Bitcoin (BTC) $109,698.36with the power it receives from the corporate demand, it has closed a week again in green, but the chain data gives cooling signals behind the curtain. The decrease in the number of active wallets indicates that short -term investors are taken aside, while the slight decrease in the hashrate shows that miners are adjusted without damaging the network security. The price manages to hold over 107 thousand dollars, but the acceleration falls and analysts predict that the distribution phase has begun in autumn.

What does the decrease in the number of active wallets tell?

On a weekly basis active walletThe s fell by 6.5 percent to 8.06 million. This decrease reflects the tendency of the small investor to put the snow in the previous rise wave in his pocket and withdraw aside. Similar movements became a harbinger of consolidation in past cycles and opened the door to supporting the price with corporate entries for a while.

The price of 3.5 percent in the same period to reach 107 thousand 839 dollars, despite the individual weakening, despite the fact that large portfolio flows are still strong. The total market value exceeds $ 2.14 trillion, while Bitcoin’s dominance on the market continues to remain in the 63 percent band. Although acceleration is preserved, there is some loss of power. Rsi and mAMomentum indicators, such as CD, tied to bed on the hill and narrows volatility.

Hashrate The decrease of 1.4 percent on the side is explained by routine care and equipment transport. The security coefficient of the network is far above critical limits. This does not have a painting for long -term investors. The miners’ profitability margin is still positive and the sales pressure is low, although the block prize has been split.

The market cycle shows autumn

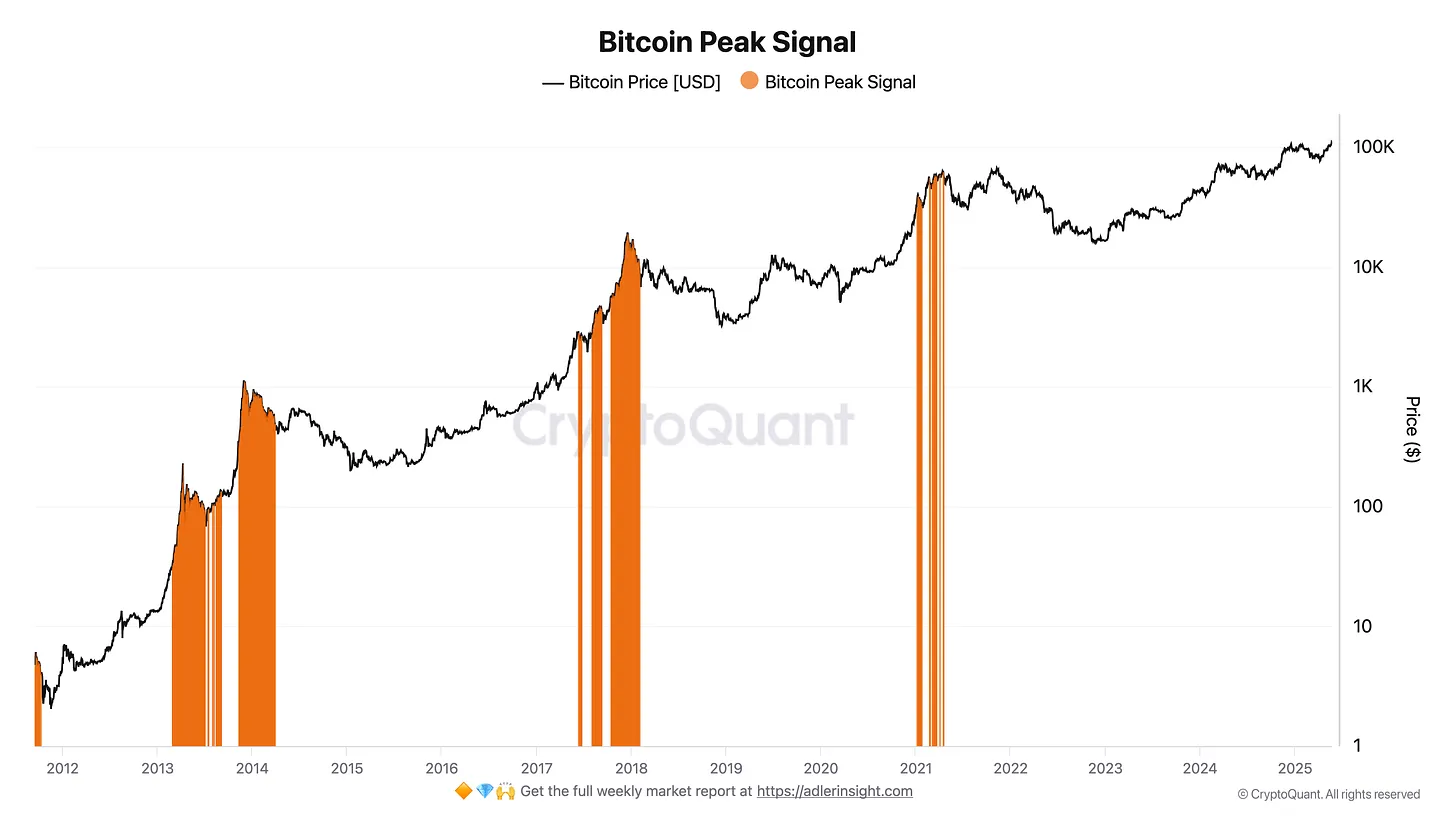

MRPI And VDD Their rates continue to remain under thresholds that trigger the 2013, 2017 and 2021 summits. Analyst Axel Adler Jr.‘Bitcoin Peak Signal ”indicator followed by the red zone is not yet in the red zone. This indicates that the real peak point may be far more. According to the historical fractal model, the most likely calendar for the last excitement of the cycle is the last quarter of the year.

Critical level in the short term is 107 thousand dollars. If this support is maintained, the bull trend can be refreshed. Candle closure, which will be below 107 thousand dollars, can bring up to 95 thousand – 100 thousand bands. Such a withdrawal can prepare the ground for long -term addresses to accumulate again.

In addition, fund flow reports show that regular entry into Spot ETFs continues, and corporate portfolios maintain the “buy and hold” strategy. On the individual investor side, the rest of Google search volumes and social media interactions is another indication that the market is breathing. In the psychology of investor, enthusiasm has been replaced by cautious optimism.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.