Paris -based The Blockchain Group (TBG) announced that it has added 624 BTC to its portfolio for approximately 60.2 million euros. So the company’s total Bitcoin $104,365.15 The presence reached 471 pieces. Created Bitcoin The return of the portfolio since the beginning of the year has impressively climbed to a thousand 97 percent. TBG, which is traded on the European stock exchanges, reinforced the title of “Bitcoin Treasure” and re -flared the expectations of corporate investors’ crypto currency strategies.

TBG’s Bitcoin Treasury Strategy

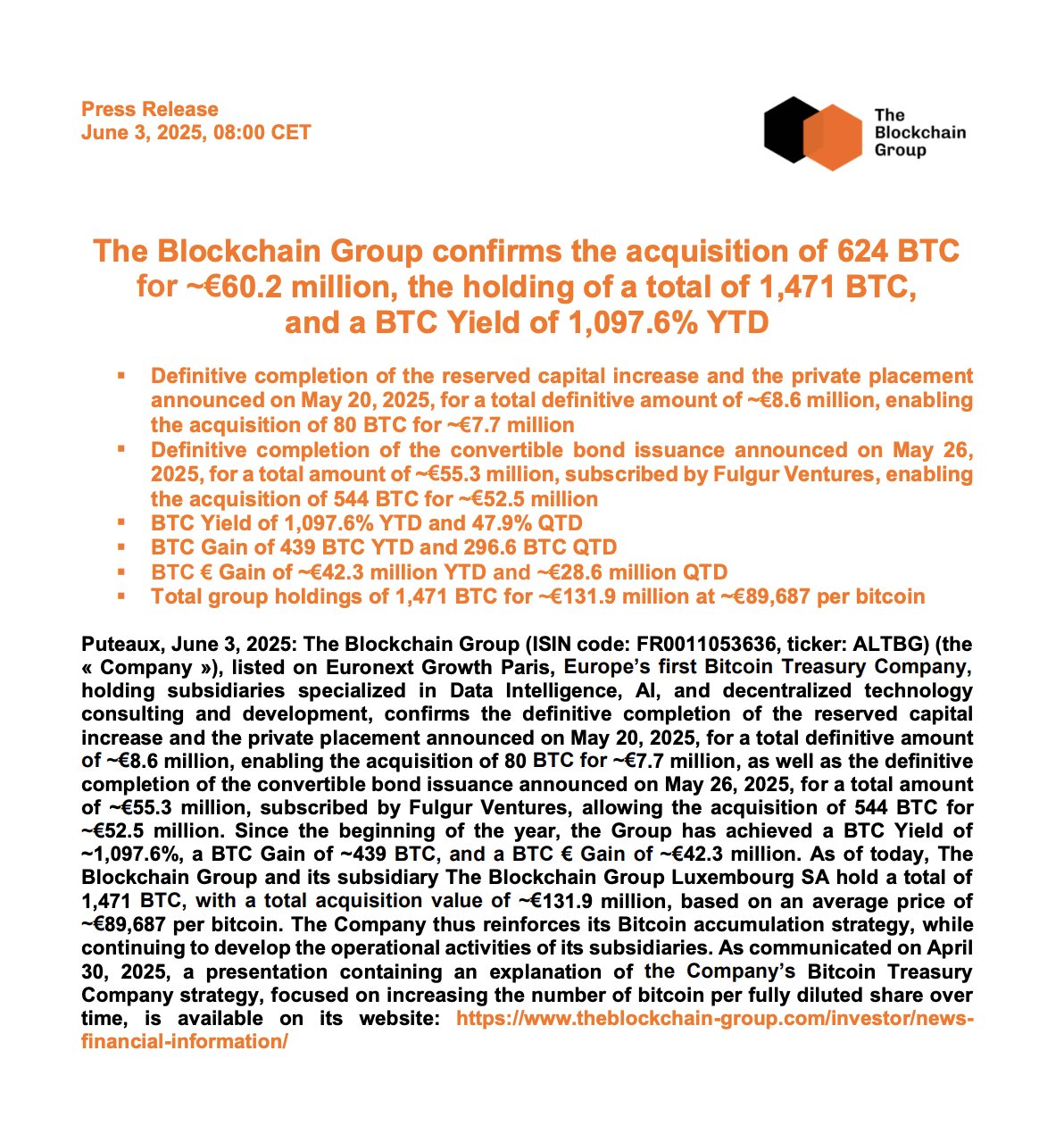

TBG’s last acquisition was the last ring of Bitcoin purchases announced by the company in the first half of the year and carried the crypto currency balance in the balance sheet to 471 thousand BTCs. The management said that the average cost -reduction policy, which has been monitored since the beginning of the year, united with the price rise and increased the return to a thousand 97 percent. Chairman of the Board of Directors Rémi Fortbac “Bitcoin treasure is the concrete proof of our vision of creating long -term value for our shareholders”. The performance of the portfolio is considered unique among public companies in European capital markets.

The Treasury Team of the company secures the storage process with multi-impact wallets in line with banking standards. Each quarter independent audit report is published and transactions are transparently announced in the Euronext regulatory bulletin. Analysts emphasize that TBG’s retention of Bitcoin instead of cash strengthens balance sheet ratios in high inflation and negative real interest rates and also provides reputation in the market. Experts Model Strategy (Microstrategy), such as the first serious response from Europe to US samples.

The source of the fund used by the company for the purchase of Bitcoin

TBG, Bitcoin Treasury last week to export 63.3 million euros convertible bonds by exporting the balance sheet fresh resource. Most of the bonds are crypto money -oriented funds Moonlight Capital with Fulgur Ventures undertook. The management announced that 544 BTCs were purchased with this financing and that the remaining 80 BTCs were covered by a capital increase of 9.8 million euros completed at the end of May. The hybrid capital method limited the shareholder dilution while the Bitcoin -oriented strategic investor pool gave the company.

Post -news TBG shares In the first hours of the day, up to 4 percent rose. The volume of transaction increased to three times the monthly average. Market experts say that the price of Bitcoin wandering in the $ 105,000 -dollar band does not pursue the company “buying from the bottom, and that it is progressing with a long -term retention reflex.

Although some analysts say that volatility can increase the balance of the balance sheet, corporate investors escape from interest pressure and turn to alternative assets strengthen the hand of the TBG. The France’s Amp Authority considers the existence of the Great Bitcoin as “innovative but managed”, provided that transparent reporting is maintained.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.