Companies such as Metaplanet, The Blockchain Group and Semler Scientific Bitcoin $106,616.75 While attracting attention with their accumulation rates, the “provision duration olan, which is a new metric, offers investors the opportunity to evaluate these companies more deeply. It calculates how long they can meet the market values of these metric companies with existing BTC accumulation rates. Companies with a high daily BTC return stand out with more realistic and sustainable Bitcoin strategies for investors.

What does Bitcoin show “provision time ,, why is it important?

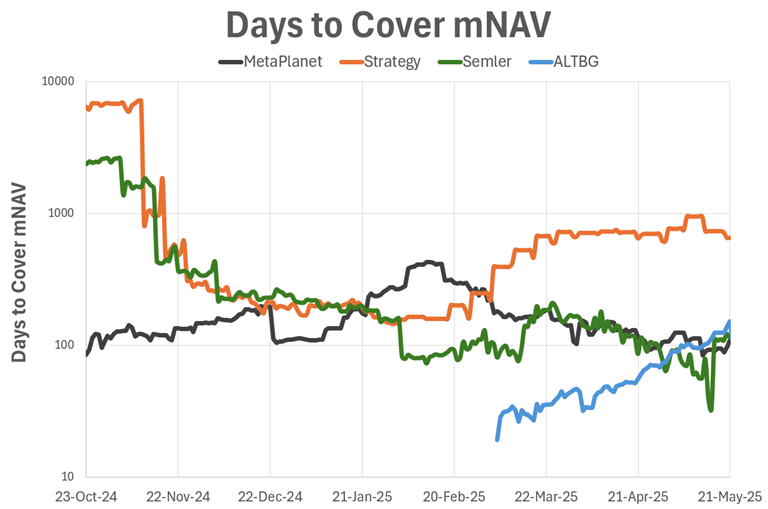

Blockstream CEO, one of the leading names in the Blockchain sector Man back It clearly demonstrates the loyalty of these new metric companies to Bitcoin. The “provision time özel calculates how long the market value of a company can be met on a BTC basis. For this reason, the ratio between the market value of the company and its BTC assets enclosure Daily BTC YELD is used with its value and daily BTC. The formula is simple: Ln (Mnav) / LN (1 + daily BTC return).

This formula is not only a numerical indicator. At the same time, it shows whether a company really accumulates BTC, or whether it is only trying to attract investors with a brand perception. For example Metaplanet‘s daily BTC return is 1.49 percent and this rate is calculated to meet the market value in 110 days. In the same way The Blockchain Group This period is 152 days. Although Microstrategy The company, which has a giant BTC portfolio, such as the daily return of the company is only 0.12 percent and the provision time is 626 days.

The guiding role for investors

While the crypto money market matures, investors only in the selection of companies BTC Not to the amount, but the speed of these Bitcoins have to look at. The “provision time” comes into play at this point. Thanks to this metric, investors can separate BTC stock companies from bets on Bitcoin.

The Blockchain Group, which has the shortest “provision time” data in March, has increased by 834 percent since then. Companies with a high daily return and balanced MNAV value offer a more attractive investment opportunity than this mistress. Especially for medium and long -term investors, it is possible to take positions before metric price movements.

In Bitcoin -based investment strategies, not only how much BTC holds, but also how rapidly accumulated these BTCs are a critical indicator. This new perspective is an important road map for investors who want to evaluate corporate Bitcoin investments and invest in their shares.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.