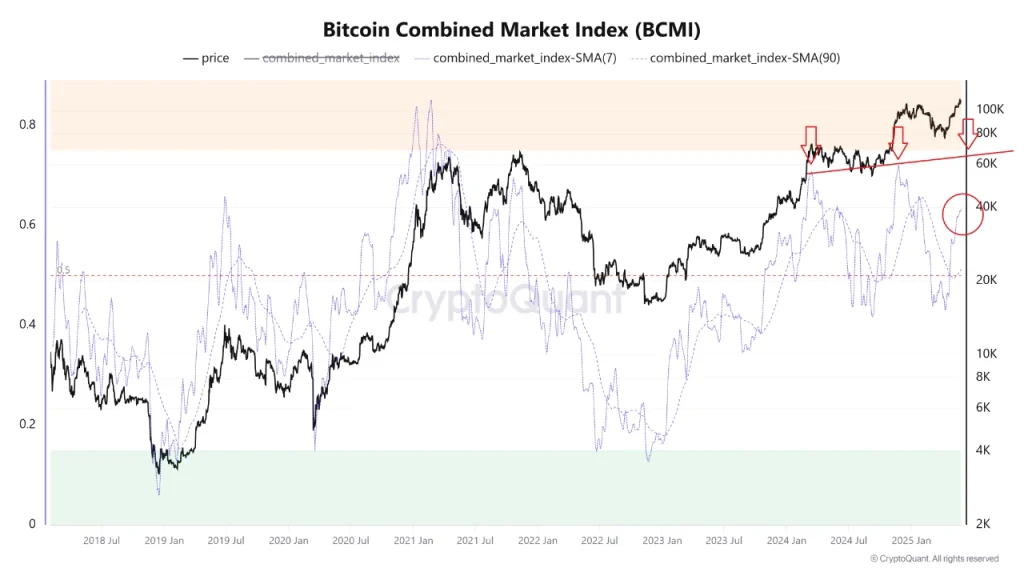

A new update from crypto analyst Woominkyu highlights a sharp rebound in the Bitcoin Combined Market Index.

This suggests that the Bitcoin market may be entering an early accumulation phase.

With improving sentiment and reduced profit-taking, on-chain indicators are flashing a potential upside signal for Bitcoin investors.

Here is what you should know.

What is BCMI?

Bitcoin Combined Market Index (BCMI), developed and popularized by on-chain analyst Woominkyu, is a composite indicator designed to assess the overall market sentiment and cycle stage of Bitcoin using four key on-chain metrics (MVRV, NUPL, SOPR, and Fear & Greed Index).

Market Value to Realised Value compares Bitcoin’s current market price to the average price at which all coins were bought.

Net Unrealised Profit/Loss measures the overall profit or loss of Bitcoin holders.

Spent Output Profit Ratio tracks if coins being moved are in profit or loss.

Fear & Greed Index is a sentiment index that reflects investor emotions.

The BCMI reading below 0.15 indicates that the market is in the extreme fear zone. This is often seen near macro bottoms, when prices are low and sentiment is negative.

The reading above 0.75 suggests that the market is in the state of Euphoria. This is seen at cycle tops, when prices are high and greed is rampant.

BCMI: Analysing the Current Status

According to Woominkyu’s analysis, the 7-day SMA of BCMI stands at 0.6 and the 90-day SMA of BCMI at 0.45.

The rebound of the short-term average, especially in light of recent market corrections, suggests growing investor confidence supported by increased transaction volume and stronger on-chain fundamentals and possible early signs of a bull phase,

Meanwhile, the stability of the long-term average suggests that the market is stable, not overheated.

What BCMI Indicates about the Current Trend?

Investor sentiment is improving, supported by a drop in exchange outflows and long-term holder accumulation, while profit-taking has declined, as indicated by the decreasing Spent Output Profit Ratio (SOPR).

This sets the stage for an accumulation phase, where institutional or savvy investors start buying while prices are still relatively low.

In the last seven days, the Bitcoin market has reported a decline of 1.9%. In the last 24 hours alone, the market has plummeted by 0.3%.

Recently, the Bitcoin price reached a new all-time high of $111,980, surpassing its previous ATH of $108,786 recorded in January 2025.

Currently, the BTC price sits at $108,492.71 – at least 3.11% below the ATH recorded on May 22, 2025.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

BCMI is a composite indicator measuring Bitcoin market sentiment using MVRV, NUPL, SOPR, and Fear & Greed Index.

BCMI readings below 0.15 signal fear/bottoms, above 0.75 indicate euphoria/tops, helping identify market cycle stages.