Crypto Money MarketThe total value of the total value of 0.68 percent in the last 24 hours decreased to 3.3 trillion dollars. The daily transaction volume fell to 101.76 billion dollars. Kriptoko indicates that investors do not have a clear opinion at the 55 level of fear and greed index. In this atmosphere JP MorganThe acceptance of crypto currency ETFs as a credit guarantee was a critical development that faint the line between traditional banking and crypto currencies. However, Bitcoin is still in the center of gravity in the market $105,658.08 there is. Analysts are currently proposing a roadmap focused on selective crypto currency accumulation while preserving the capital.

What is JP Morgan’s collateral decision?

Wall Street giant JP Morgan, Spot and Futures Crypto Money ETF He accepted his shares in corporate loans and opened a new door under risk management. The bank will cut according to the volatility while determining the guarantee value. Thus, in portfolios, traditional securities and crypto currencies will be encouraged. This model officializes the increase in corporate crypto currency interest in the United States, as well as preparing the ground for the expected flexibility in Basel arrangements.

The timing of the decision is quite strategic. Because the uncertainty and balance sheet narrowing of the Fed’s interest path leads companies to alternative collateral classes. Bitcoin ETFConsidering the continuous entries to their ‘, it seemed inevitable that banks would start to accept liquid and transparent crypto currency products. JP Morgan’s move can be guided by other major banks as risk premiums improve. This can indirectly strengthen Spot Bitcoin demand.

Bitcoin’s leadership continues

On the other hand BitcoinWhile the dominance of the market at long -term peaks, the 20 and 50 -week moving averages are the critical reference point. As the price holds over 82 thousand 600 dollars, the rise trend will be preserved. 93 – 95 thousand dollars to the band that will be seen as a “cheap value” zone. Keeping core Bitcoin in the portfolio allows both liquidity and sensitivity to the market direction.

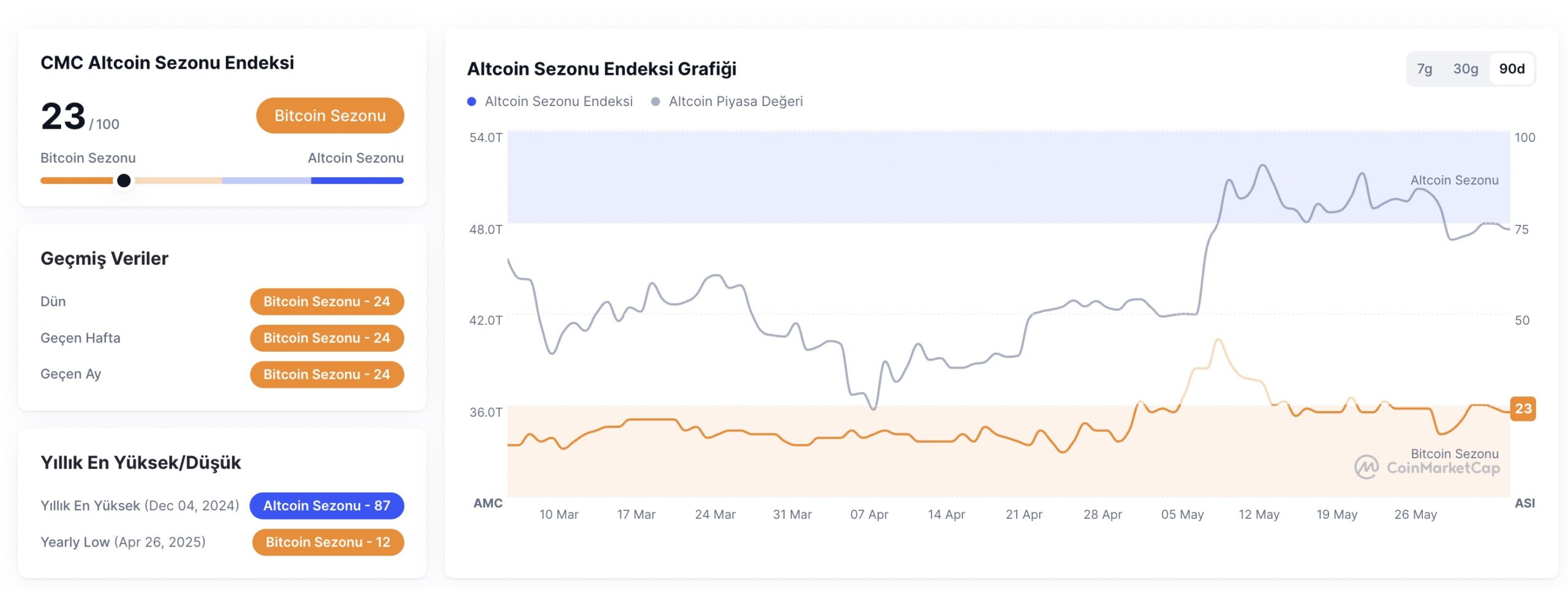

Altcoin‘s has been stuck under the old summits for more than a thousand 300 days. The tendency in Bitcoin’s dominance graph shows that the signal of a wide -scale “Altcoin Season” signal has not yet been formed. Again Ethereum  $2,641.32, Solana, Bittensor And Pepe Popular Altcoins, such as, offer gradual purchase opportunities in prominent support zones. During this period, it is critical for portfolio management to stand distant to valuable coins until the strong momentum confirmation arrives.

$2,641.32, Solana, Bittensor And Pepe Popular Altcoins, such as, offer gradual purchase opportunities in prominent support zones. During this period, it is critical for portfolio management to stand distant to valuable coins until the strong momentum confirmation arrives.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.