Bitcoin (BTC) $111,030.01He tested a historical level by seeing 111 thousand 980 dollars, albeit for a short time. This time, the leader of this rise was US -based corporate investors. Many actors, from Wall Street giants to crypto -money politicians, are on the stage. However, this is not just an upward, but it is seen as the signal of a growing digital power race between the United States and China.

USA seizing leadership in Bitcoin

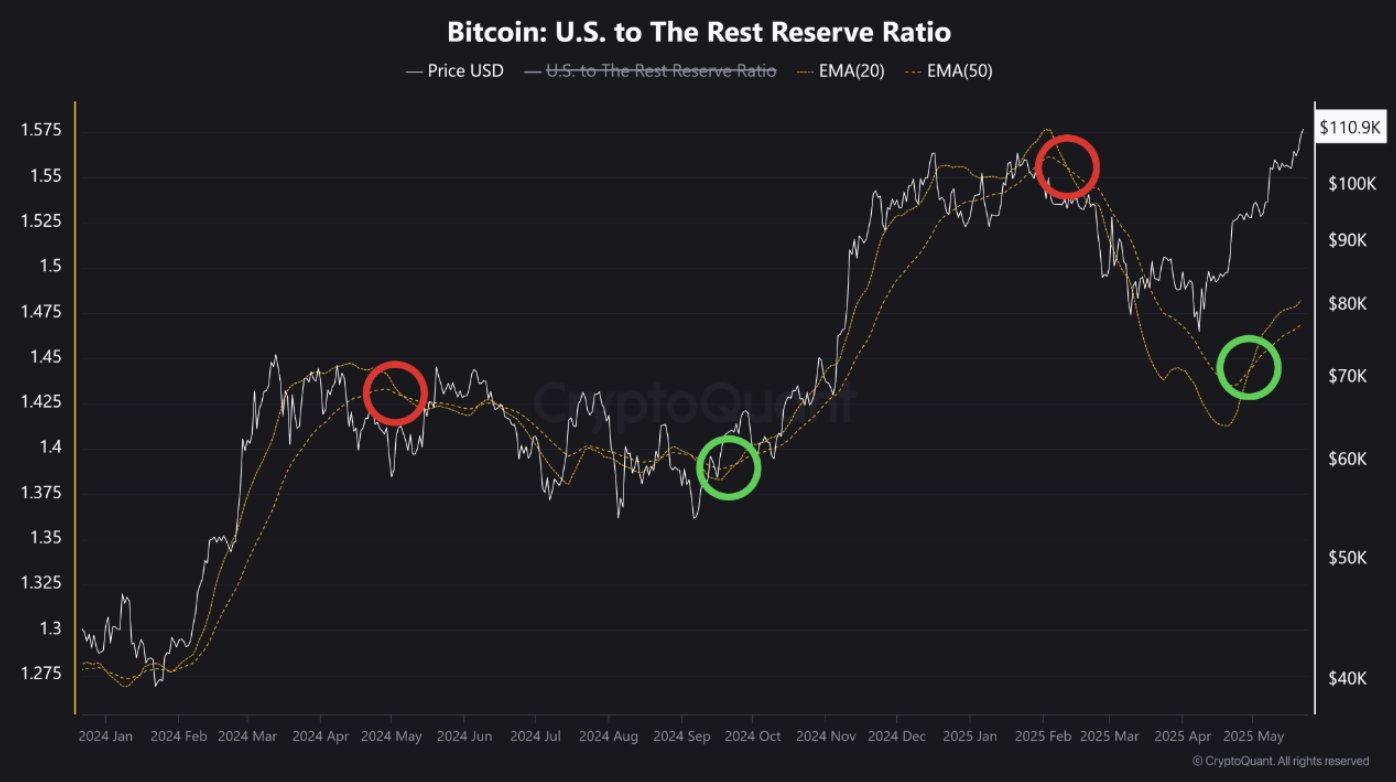

Blockchain Analysis Platform CryptoquantAccording to the data USA Centered banks, stock exchanges and investment funds began to hold most of the Bitcoins around the world. This is the biggest crypto currencyIt creates a serious upward pressure on the price of the price. Analysts say that this pressure coincides with a technical formation, known as “Golden Cross ve and usually harbinger of a major price increase.

During the past periods of this signal, strong rally had been seen in Bitcoin. Now we are facing a similar painting. The aggressive purchases of the USA are not only the price, but also global crypto currency It also affects the balance of the ecosystem. Especially Microstrategy, Tesla And Semler Scientific Large Bitcoin investments of companies such as attract attention. The total amount of BTC under the control of the US state is currently about 207 thousand 189 units. This corresponds to $ 22.99 billion at current prices.

However, the fact that the legal infrastructure for crypto currencies in the United States becomes clear increases the investor appetite. With the new regulations, the claim of leadership in this field is strengthened not only in financial but also in the political level.

China is in the background but not outside the game

Although the US seems to be by far it seems to be ahead, China is still Bitcoin marketHe’s a strong player. Although there is a distant stance against crypto currencies with official policies, Chinese -based mining facilities and indirect investment routes allow the country to maintain its effectiveness in the market. China, which seems to be passive, plays an important role behind the scenes.

ChineseThere are currently 194,000 BTCs in his hand, which corresponds to a size of about $ 21.53 billion. Although the difference between the United States is low, it is possible to close it with strategic moves. Moreover, China is still one of the largest actors in the world in crypto money mining.

On the other hand, the US political support and efforts to strengthen the legal ground are forcing China in this race. Minister Donald Trump‘s full support for Bitcoin mining shows that the US aims to global leadership in this field. However, what happened in the past reminds us that the rise is not always permanent. Cryptoquant warns that similar graphic formations have previously returned to “Death Cross, and that there are after harsh decreases.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.