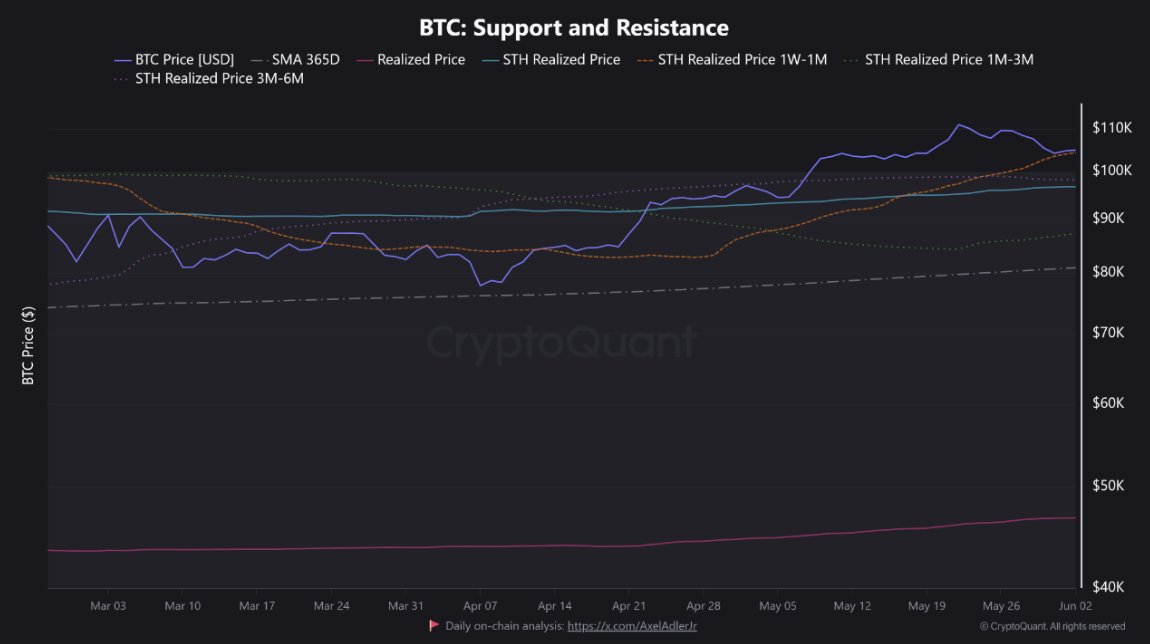

Bitcoin $104,365.15The average purchase price of short -term investors in (BTC) in the beginning of the week is close to the $ 97 thousand dollars, while the chain analysis platform Cryptoquant The price is based on network -based support of 96 thousand 700 dollars. According to the data, the region in question is the intersection point of the average cost of short -term investors. Analysts recall that sales have increased if this threshold is broken in previous cycles, but in the scenarios where it is protected, there is a fresh capital entry to the market. For now Bitcoin market The future has held his breath for movement.

The importance of 96 thousand 700 dollars for investors is of great importance

96 thousand 700 dollars of the band in the chain price indicator corresponds to the short -term investor branch. So in the last 155 days BTC The average cost of the wallets received corresponds to this level. Cryptoquant Analyst Abramchart“This price line is the last trench both technically and psychologically,” he pointed out the importance of the price threshold.

Past data shows that the price attached to this threshold is rapidly recovered with the volume increase, and in the scenario it cannot hold, it is looking for a bottom up to 80 thousand dollars. From this perspective, the capital prepared for the purchase Spot ETF It may be closely monitored by this region, regardless of its flow. Short but harsh wicks test the investor psychology, while in -chain activity supports the value of the network for the network for now.

In addition to internal measurements, futures funding rates have approached the critical level. Nevertheless, there is no significant leverage increase. This means that the liquidations that can be triggered by harsh price movements are not on the table for now. MVRV The ratio is still at the level of 1.89 and is far from the over -valuation zone. However, it is seen that there is a slight increase in the sales of miners in the last 24 hours.

Hash Price When it falls below 102 dollars, its historical sales pressure tends to accelerate. If these sales are intensified, 80 thousand dollars can be tested in the short term, but the still supply of long -term investors in the chain continues to balance this pressure. On the other hand, the purchase orders of OTC tables in the evening increases the likelihood of completing the price in the positive region.

Market sensitivity and possible scenarios in Bitcoin

Spot liquidity in the market decreases by 8 percent on a weekly basis, while the reverse delta curve in the option market indicates gradual recovery in the 30 -day term. Investors US inflation data And FOMC meeting It is busy adjusting the risk profile before. Therefore, new purchase orders are partially delayed. However, the stablecoin inputs outside the chain are fixed at the level of $ 820 million, and the cash waiting on this edge still has a certain risk appetite. It can raise the appetite of funds known as a hard needle bottom hunter to be experienced in a short time. On the contrary, the course above $ 101 thousand can bring the barrier of 105 thousand dollars to the agenda.

In the Technical Graph Falling Kama Formation As long as it is not supported by volume, there is a low probability of a break. But in 4 -hour candles Relative power indexGently curling up at the level of 38 (RSI) indicates the possible rotation of the momentum.

Glassnode Although the data showed that there is no striking change in the number of active wallets, the net outputs made from the stock exchanges to the wallets found 17 thousand 300 BTC in the last three days. This mobility, which has been observed since August 2024, makes it possible to think that investors holding long -term levels are purchased. If new outputs from Spot ETFs are limited and a negative surprise news from the macro front, the 96,700 dollar band can once again work as “strong support .. Otherwise, it is possible to search for a stronger foot at the levels of 80 thousand dollars.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.