The largest Altcoin Ethereum $2,544.43One of the founding partners of the (ETH) Jeffrey WilckeETH transfer of 262 million dollars of ETH has led to concern in the market. This transfer, which came with the rise trend of Ethereum in recent weeks, has raised the question of whether it is a sales signal or a wallet management strategy. Wilcke’s silence increased speculation, while there was no significant decrease in the price.

Wilcke’s transfer to Kraken confused

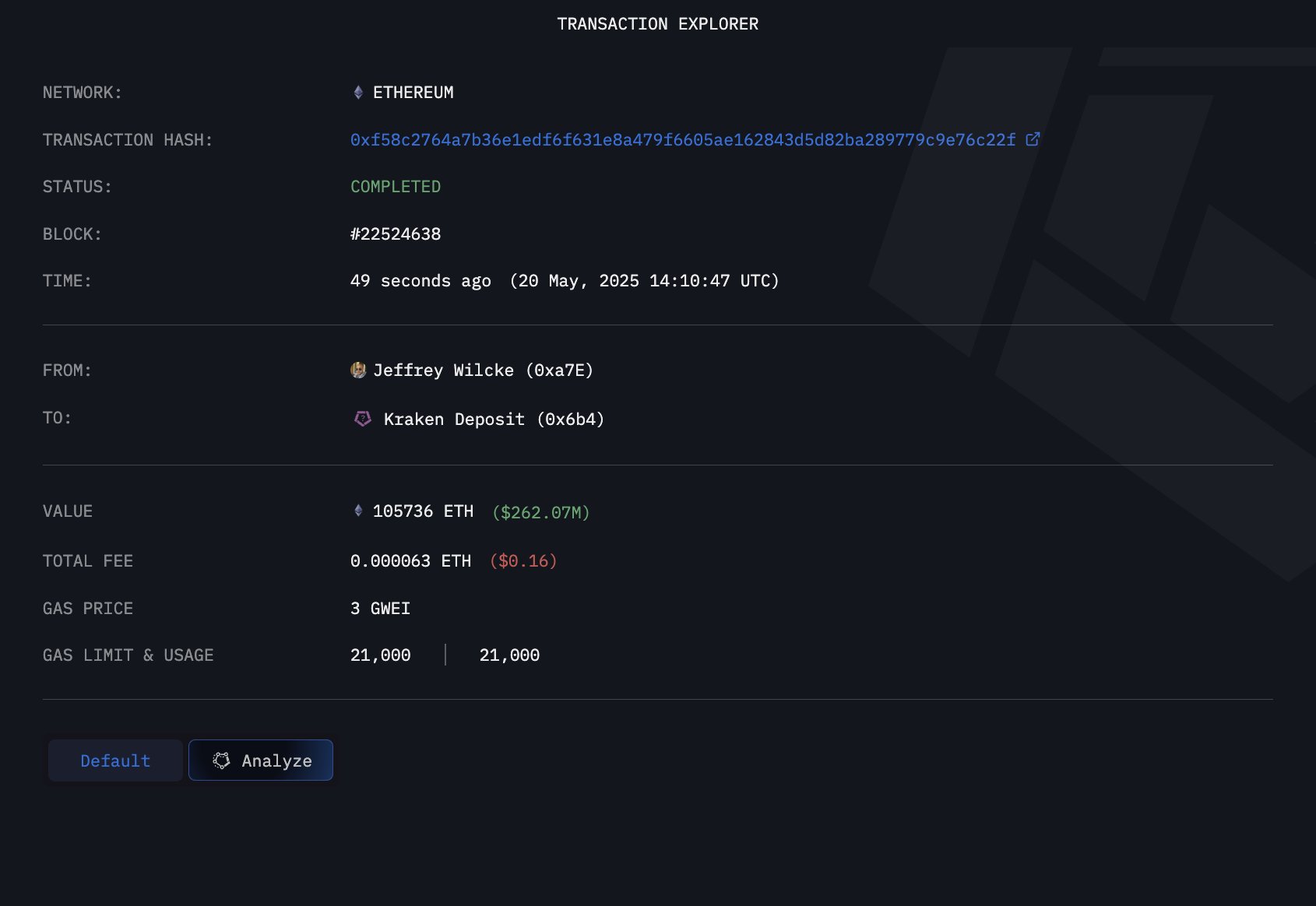

EthereumJeffrey Wilcke, one of the founding partners of the founding partners, transferred 105,000 ETH (about 262 million dollars) to the Kraken stock market from his long -standing wallet. The timing of the transfer was remarkable because the process Eth It took place immediately after the price exceeded 2 thousand 600 dollars. This development caused speculation that Wilcke would make a major sales.

After Wilcke, who had previously made a similar move in November 2024, after that period Ethereum price He reached the local summit and then remained in a harsh correction. For this reason, investors are concerned about the re -experienced scenario. Interestingly, Wilcke did not make any explanation about his transfer to Kraken this time, and only shared the process news. This increased uncertainty by creating a picture free of transparency.

So is this a distribution of funds or a sales preparation?

Although the transfer is thought to have a purpose of sales at first glance, some in -chain data indicate a different possibility. Crake The amount of ETH sent to the stock exchange was distributed evenly to eight different wallets. This shows that Coins may only have been re -positioned. Instead of making a large -scale sales of Wilcke, the possibility of distributing its assets to different addresses provides some relief to the market.

However, such major transactions directly affect investor psychology. In particular, a high -profile name such as Wilcke transfer funds to a stock market can naturally create panic atmosphere. However, there has been no serious decrease in the price of Ethereum so far. On the contrary, ETH managed to hold around 2 thousand 600 dollars. In addition, the total ETH supply in the stock exchanges decreased to 4.9 percent to the lowest level of the last 10 years. This shows that sales pressure in the market is reduced and offers a positive signal for long -term investors.

While the positive atmosphere continues on the Ethereum side, on the developers front EIP-7702 updateA possible mistake is discussed. It is not yet clear whether this will affect the speed of innovations in the network.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.