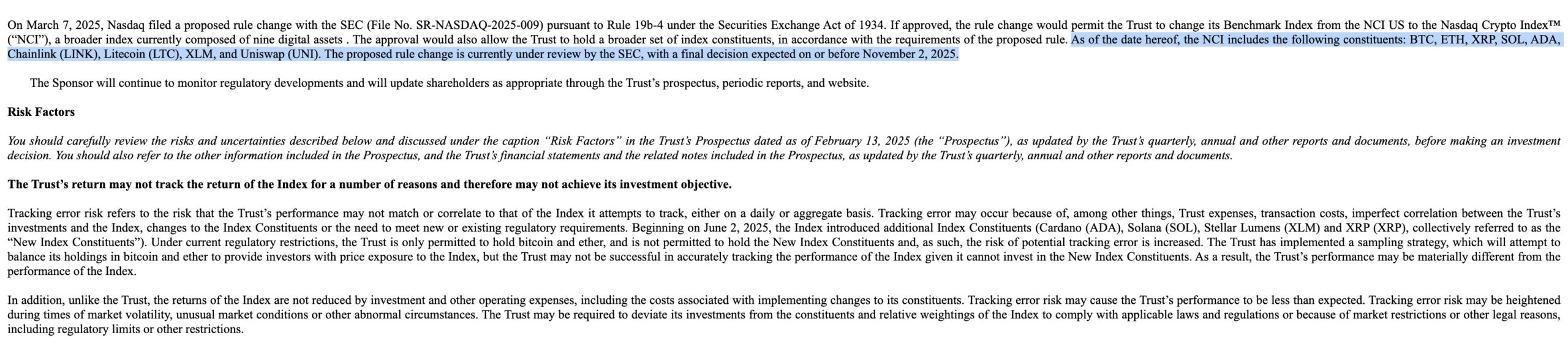

Altcoin CARDANO $0.675208Ada Coin is between 0.654 dollars and $ 0.678, and then consolidated $ 0.662. The price, which has fallen by about 10 percent since the April summit, dangled under the rising trend line last week and gave a short -term decline spark. Analysts, third generation blockchain coinHe emphasizes that it must remain above $ 0.65 during the week, otherwise it can recapture the short -term control of bears. The reference index with Nasdaq’s 8-K form offered to SEC XRP, Solana, Stellar  $0.267835 And his desire to expand to nine assets, including Cardano, keeps optimism alive in Altcoin. The approval process is expected to result on 2 November 2025. It is a question of whether ETF’s demand can withdraw the price of Ada Coin again.

$0.267835 And his desire to expand to nine assets, including Cardano, keeps optimism alive in Altcoin. The approval process is expected to result on 2 November 2025. It is a question of whether ETF’s demand can withdraw the price of Ada Coin again.

Ada Coin’s price is critical to around $ 0.65.

Ada Cointrying to protect the lower band of the parallel channel rising in the last 7 days, strengthened the defense line of buyers with closing over $ 0.635. 50 and 200 -day moving averages in the current fluctuation serve as local resistance and support, respectively. The light rise at these levels raises a potential “Golden Cross” expectation. The highest -volume purchasing orders are still intensifying around $ 0.65, and this area is likely to recover short -term recovery unless it is broken downward.

However Relative power index‘s (RSI) to the line of the trend line twice in a row shows that the rally has lost acceleration. If the sales pressure weakens RSI further and the price goes below $ 0.635, analysts remind that the second defense line in $ 0.60 can come into play. Backwards, ISLAND If it can gain acceleration for $ 0.70, the band of 0.77-0,80 in the medium term will be on the agenda. As long as this region is permanently broken, the rise will still be limited.

Nasdaq’s application can make Cardano a center of interest

NasdaqHe announced that Cardano has also included Cardano by increasing the crypto currency reference index from five assets to nine. This enlargement in the index gives corporate showcase to large Altcoins, including the island, and the Spot ETF approval is still waiting in front of the SEC. Market participants foresee the announcement of SEC’s decision on 2 November 2025 and are preparing to pricit the potential capital flow.

The expansion in question altcoinIt is considered an important threshold in terms of reaching the wider audiences. In particular, Ada Coin investors read the change in the index structure as a long -term adoption indicator. Nevertheless, as the regulatory uncertainty continues, it seems inevitable that the price will monitor the wavy course.

Technical indicators will be the determinant of the net direction in the short term

Market Psychology is said to have the island’s stuck in the existing narrow band and the sagging below $ 0.65 will encourage sellers. On the other hand, a possible intersection between 50/200 days of averages may renew confidence on the purchase side. As long as the zone of $ 0.77–0.80 in the short term is not exceeded, the probability of profit purchases will be activated.

In addition to weakening in RSI, the faint table in the process volume shows that the desire for rise is limited. Investors protect their cautious stance, especially unless permanent closing over $ 0.70. All technical signals indicate that either a strong volume increase or a critical support should be closed to determine the net aspect of the island’s price.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.