XRP Investors Again in excitement. Italian analyst Fabio Zuccara, “Ripple $2.32 What happens if it opens to the public. Due to the uncertainty of their plans, expectations are extremely optimistic.

What does Ripple’s public offering scenario promise for XRP?

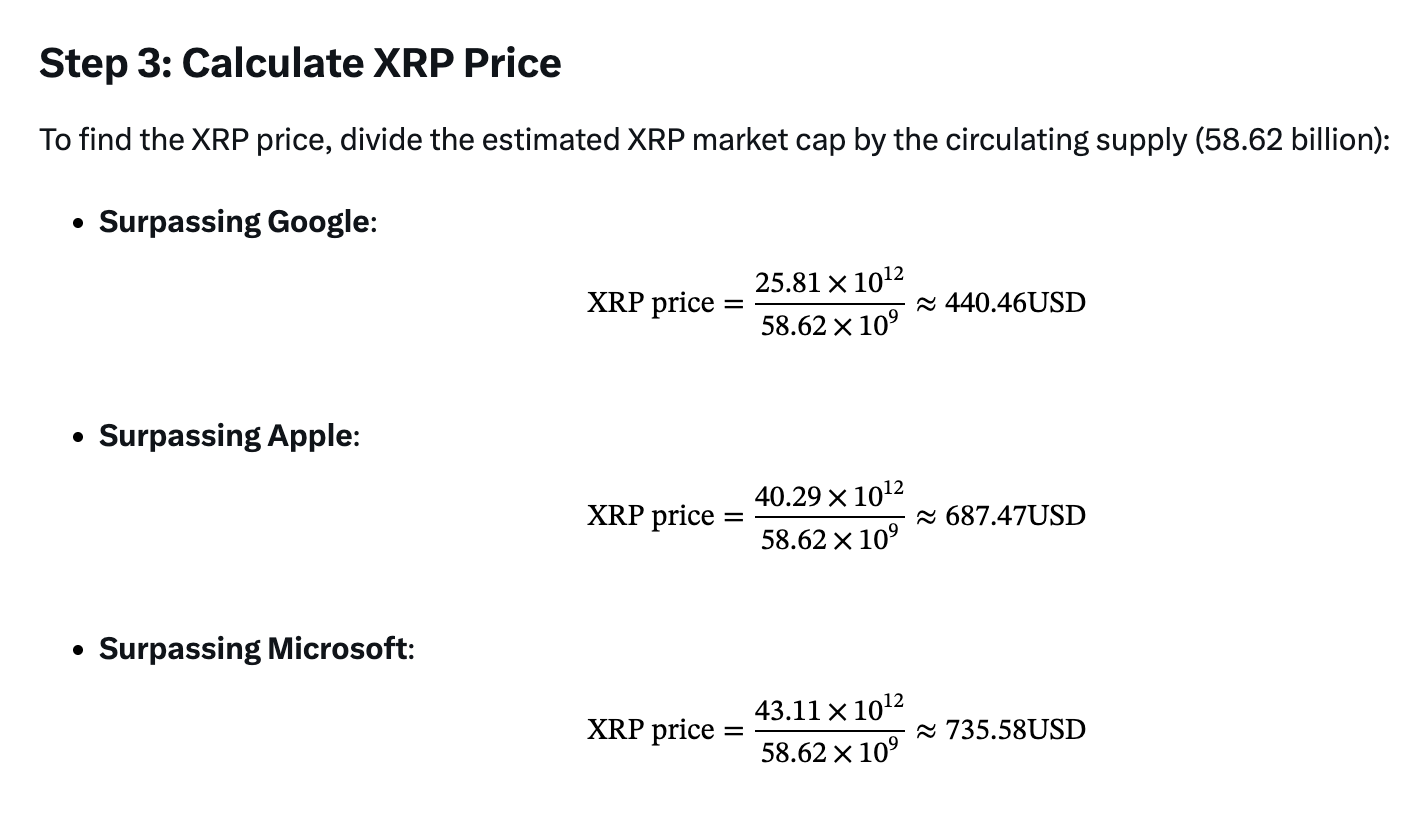

After a public offering according to Gok’s simulation RippleIf the value of Google reaches a market value of $ 2.02 trillion, the XRP price may rise to around $ 440. If the valuation is equalized to Apple’s $ 3.15 trillion, the estimated price dates back to $ 687 and Microsoft is compared to $ 735 compared to $ 3.37 trillion.

These brave numbers XRPToday, it corresponds to an unimaginable increase compared to the 58.62 billion circulating supply and a market value of $ 137.36 billion. Zuccara called for optimistic audience, saying, “When Ripple is opened to the public, the company’s profitability and institutional growth expectation can push the XRP demand up like a domino stone,” Zuccara said.

However, it should not be forgotten that Ripple Labs’s existing private market value is only 10.88 billion dollars. The company has not announced a definite calendar for public offering so far and CEO Brad Garlinghouse He recently stressed that public offering plans do not “appear on the horizon”. However, the community argues that a possible premium public offering can directly bring positive waves to XRP. Especially if the adoption of global crypto money accelerates, this is inevitable.

The most realistic predictions for XRP

According to the cautious part of the market, the target of $ 735 is far from realism. Many crypto money analysts find it more reasonable by 2030 to the $ 3–20 band even if there are regular growth. As the biggest reason for this XRP CoinThe price dynamics of the price are not only dependent on the performance of Ripple, but also on the climate of global regulation and the dependence on corporate liquidity. Selection The shadow created by his cause is still not fully lifted, and therefore the investor trust is quite fragile.

The other obstacle is the regulatory clarity. Crypto currency legislation in G20 countries is still patchy bundle. Banks and funds need open road maps, especially in the US and the EU before they enter a large volume. Even if the corporate capital is not withdrawn, even the most optimistic ripple valuation may not be able to throw the XRP price alone. Nevertheless, the community maintains its positions in “Wait – Gör” mode. He believes that a possible public offering announcement can start a new era in the price graph.

XRP manages to remain on the agenda with speculation of Ripple’s possible public offering. However, the three -digit price targets continue to be a dream for now without clarifying dates and gaining acceleration for global adoption.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.