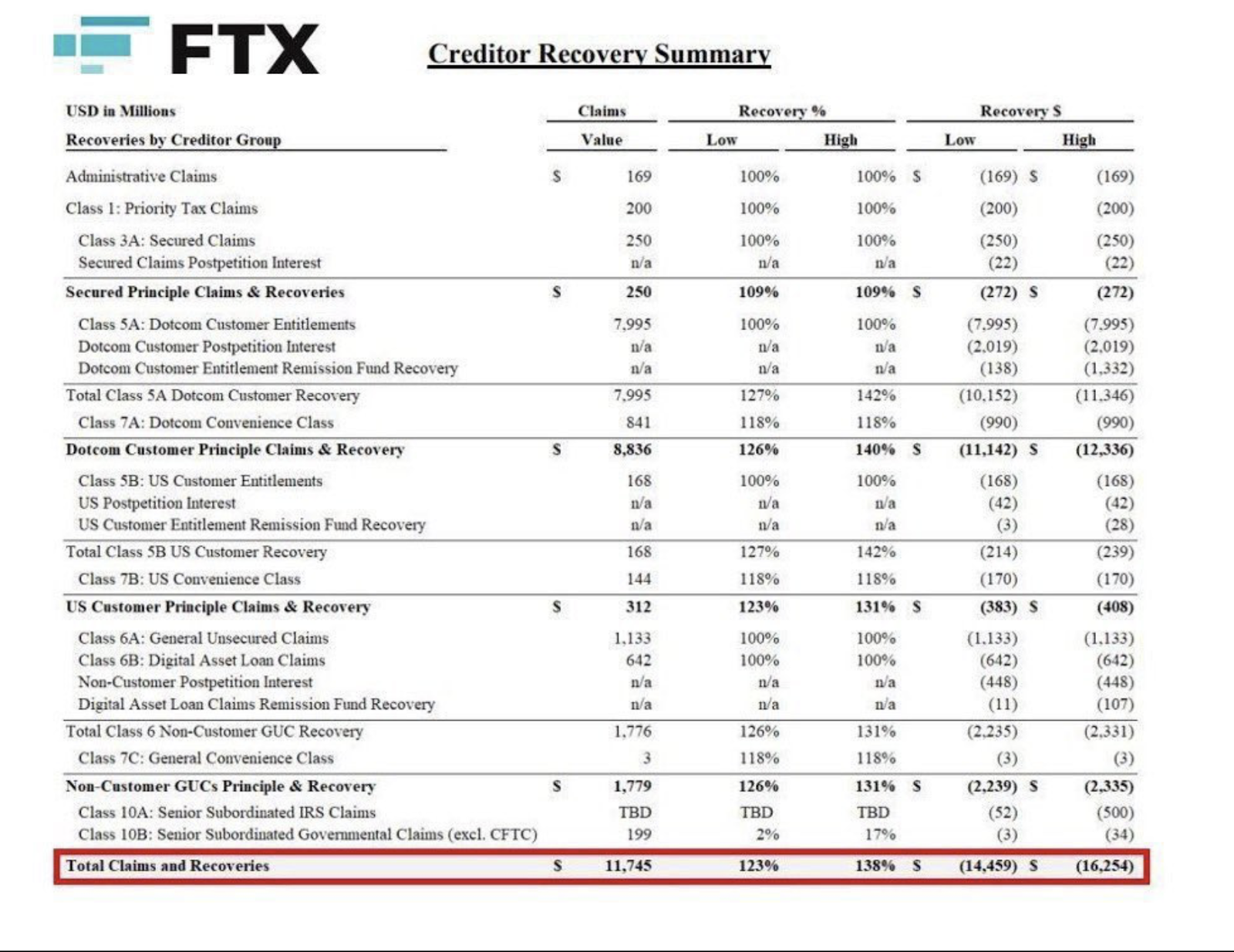

FtxThe 5 billion dollars of stablecoin distribution launched after bankruptcy opens the door of the fresh cash flow to the crypto currency market. The creditors waiting to get their money for about eighteen months will finally get their funds. Analysts are focused on how liquidity of this size will affect the price balance in stock markets. Bitcoin (BTC) $108,877.58 While weakening after testing new summits last week, Ethereum (ETH)  $2,731.17 2 thousand 600 dollars on the threshold is collecting power. The market is wondering which crypto money will come to the fore with the first wave of the giant payment.

$2,731.17 2 thousand 600 dollars on the threshold is collecting power. The market is wondering which crypto money will come to the fore with the first wave of the giant payment.

How will FTX’s creditor payments reflect on crypto currencies?

FTX’s liquidation team arranged to creditors like USDC and USDT stablecointo minimize banking delays by paying with s. This model increases the likelihood of assets to enter the central stock market because most users will be ready to process immediately after receiving the fund. In -chain data companies Stablecoin reservesIt is already narrowed, but when the day of payment arrives, the safes of the stock exchanges will be filling again. The flow of liquidity into a single channel often does not result in one -way price movement and can feed volume increase and volatility.

Every new stablecoin that will enter the stock market wallets has two options in the short term: return to cash or another crypto currency to buy. Small investors who are not included in Tradfi -like portfolios tend to evaluate liquidity in the market. In this scenario, the dominant preference is usually bitcoin because the volume is wide and the entry/output cost is low. On the other hand, considering the growth of Ethereum in the institutional ecosystem, some of the corporate creditors Eth can add position.

The calendar of the payment plan is also critical. 5 billion dollars will be paid gradually, not at one time. This will create volume in waves instead of instant shock. Strategies “sell, then take back” strategies may come to the agenda by following price movements after each reimbursement. Liquidity will spread over time Crypto Money MarketIt will make it easier for the liquidity wave to absorb. This means that the probability of sudden collapse or vertical jump will be limited.

Liquidity scenarios expected in Bitcoin and Altcoins

Bitcoin is experiencing a volume decrease while trying to hold on the threshold of 105 thousand dollars. The arrival of fresh stablecoins can re -push the price by feeding the purchase blocks in the order book. However, the past examples show that cash return can also create sales pressure at the first moment. Because if the creditors exit to compensate the damage, spot demand weakens. On the other hand, this distribution for long -term Hodls means the opportunity to accumulate.

Current “Core Development” news on the Ethereum front keeps corporate interest alive. High liquidity flow Layer 2 can also open space for ecosystem coins. XRP And CARDANO  $0.754124 In Altcoins, which are under pressure, such as (island), the direction will depend on liquidity distribution as well as the expectations of the community. A large amount of stablecoin altcoin The shift to the basket can create a ratio growth according to the market value.

$0.754124 In Altcoins, which are under pressure, such as (island), the direction will depend on liquidity distribution as well as the expectations of the community. A large amount of stablecoin altcoin The shift to the basket can create a ratio growth according to the market value.

Memecoin‘s have a different risk profile. Sudden inputs may bring short -term jumping at the price, but exits can also occur at the same speed. If some of the new investors are in pursuit of speculative return, double -digit rises in this segment will be inevitable. Nevertheless, most of the total liquidity tends to turn to high -capital subcoins. Therefore, a memecoin wind that may begin after liquidity flow can release in a short time.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.