Bitcoin $104,365.15 price Just below 104 thousand dollars and the US markets were opened with sellers. While the latest developments increase the concern in crypto currencies, we are now moving towards the days when abnormality begins to normalize. Every day, another chaos is trying to drown the risk markets. So how many dollars are the summer summit targets for MKR and BTC? What will happen at 20:00?

MKR Coin and BTC Target

We have been talking for a long time that the volatility will increase even more as of the last day and mid -June for 9 July tariffs. It is as we expected, while the tariff bargain is heating, Trump is trying to open negotiations that are blocked by harsh statements. The process has accelerated with the EU, now it’s time to reconcile with China. During this period, the announcement of consecutive agreements with many countries such as India is expected.

Waleed Ahmed is with the rise in the summer months MKR Coin The price is waiting to reach $ 3,250 and $ 4,074.

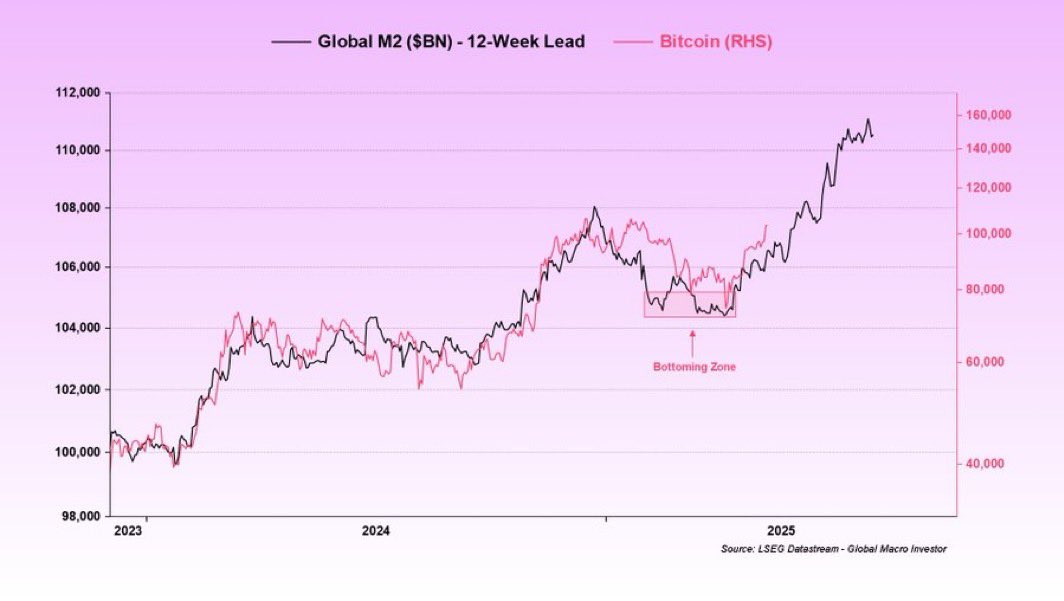

Quinten, on the other hand, inevitably increased global liquidity BTC The price will carry for $ 150 thousand in the summer months. If we see such a summit, it will be possible for the liquidity flowing from BTC to the subcoins even during the 1-2-month rise in the 1-2-month rise. Of course not for all subcoins.

June 2 Powell Statements

Today at 20:00 Powell will make statements. At the 75th anniversary conference of the International Finance Department of the Federal Reserve Board, Washington will share his comments on exchange rates and interest rates, which will speak at DC. The statements that will come in the midst of rumors that Powell wants Trump to go to guarantee interest rate cuts and that Powell would soon resign.

Moreover, a few days ago in the White House, Trump’s words, a “good öyle interview was held, everyone’s eyes will be on the screen. It doesn’t make sense to expect Powell that he will signal a resignation at this event, and his sudden resignation will not be good for crypto currencies.

However, if we see that “tariffs will not cause problems as much as they are afraid of, and that concerns will be more restrained with future agreements this month”, this would be great. The Fed delays interest rate cuts with the concern of the big crisis environment that tariffs can bring. In this tone, the explanation supports markets with the rapid increase in interest rate reduction expectations. A few hours left to find out what they were talking about with Trump.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.