The world’s second largest crypto currency network Ethereum (ETH) $2,541.90is approaching a new turning point with the interest of corporate investors. In the report published by Bernstein on Monday, June 9, Analyst Gautam Chhugani and his team, Bitcoin in the latest market cycle  $107,521.22‘s (BTC) “Value Storage” narrative stands out, but real financial innovation was shaped in Ethereum and similar public blockchain. While analysts maintain their loyalty to the target of 200 thousand dollars in Bitcoin, the real growth stablecoin and emphasized that it will accelerate in Ethereum thanks to its usage areas such as asset tokens. In the last 20 days, the entrance of $ 815 million to the US Spot Ethereum ETFs has been shown as a sign of this change.

$107,521.22‘s (BTC) “Value Storage” narrative stands out, but real financial innovation was shaped in Ethereum and similar public blockchain. While analysts maintain their loyalty to the target of 200 thousand dollars in Bitcoin, the real growth stablecoin and emphasized that it will accelerate in Ethereum thanks to its usage areas such as asset tokens. In the last 20 days, the entrance of $ 815 million to the US Spot Ethereum ETFs has been shown as a sign of this change.

Corporate interest is increasing rapidly in Ethereum

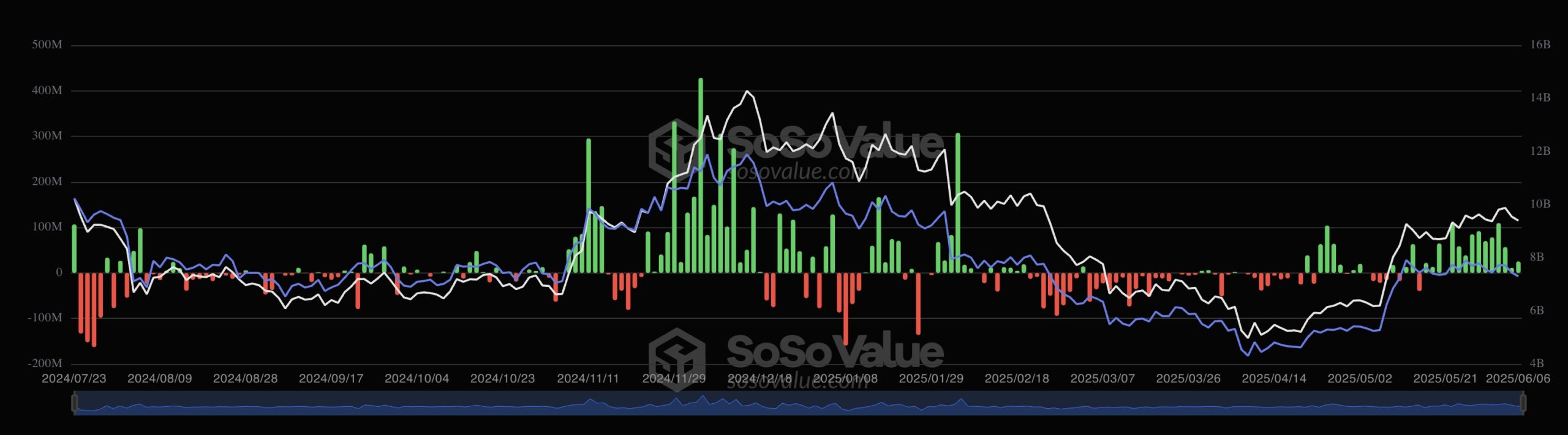

Launched in January 2024, Spot Bitcoin ETFs reached an asset size of exceeding $ 120 billion and became one of the most successful investment products in history. On the other hand, Spot Ethereum ETFs, which were initiated in July 2024, had only $ 9 billion. However, this difference is not surprising, as Ethereum’s market value is one -seven of Bitcoin. More importantly since the beginning of the year Ethereum ETFNet entrances to 658 million dollars rose. The intense demand in the last three weeks shows that corporate investors have rediscovered ETH.

Bernstein argues that Ethereum is the natural home of new financial products thanks to the ür Global -decentralized computer ”identity. Most of the stablecoins and tokecination projects are already Ethereum -based. The network fees paid for these transactions give direct value to ETH. Analysts, “Blockchain useful, crypto curren ETH pricena reflected.

Payment and fintech moves that accelerate innovation

Visa, MasterCard And Strip While paying giants such as stablecoin strategies, coinbase and Crake Crypto currency exchanges such as Blockchain began to offer new financial services. CoinbaseIn its own Layer-2 network, Base is running the payment pilot to traders with stablecoin. Kraken plans to offer international users with tokenized US stocks. Robinhood on the other hand, it actively defends the idea of token the real world assets.

According to Bernstein, these steps represent a transformation of individual investors’ speculative Coin games to capital markets, payments and new generation fintech applications. As more companies use blockchain rails, network fees will increase and this income is directly Ethereum’s main network presence Ethwill be reflected. Analysts, “Basic blockchain assets are now out of useless speculation and transformed into concrete financial innovation. Investor’s interest is followed by it,” he foresees the process of self -feeding cycle.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.