Spot Ethereum traded in the USA $2,624.88 ETFs (stock exchange investment funds) continue entrances during a row for ten consecutive trading days. With the increase in the interest of investors to Ethereum, the entrances to Blackrock’s Ishares Ethereum Trust (ETHA) fund, one of the most important companies in the sector, are remarkable. According to the latest data, the total entrances in Ethereum ETFs increased over $ 3 billion.

Crypto Money ETFs

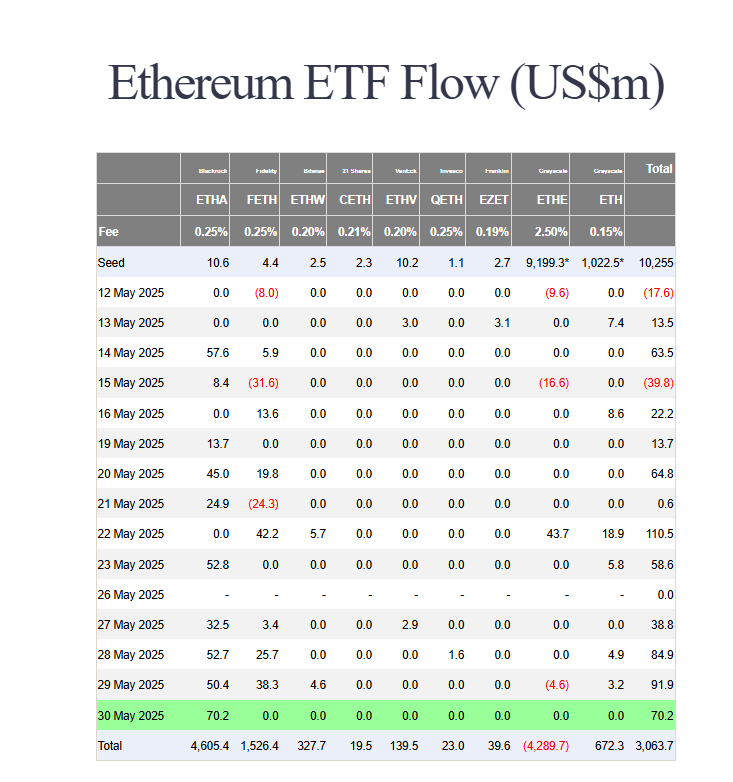

According to the figures released by Persian Investors, on Friday, May 30, the ETH ETFs were $ 70.2 million in a net entry. All of the entrances have exceeded $ 4.6 billion, a total net input since Blackrock’s ETHA fund and the establishment of the fund. The total net entries of all ETHERUM ETF exporters in the United States have exceeded $ 3 billion.

While the interest in Ethereum ETFs increases rapidly, Bitcoin  $105,926.72 In the ETFs, a significant amount of exit was seen in the last two transaction sessions. While the US-China tension increases, investors’ tendency to cash their earnings is strengthened. However, the detail that draws attention here is the fact that Blackrock customers are less willing to sales.

$105,926.72 In the ETFs, a significant amount of exit was seen in the last two transaction sessions. While the US-China tension increases, investors’ tendency to cash their earnings is strengthened. However, the detail that draws attention here is the fact that Blackrock customers are less willing to sales.

Some analysts argue that investors may have turned to Ethereum, which they see as a higher return potential. Market experts also argue that the possibility of stinging in Ethereum ETFs (asset locking income) increases the interest.

ETH and BTC ETF comparison

Ethereum’s strong performance in the near future does not prevent Bitcoin from being left behind in the past years. When the monthly returns are examined, the rise in ETH price is more pronounced than BTC. However, when we look at the cycle, the price of ETH came to the same place for a few years. When it is viewed periodically, it may be time for the ETHBTC parity, which has been ongoing more than a thousand days, to reversed. ETH ETF entrances in the possible ETH rally are likely to reach crazy levels.

According to Farside Investors data, the flows to ETHA have increased its total net entries over $ 4.6 billion since its establishment.

Recently, the increasing interest in Spot Ethereum ETFs and the outlets from Bitcoin ETFs are interpreted as a significant transformation in the crypto currency sector. The data indicate that corporate investors have included more Ethereum -weighted strategies in the second half of the year in their portfolios. While the above information provides important signs about the change of investor behaviors, closely monitoring the developments in the sector is important for investors and market observers.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.