Spot Bitcoin and Ethereum ETFs, the daily net entries exceeding $ 1 billion on Thursday, has reached the highest level since January. The record flow at the entrances to the ETFs coincided with Bitcoin’s reaching the summit of all time and being the scene of Ethereum’s most powerful rise in recent months. While the entrances to Spot Bitcoin ETFs exceed $ 934 million alone, Ethereum ETFs have experienced the best day since February with an entrance of 110 million dollars. This process in which investor interest is supported by corporate purchases Crypto Money MarketIt forms the basis of the rise in it.

Seven -day strong entrance series in Bitcoin ETFs

The entrances to Spot Bitcoin ETFs reached the summit in the last week of May. 934.8 million dollars of a net entrance took place on Thursday. 877.2 million dollars of this amount Blackrock IBIT came from the fund. Fidelity’s FBTC and Ark Invest ARKB The funds contributed to the entrances of $ 48.7 million and $ 8.9 million, respectively. No entrance was recorded in other funds. With this development, the positive series of Spot Bitcoin ETFs, which lasted seven days in a row, reached $ 3.2 billion in total. Since the beginning of the year, the total money that has entered the ETFs has reached 9.1 billion dollars, while a total entrance has exceeded $ 44.6 billion since the launch in January.

Blackrock’s IBIT product entered the top five among all ETFs on a year with an introduction of $ 7.7 billion in the last month. The company’s assets climbed for $ 68.7 billion. Bloomberg ETF analyst Eric BalchunasIn my words, IBIT is dominating the market like a pac-man ”. According to experts, these strong entrances are balanced with corporate demand despite the profit purchases of individual investors. BRN Research Manager Valentin FournierHe said that the caught volumes are well above the daily averages and support the upward acceleration in the market.

The highest daily entry to Ethereum ETFs

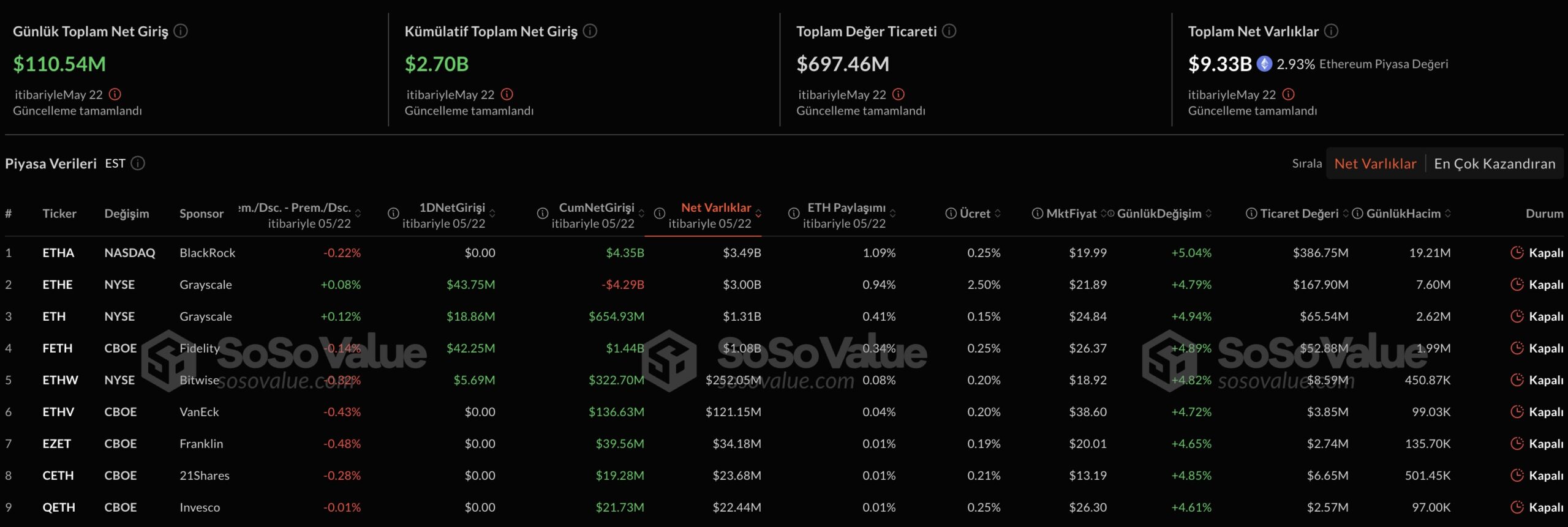

Spot Ethereum ETFs drew attention with an entrance of 110.5 million dollars on Thursday. This figure represents the highest daily net input since February. Grayscale to the entrances Ethe Product 43.7 million dollars, Fidelity’s Conquest The fund contributed 42.2 million dollars. Bitwise’s ETHW While the product is included in the list with $ 5.7 million, Blackrock’s ETHA There was no movement in some products, including the fund. At the end of the five -day positive introduction series, a total of $ 211.8 million flowed to ETHERUM ETFs. ENTERUM ETFs since the beginning of the year, entrances have reached $ 61.9 million, and the funds have reached 2.7 billion dollars since the launch.

Ethereum’s price performance also supports these entries. EthAt the beginning of April, it had declined to 392 dollars, but since then, 91 percent rise to 2 thousand 668 dollars. This strong recovery points to a remarkable turn after the 50 percent depreciation against Bitcoin. CF Benchmarks Product Director THomas ErdösiHe stated that the rise is supported by exaggerated leverage use, but supported by more restrained and balanced spot purchases, there is still a space for the upward movement in the market.

Although there is a temporary pause in corporate interest in entering the weekend, alternatives such as ETH and Solana (left) have gained momentum with individual capital from BTC.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.