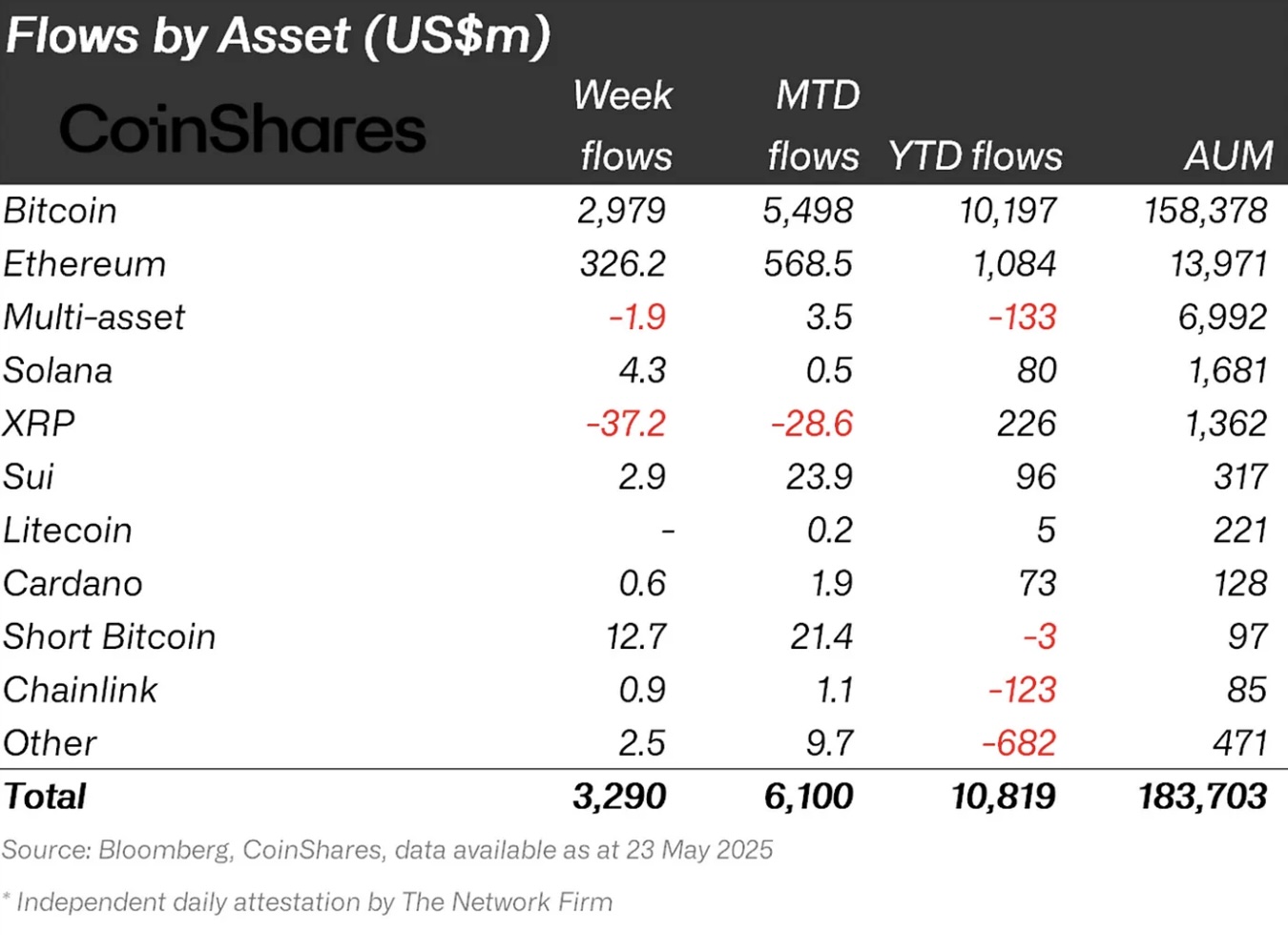

Crypto currency The new capital of $ 3.3 billion flowing to based investment products last week has carried its total entry to the highest level of all time with 10.8 billion dollars since the beginning of the year. Most of the volume Bitcoin $107,078.29(BTC) flowed. The largest crypto currency alone with a capital of 2.9 billion dollars, formed one quarter of the year total. Ethereum (ETH)  $2,499.34 With the recovery of investor sensitivity, it closed the fifth rise week with an introduction of 326 million dollars. In contrast, Ripple

$2,499.34 With the recovery of investor sensitivity, it closed the fifth rise week with an introduction of 326 million dollars. In contrast, Ripple  $2.29‘of XRPIt ended the 80 -week uninterrupted entrance series with an output of $ 37.2 million.

$2.29‘of XRPIt ended the 80 -week uninterrupted entrance series with an output of $ 37.2 million.

US dominance continues

Moody’s led to crypto currency -based investment products in search of secure harbor in search of a safe harbor in search of the US grade view and bond interest rates. 3.2 billion dollars of the weekly total USAWhen coming from Germany 41.5 million, Hong Kong 33.3 million, Australia It brought 10.9 million dollars. SwitzerlandLi fund executives used the price of strengthening for profit purchase of 16.6 million dollars output. In short, capital was rapidly redistributed from the regions where economic concerns increased to the centers where risk appetite continued.

The assets managed during the week broke a record with $ 187.5 billion for a short time. There were also those who wanted to play the opportunity to rise. In this respect, Short-Bitcoin has a capital entry of $ 12.7 million and has reached the highest weekly volume since December 2024. The meeting of the strong flow and the opposite positions on the same graph shows that both upward and downward expectations work simultaneously in the market.

Latest situation on the Altcoin Front

The largest in the shade for a long time altcoin Ethereum re -caught acceleration with positive expectations for Spot ETF applications for stinging. Combined with an uninterrupted capital input for five weeks, the network updates and the increase in institutional interest, he corrected the perception for the “second largest”. The current table shows that investors do not want to leave their portfolios only to Bitcoin.

On the other side of the table is XRP. The $ 37.2 million output led to the break of the entrance chain that lasted for eight quarters. 37.2 million dollars corresponds to the hardest weekly loss so far. Although market experts read this as “snow locking ,, some analyst argues that the delay of Spot ETF, which is waiting for approval, weakens the interest.

Solana (LEFT), Sui (Water), CARDANO  $0.73675 (Island) and Chainlink

$0.73675 (Island) and Chainlink  $15.16 (LINK) Altcoins, respectively $ 4.3 million, $ 2.9 million, 600 thousand dollars, 900 thousand dollars entrance was.

$15.16 (LINK) Altcoins, respectively $ 4.3 million, $ 2.9 million, 600 thousand dollars, 900 thousand dollars entrance was.

The resulting table Altcoin marketNa shows that there is still a flow of capital, but the flow direction is no longer progressing from the same corridor.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.