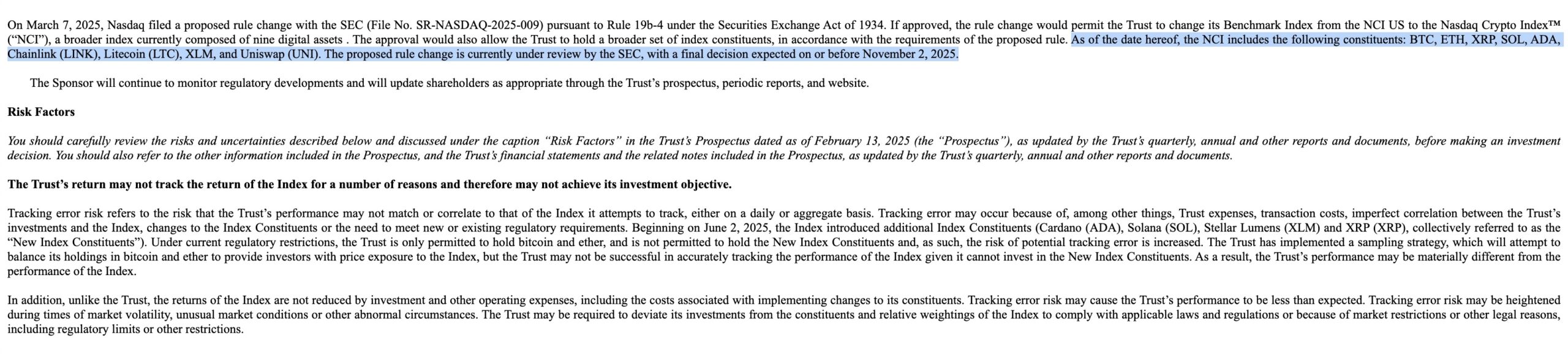

NasdaqHashdex Nasdaq Crypto Index US ETF (NCIQ) with the Rule 19b-4 file presented to the US Securities and Stock Exchange Commission (SEC) on June 2 reported. Currently only Bitcoin $107,521.22 And Ethereum  $2,541.90ETF following ETF is aimed at transforming Nasdaq Crypto Index (NCI), which covers nine large crypto currencies. If SEC accepts the application XRP, Solana, CARDANO

$2,541.90ETF following ETF is aimed at transforming Nasdaq Crypto Index (NCI), which covers nine large crypto currencies. If SEC accepts the application XRP, Solana, CARDANO  $0.675208, Stellar

$0.675208, Stellar  $0.267835 Lumens, Chainlink

$0.267835 Lumens, Chainlink  $13.91, Litecoin

$13.91, Litecoin  $88.86 And Uniswap will also be included in the index. However, SEC regulations allow ETF to keep only BTC and ETH for now. This leads to a tracking error. The deadline for SEC’s decision is 2 November 2025.

$88.86 And Uniswap will also be included in the index. However, SEC regulations allow ETF to keep only BTC and ETH for now. This leads to a tracking error. The deadline for SEC’s decision is 2 November 2025.

The basic basis points of the proposed change

The application aims to leave NCIQ out of its two wealthy structure and offer a very wealthy appearance. The new index is BTC and ETH, as well as seven important altcoin It will offer a wider photo of the crypto money market by adding. Thus, investors will be able to follow the main tendencies in the sector with a single indicator.

Hashdexdue to existing regulations, all crypto currencies in the index cannot directly invest. The company creates a portfolio that represents the index using the “sampling” model to reduce the performance difference. This method is trying to close the gap between monitoring and actual asset limitations.

Secure Approval Process and Calendar Details

The SEC has the authority to approve or reject Nasdaq’s offer by November 2, 2025. In case of approval, ETF will be able to invest in the entire nine crypto currency in the index. This is within the legal framework altcoin It can increase corporate demand by allowing exposure.

The most cautious attitude of the regulatory institution is multiple ETF It creates uncertainty for all of its applications. Nevertheless, the application indicates that the regulatory approval mechanism can expand to diversified crypto currency investments. Market observers closely follow the decision of the decision to influence both the ETF ecosystem in the US and the potential to influence the lower liquidity.

Possible effects of the expanded index

Altcoins added to the indicator NCIQIt can change the risk-influx profile of ‘. While more assets balance the volatility structure of the index, it can allow investors to access the diversified crypto currency basket through a single product.

This change may be an important milestone for the representation of Altcoin in arranged products. With the growth of the market, crypto currencies included in the index are expected to meet with a wider audience. Thus, it is possible to strengthen liquidity and price discovery processes in the sector.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.