US Senateby signing a historical development for the crypto currency market, the draft law, which includes the regulation of the Genius ACT, has forwarded the draft law with 32 votes. This move Bitwise CIO Matt HouganAccording to, not only the regulation, but also the beginning of a long -term bull season. Hougan stated that with the adoption of the law, the crypto currency world and the traditional financial system “officially marry”. crypto currency lawHe believes that he will come into force.

Historical Reconciliation Between Wall Street and Crypto Money

GENIUS ACTThe US dollar crypto currencies are completely supported by state bonds or equivalent assets. In addition, the annual audit requirement for exporters with a market value of $ 50 billion will include regulations for foreign exporters and obligations for fighting money laundering. This means net rules for big players in the industry and a more solid legal ground.

It was reported that more than 60,000 support e-mails were sent before the vote in the Senate. Republican Senator, one of the architects of the draft law Bill Hagertywith this regulation, the US payment system will be moved to the 21st century, he said. Hougan goes even further, Spot Bitcoin $106,616.75 ETFHe argued that it was a more important milestone than the approval of their s. For him Ethereum (ETH)  $2,544.43, Solana (LEFT), Uniswap (UNI) and Aave Great Altcoins such as (Aave) will be the biggest winners of this new era.

$2,544.43, Solana (LEFT), Uniswap (UNI) and Aave Great Altcoins such as (Aave) will be the biggest winners of this new era.

Banks, Amazon and 2.5 trillion dollars

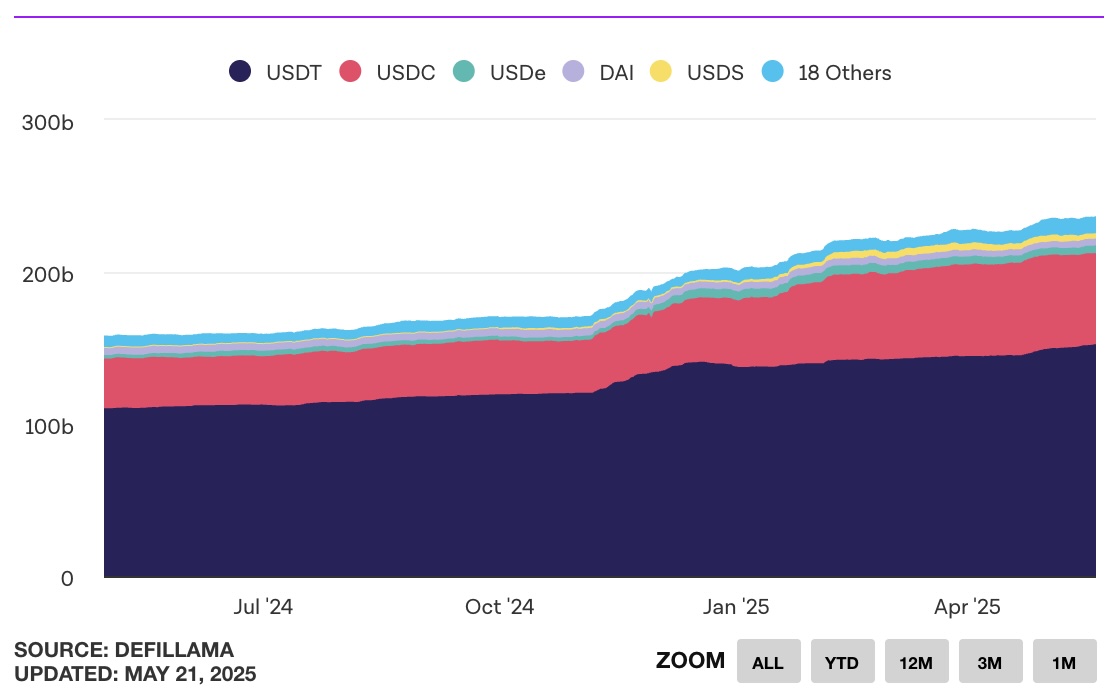

Although Stablecoins currently represented a $ 236 billion market, Bitwise CIO predicts that this figure can reach $ 2.5 trillion in a short time. Because the law allows large banks to remove their own stablecoins, and to receive payment directly to e-commerce giants with these money. For example Amazon It is no longer far from a future where companies such as companies can offer 2 percent discount on payments made with stablecoin instead of Visa.

According to Hougan, this development is only the beginning. When the transfer of US dollar through Blockchain becomes ordinary, there will be stocks, bonds and other financial assets. This will pave the way for the transport of the traditional financial system over $ 100 trillion to blockchain -based infrastructures. This scenario for investors Bitcoin A new growth period can be the starting signal of a new growth period in non -crypto currencies.

Stablecoin arrangement approved by the US Senate eliminates the uncertainty of regulation, one of the biggest deficiencies in the sector. The arrangement paves the way for both corporate adoption crypto currencyIt may initiate a long -term rise period for s.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.