The biggest crypto currency Bitcoin (BTC) $108,867.65After entering the level of 94 thousand 146 dollars in May, 18.66 percent in three weeks, on May 22, reached a fresh summit of around 111 thousand 970 dollars. 3.9 percent of the withdrawal on May 23 was short, the next day when the buyers came into play, the price returned up again. Currently the largest settled around 108 thousand 789 dollars crypto currencyonly 2.8 percent of the highest level of all time and the market is still in a cautious optimism. Analysts Lark Davis does not agree with the recent discourse of “rally over”. According to him, the indicators have not yet given the classic hill signals.

May Bitcoin brought strong price movements

Bitcoin’s acceleration in May has been intertwined with the institutional demand that has been ongoing since the beginning of the year. Spot ETF Considering the flows, the shrinkage of supply after the block award was split and the expectations of interest rate reduction in the USA is not a surprise that the price provides more than $ 100,000. As of May 18, the open positions in the futures market exceeding $ 15 billion showed that leverage investors also chose to stay at the table. On the other hand, Bitcoin’s dominance on the market, over 60 percent, exhales the altcoin season ”claims for now.

Despite this table, technical indicators point to mobility in the short term. Daily time period Relative power index (RSI) Attempting one step back from the extreme purchase zone and in a calm course in the 68 band. 30 -day volatility has been hanging below 3 percent for the first time since mid -March. In other words, a wide correction has not yet been confirmed, even if the price rise slowed down. In -chain data shows that long -term investors (LTH) continue to hold instead of selling them in the last rally. This approach prepares the ground for an additional congestion on the supply side.

According to Lark Davis, the market is still far from the summit

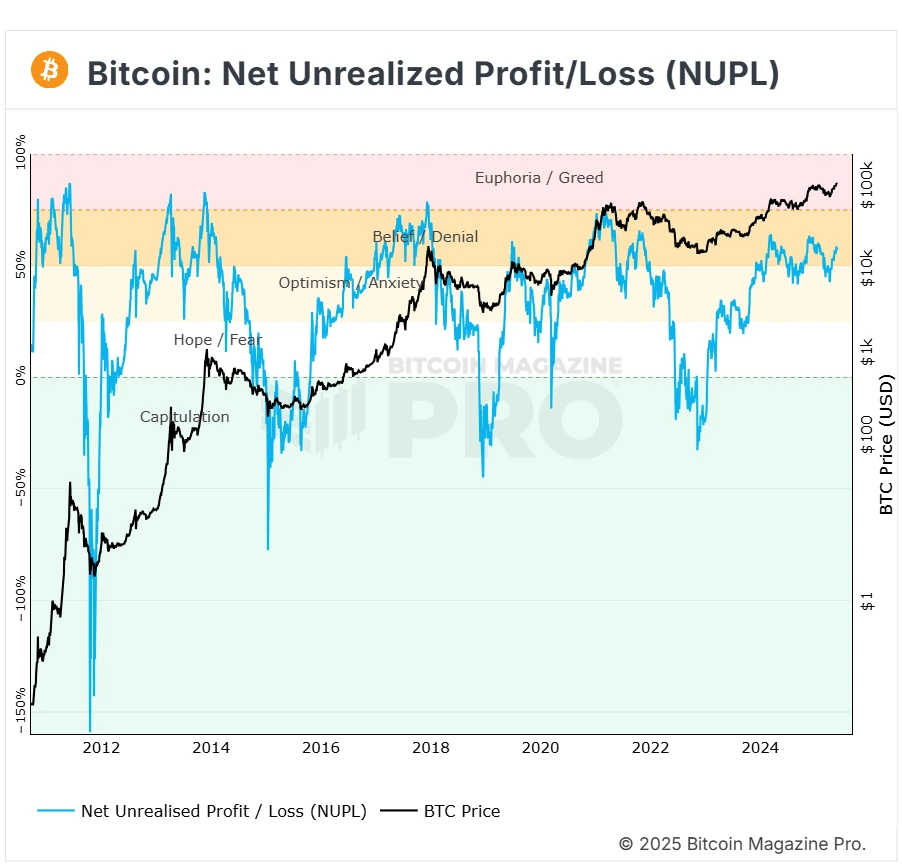

Lark Davis, in the latest analysis in X NET REALİSED profit-loss (NPL). The analyst pointed out the average profit of BTCs sold by the metric pointed out the desire to “return to cash ında in the market. Historically, when the NPL value is moved to the positive area, profit sales gain momentum and the probability of correction increases. However, the current levels are quite behind the peaks of the 2021 bull cycle.

A similar insight Net Unrealized Profit-Loss (NUPL) indicator can also be read. The indicator, which was 52.78 percent on May 5, increased to 58.7 percent on the price day, but it did not reach the 75 percent band accepted as the “Euphoria” region. In other words, although most investors are in snow, the mass wave of mass sales is not triggered. Davis said, “Not everyone has left the table yet, we have a forward -looking fuel,” he opened a potential additional door.

Nevertheless, the uncertainty on the macro front should not be forgotten. The possibility of postponing the interest rate reduction calendar in the summer months, negative new news from US regulators, and the downward course of the US stock exchanges can quickly change the course of Bitcoin. For the time being, market players continue to carry their positions by closely monitoring core data such as NPL, NUPL and volume increase.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.