US Federal Bank (FED) President Jerome Powellimplying the possibility of flexibility in monetary policy, the largest crypto currency seeing $ 103 thousand at the weekend Bitcoin $104,365.15‘s (BTC) again for the splashing of 106 thousand dollars to jump. At the time of the news on the threshold of 105 thousand dollars at the threshold Bitcoin’le Altcoins recovered. Emphasizing that global data plays a critical role in decision -making processes, the explanation increased the risk appetite. In the Asian session, the transaction volumes increased significantly, while the investor interest was refreshed.

Powell’s Words Was Hope to the Markets

Powell, FedHe did not directly refer to interest rates at the international financial event, but inflationFlour decreased to 2.3 percent and unemployment of around 4.2 percent underlined. Participants think that this data carries the message that the Fed can return to gradual relaxation from the “patient tightness” attitude. Limited slimming in the dollar index also supported the expectation.

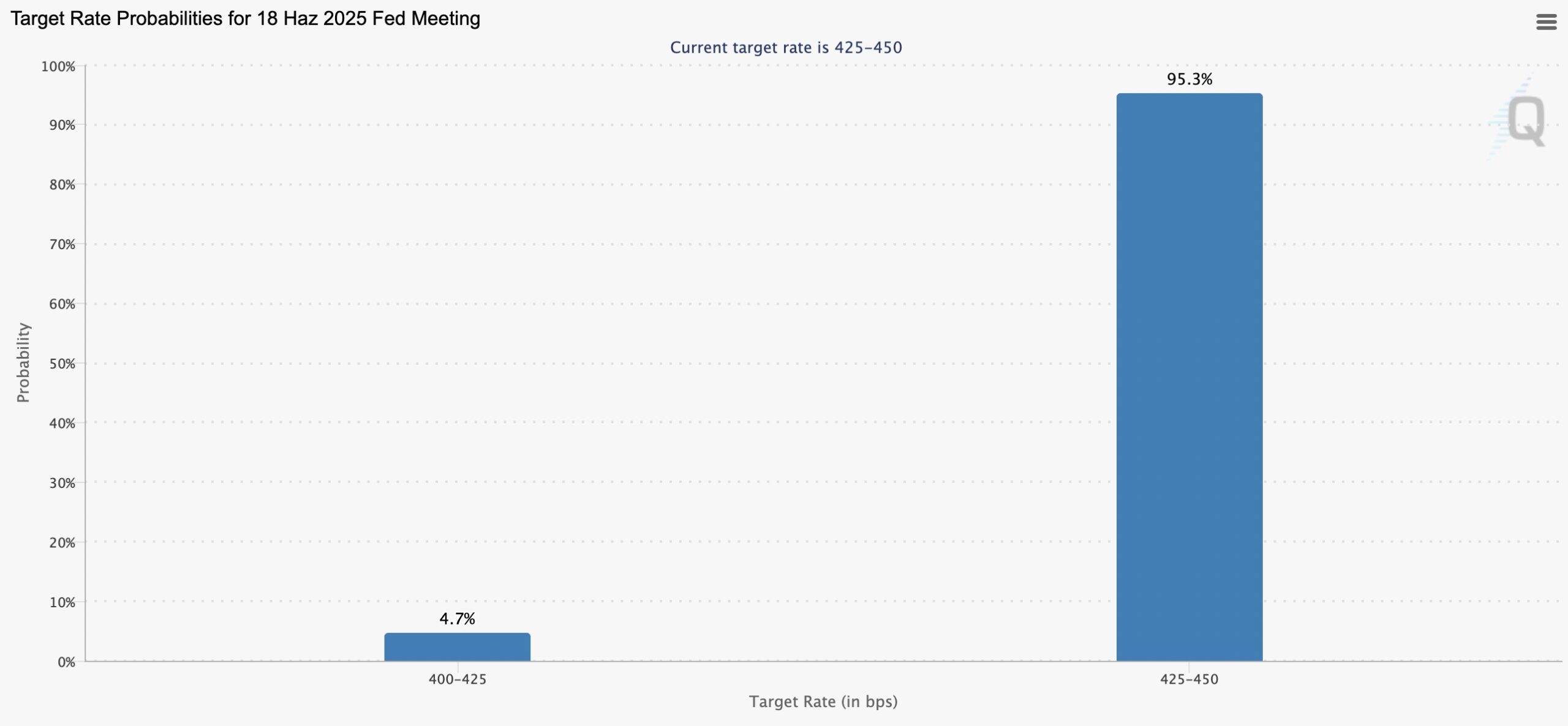

Chicago Fed President Austan goolsbeeWith the interpretation of ‘slowing down on inflation ”, Powell’s message led to the first interest rate cut from November to September. CME FEDWATCH Although the data showed the probability of interest in the FOMC meeting on June 18 over 95 percent, the probability of relaxation of 25 basis points in the last quarter rose to 55 percent. Analysts emphasize that the Fed can also review the balance sheet contraction rate and that cautious optimism is dominant.

Possible interest rate reduction can bring a new breath to Bitcoin and Altcoins

Bitcoin, after Powell’s statements gained $ 3,000 in seconds, tested 106 thousand 700 dollars and reversed the negative atmosphere at the weekend. While open positions in the futures contracts increase by 8 percent in 24 hours, in -chain data show that short -term investor costs are concentrated around 96 thousand 700 dollars. As it is above this level, they seem possible to try new records.

Technically, the daily closures of 104 thousand 800 dollars confirm the power of the trend, while analysts draw attention to the psychological resistance in 110 thousand dollars. The net $ 620 million, which entered the ETFs last week, supports the capital receiver. If the inflation indicators continue to heal until the FED meeting, it will not be surprising that the historical summit of around 112 thousand dollars will be overcome. at this point altcoin‘s the largest crypto currency can be a partner.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.