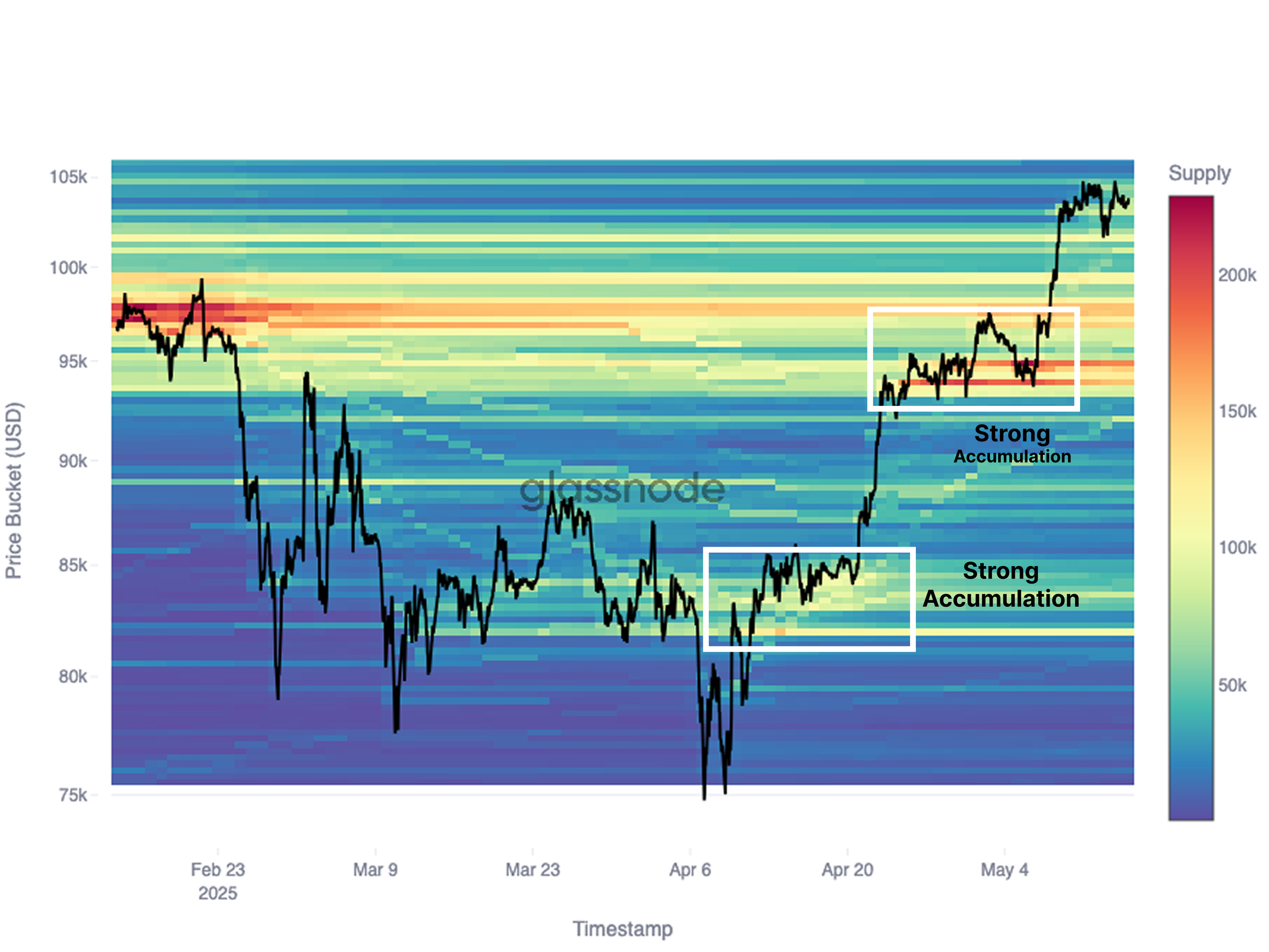

Bitcoin (BTC) $103,805.78since last week, while maintaining the threshold of 100 thousand dollars, the main element that triggered the rise was strong corporate fund inputs. The demand for Spot Bitcoin ETFs climbed up to $ 389 million per day in the week of April 25th. On April 22, a record entrance of $ 933 million was recorded. The price was supported by the psychology of “buy on sales” from the bottom of the 75 thousand dollars in April, while a stepped climb extending to 106 thousand dollars was observed. Glassnode analysts reported that the rise has put short-term investors land and that the $ 93-95,000 band could create a strong defense line in a possible retreat.

Corporate fund flows brought Bitcoin demand to the summit

Spot Bitcoin ETFIt was the main engine that feeds the rise acceleration of the capital market. The amount transferred to the Wall Street wallets increased at unprecedented speed during the week of April 25th. This momentum has proved that corporate investors are still on the table. Although the inputs have declined to around 58 million dollars today, the fund basic asset ”approach enables the price to hold the price over 100 thousand dollars.

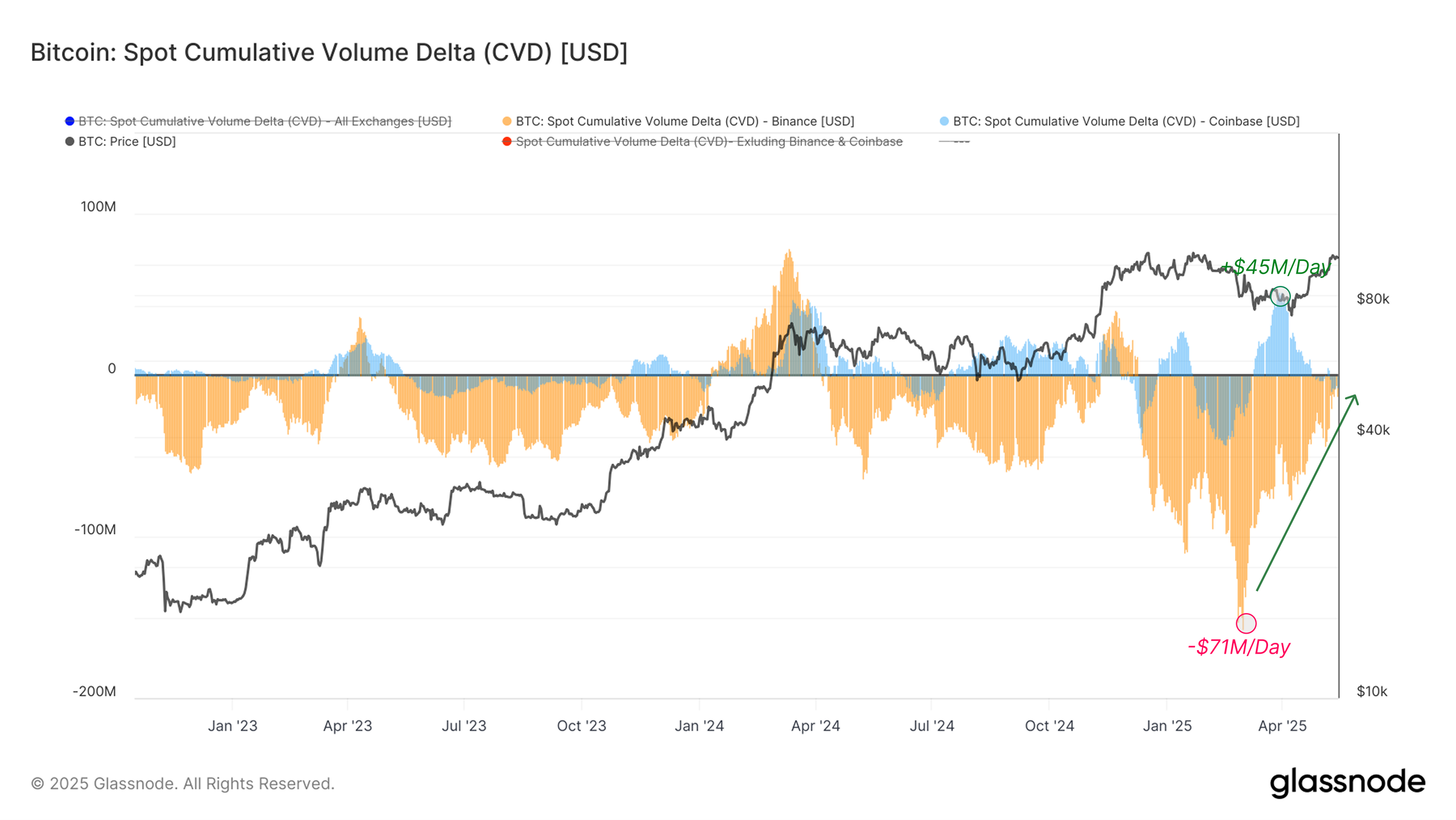

There is a similar picture on the stock market façade. Spot Cumulative Volume Delta data Coinbase While pointing to the procurement pressure of up to 54 million dollars per day, Binance‘sales orders fell from 71 million to $ 9 million.

This imbalance between demand and supply led to the exhaustion of stocks at narrow price ranges and then sudden up -to -row attacks. In short, the movement of corporate money and individual investors together embodied the discourse of “each decline is a new step”.

PROFIT REALIZATION PRICE OF SHORT INVESTORS

Another leg of the market dynamics has created the behavior of short -term investors who opened positions in the last 155 days. Glassnode Data showed that a significant amount of Bitcoin was collected in the range of 93-95 thousand dollars and that the profit rate of this group increased to 90 percent. The request for the profit realization of the rise led the price towards the end of the week to the price of 102 thousand to 103 thousand 700 dollars.

From Brn Research Valentin Fournierthe indicators give a “moderate sales signal ,, and the price can slightly hang down with the slowdown of corporate transactions at the weekend. On the other hand, Glassnode thinks that the $ 93-95,000 band has become a powerful buyer region, and that potential retreats may be limited.

In addition to all these, if the transaction volume is revived in the market, 107-110 thousand dollars are shown as the next target zone for Bitcoin.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.