Crypto Money MarketThe wind of optimism is blowing on the first day of the week. The total market value increased by 1.23 percent to 3.44 trillion dollars. The crypto fear and greed Index clearly demonstrates the dominant mood among investors, standing at the 69 level, greedy point. Bitcoin (BTC) $109,698.36 With a current price of 109 thousand 549 dollars, it rose by 6.5 percent in seven days and dominates the headlines with a market value of $ 2.17 trillion. The price range is between 106 thousand 683 – 109 thousand 855 dollars in the liquidity pool waiting at 113 thousand dollars to be thrown into the signal of a powerful jump.

Bitcoin bulls focused on 113 thousand dollars

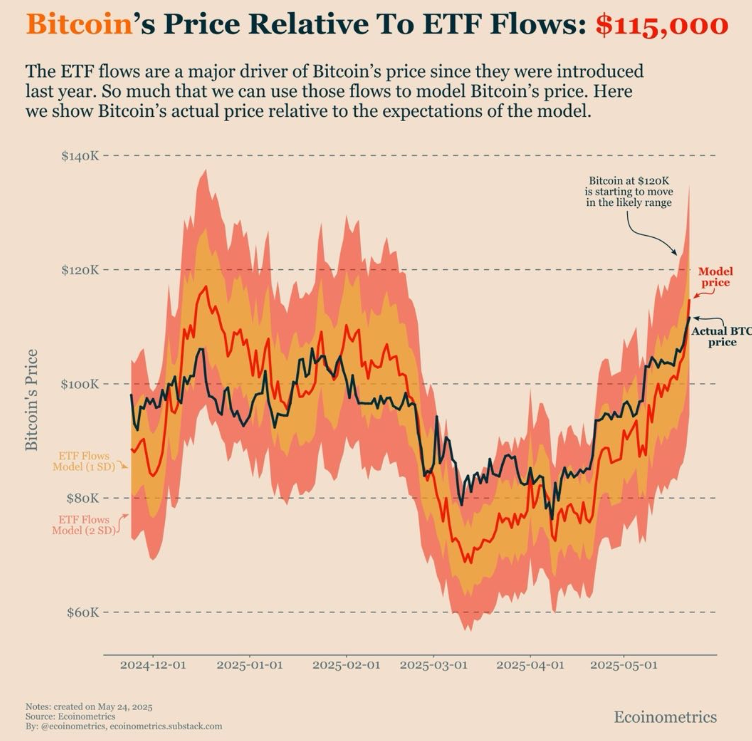

Spot Bitcoin ETFThe corporate money flow to their s is likely to draw Bitcoin’s short -term route. Ecoinometrics’ latest graphs show that ETF inputs overlap with price modeling almost one to one. Just a few thousand dollars away from the model of $ 115,000. Spot ETF volumes are $ 47 billion and the successive purchases from the Wall Street funds do not leave space on the demand side.

Bitcoin, Major, climbing to 63.3 percent of the market share altcoinIt creates an environment suitable for the continuation of the rise while leaving behind. In -chain data indicates the cluster of orders concentrated in 113 thousand dollars. When this level is exceeded, new purchase waves triggered by algorithmic procedures may be activated.

If the scenario is summarized by investors as “ETF first, then fomo”, it may cease to be a psychological barrier of $ 120,000.

Golden Cross signal can trigger a new and hard rally

Popular Analyst on Technical Analysis Front Doctor profitThe Golden Cross, which flashed for the third time in the weekly graph, took the Golden Cross under the lens. Starting from 27 thousand dollars in October 2023 and extending to 73 thousand dollars, the 170 percent leap and 73 percent jump in October 2024 offers strong evidence of the past performance of the formation. This fresh signal, which comes this month, draws attention with its “high -time hit rate 87.8 percent”.

Past data Golden Cross The average weekly increase after its formation is 3.5 – 8.5 percent. If this statistics is preserved, it will not be surprising to see a balanced but paced rally extending to the range of 117 thousand to 120 thousand dollars in the three to five -month period. If the price can hold above 113 thousand dollars, it can get a door to a season where new historical summits are recorded. As a matter of fact, most analysts comment on the excitement in the market by commenting, “Breaths were kept, the countdown has begun”.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.