Key Highlights:

- Hyperliquid’s open interest surged to $997.5M, its highest ever (CoinGlass).

- HYPE price spiked 22% in 7 days, now trading at $30.72.

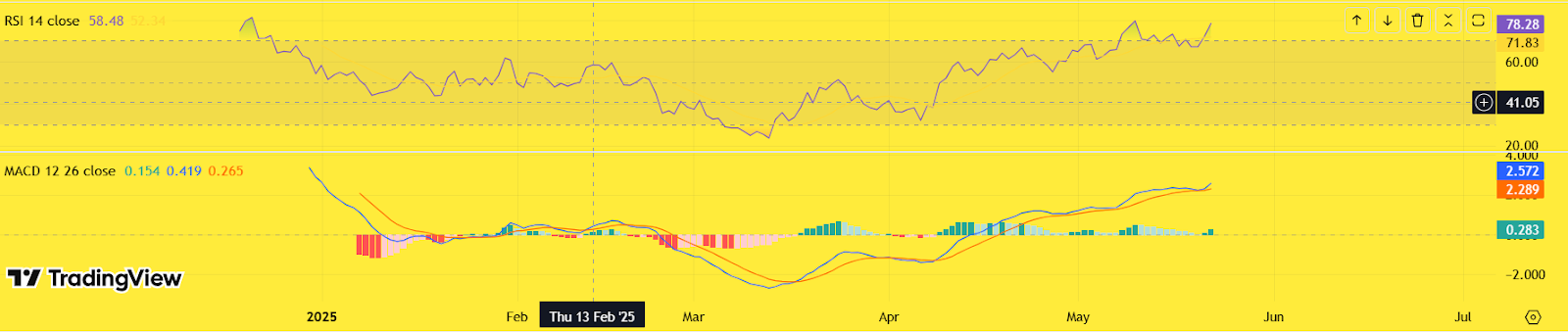

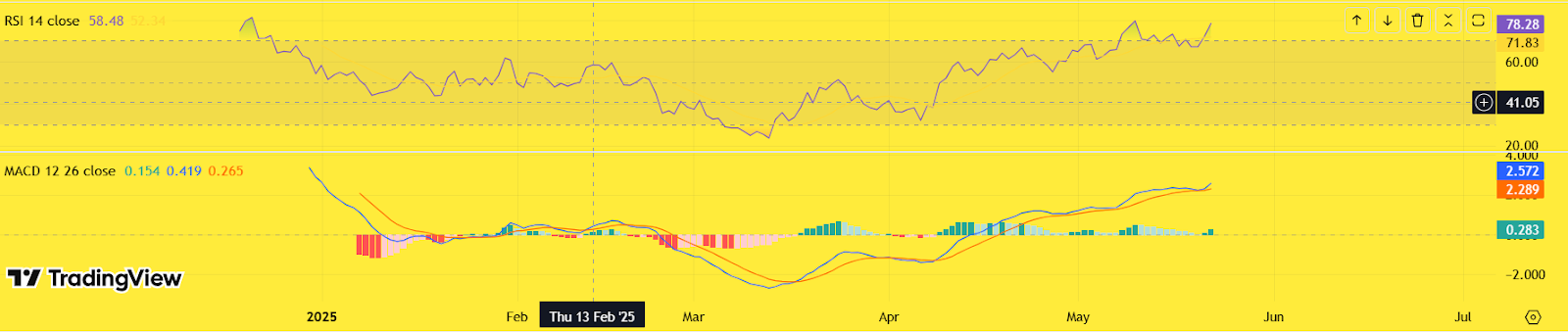

- RSI at 76.76 and MACD crossover indicate overbought momentum (TradingView).

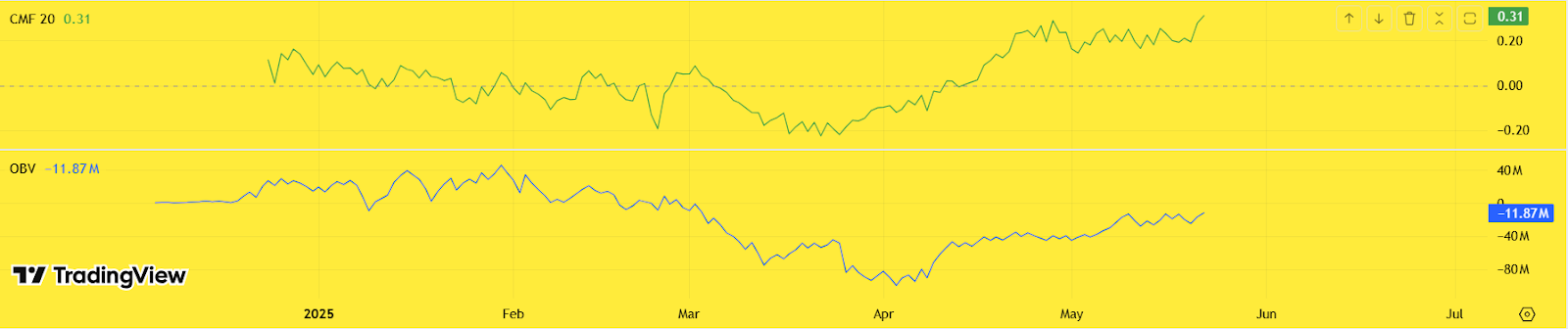

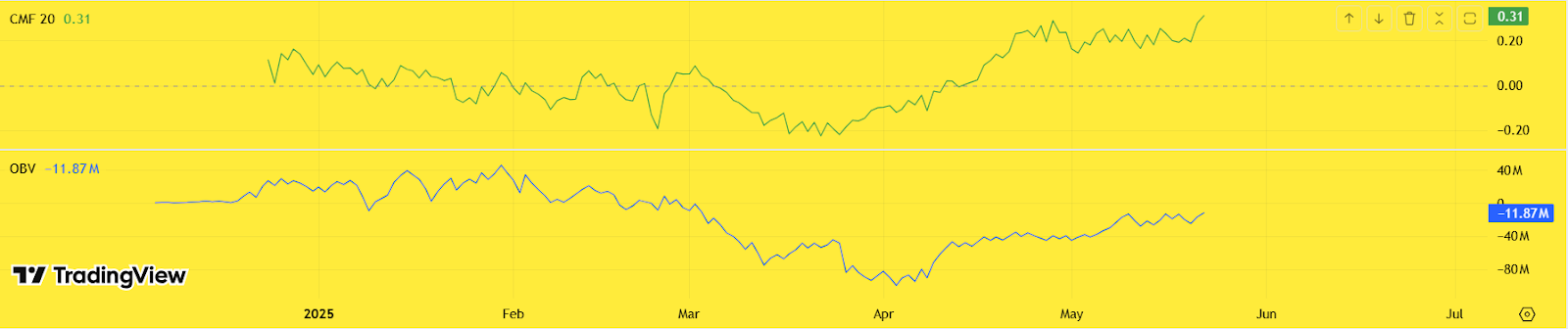

- OBV and CMF reflect rising accumulation and strong capital inflow (Chart data).

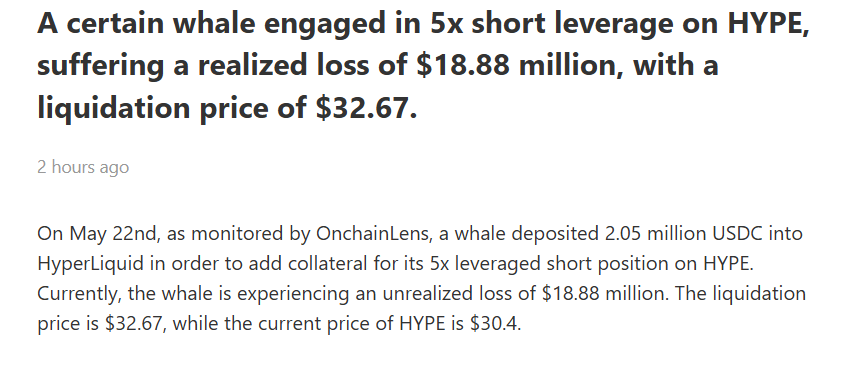

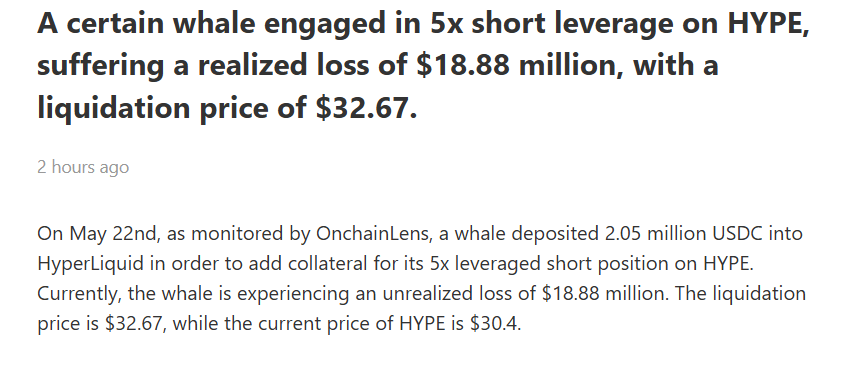

- Whale suffered $18.88M loss on a 5x short, highlighting bullish dominance (Lookonchain).

- Analyst Bias: Cautiously bullish; continuation likely if $32.67 is breached with volume.

With Open Interest nearing $1B and HYPE breaking past $30, traders are watching for a breakout to retest the $35 ATH. Whale liquidations and strong on-chain metrics are signalling continued upside.

HYPE/USDT Price Analysis: Resistance Levels in Sight

Hyperliquid coin has shown strong bullish momentum this month, surging nearly 96% from its April low. The rally began after a prolonged downtrend that started around Feb 22, when HYPE traded just below $18 and slid to a cycle low of $15.70 by April 8 — marking a ~15% drop.

This downtrend established a critical support zone between $15.70 and $18.00, which served as the springboard for the rally. From there, HYPE reversed strongly, climbing nearly 96% to its current price of $30.72.

Now, the token is approaching the $32.67–$35.00 resistance zone, aligning with both its December ATH and the whale liquidation mark.

RSI at 78.20 confirms overbought territory, signalling strong bullish momentum. MACD has crossed above its signal line, and Bollinger Bands are widening, with price hugging the upper band — all supportive of trend continuation.

The EMA stack (20/50/100/200) is in perfect bullish alignment. HYPE remains well above the 20-day EMA, now a key support near $28.20. Holding this level suggests strength in buying dips.

Volume & Capital Flows: Bulls in Control

Capital flow indicators further validate the uptrend. CMF at +0.30 signals robust inflows, while OBV is rising after months of decline — a clear indicator of renewed net accumulation. This confluence adds weight to the bullish case for a breakout above $32.67.

Momentum strongly favors bulls, but entries at current levels carry higher risk due to stretched indicators. A volume-backed breakout above $32.67 or a retracement toward $28.20–$25.10 could offer stronger entry points. Bulls remain in control unless $25 breaks down.

On-Chain Metrics: Volume Surge and Whale Liquidations

Open Interest has now reached $997.57M (as of May 22), suggesting increased leverage and directional bets — sourced from CoinGlass. Perpetual volume is surging alongside DEX activity, with Hyperliquid leading OI dominance across platforms.

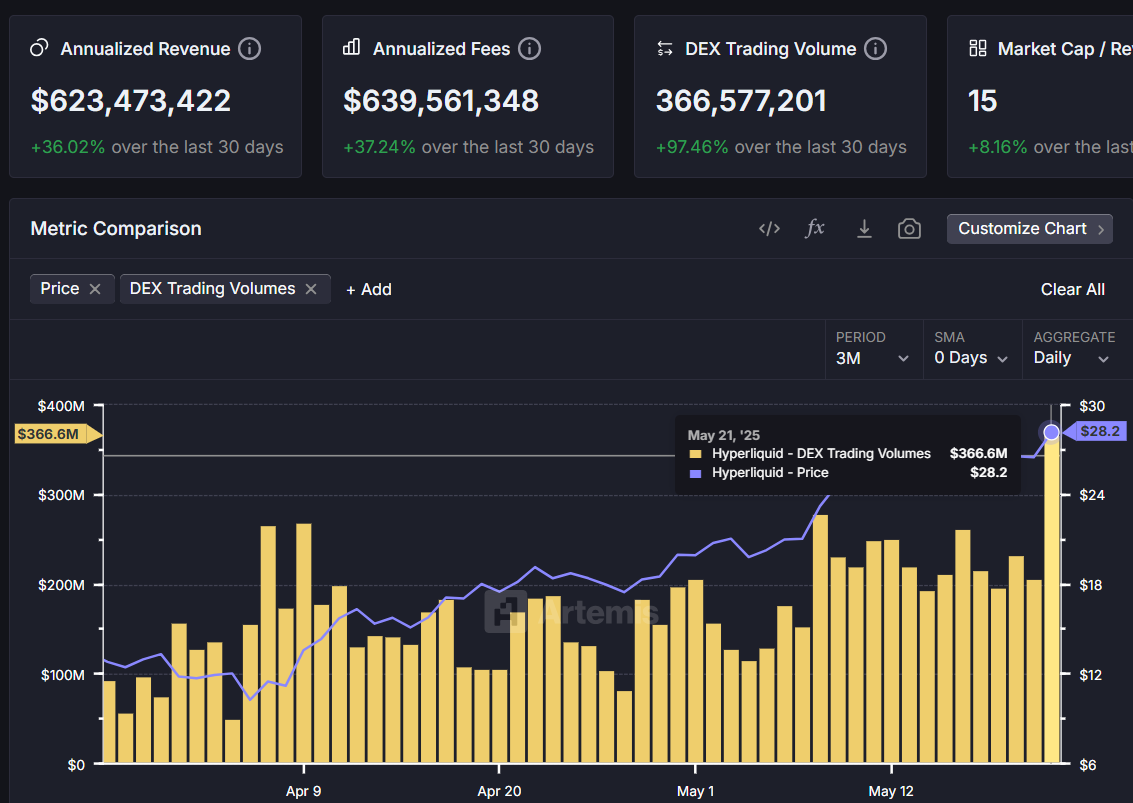

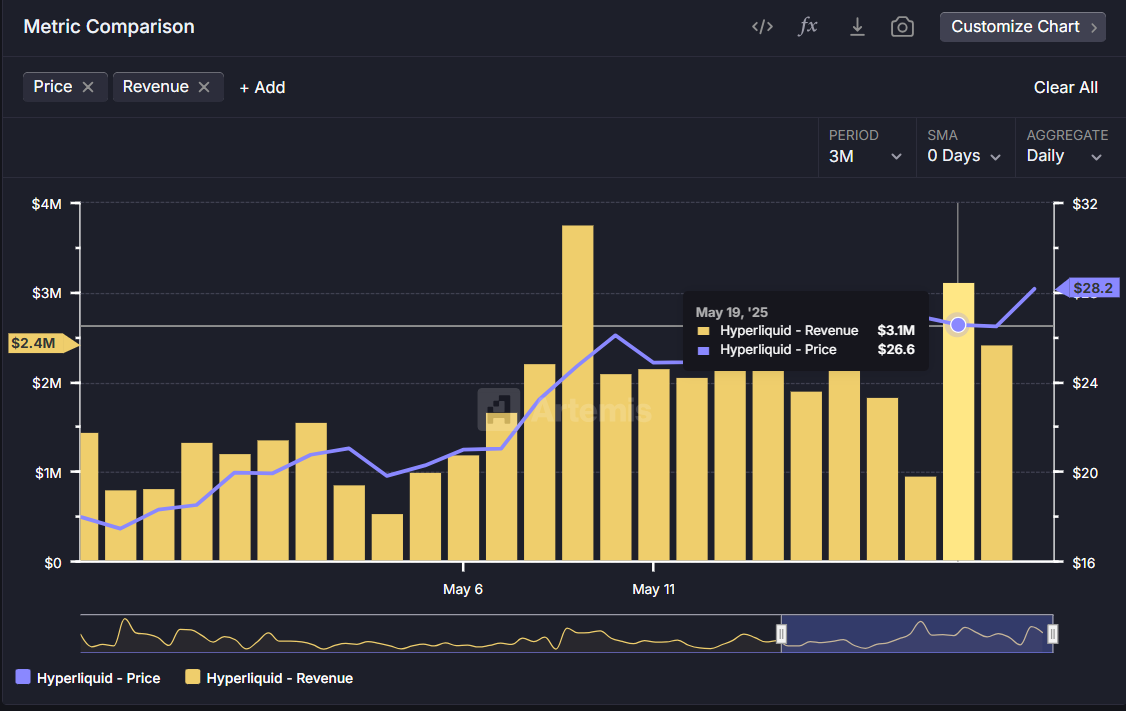

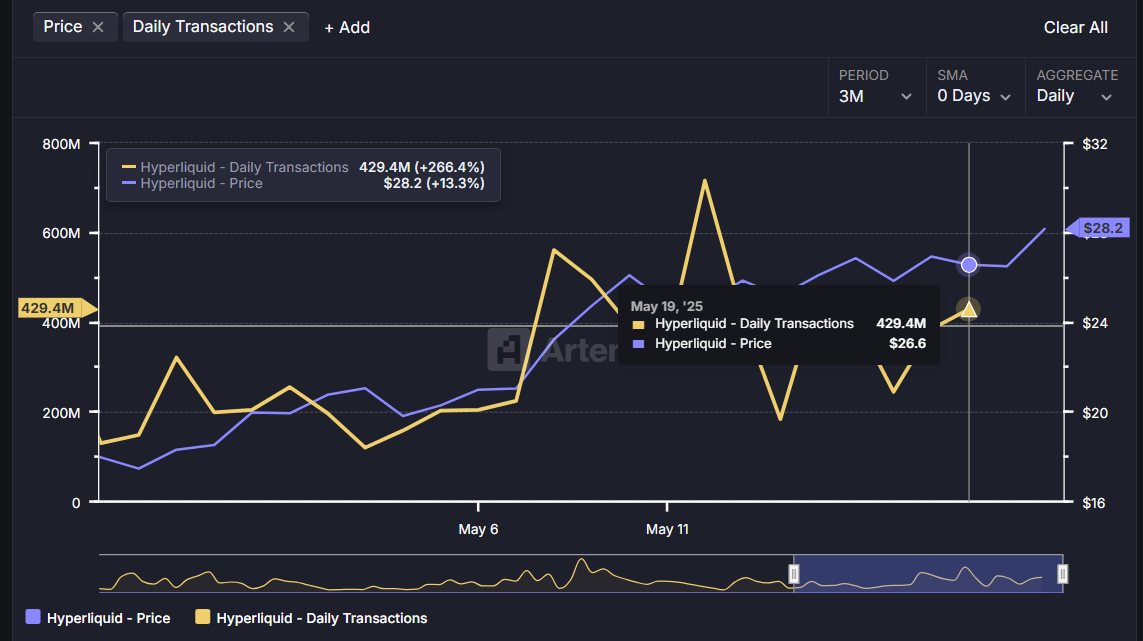

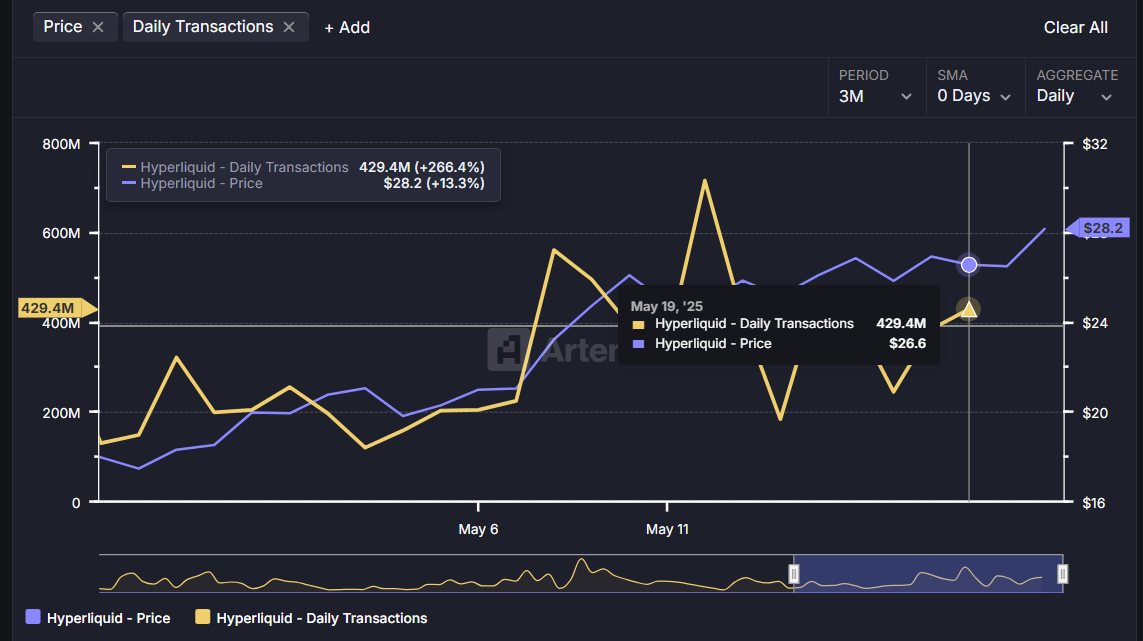

According to Artemis Terminal, DEX trading volume has surged 97.4% month-over-month, while daily protocol revenue climbed to $3.1M, up from ~$2.1M a few weeks ago. Daily transactions are holding above 429.4M, reinforcing consistent usage.

Whale activity is also shaping sentiment:

- As per Lookonchain, on May 22, a whale took a 5x leveraged short against HYPE, posting 2.05M USDC — only to face an $18.88M unrealized loss, with liquidation looming at $32.67.

- Data from Mitrade also highlighted another whale placing a $830M BTC long at 40x leverage on Hyperliquid, reflecting increasing platform confidence.

These whale movements — both failed shorts and bullish long entries — support the current uptrend in HYPE’s structure.

Conclusion: ATH in Sight, But Momentum Must Hold

Hyperliquid’s native token HYPE, is experiencing a textbook breakout scenario, backed by strong technicals and on-chain activity. With leverage piling up and whale shorts getting punished, the path to retesting $35 looks increasingly probable.

However, traders should monitor the $32.67 zone closely. A breakout above this level with rising volume could flip it into support and trigger a new ATH. Failure to breach may invite consolidation toward $28.20 or even $25.10.

Bullish bias remains intact while above $28.20. A breakout above $32.67 confirms upside continuation. Caution if RSI diverges or volume drops.