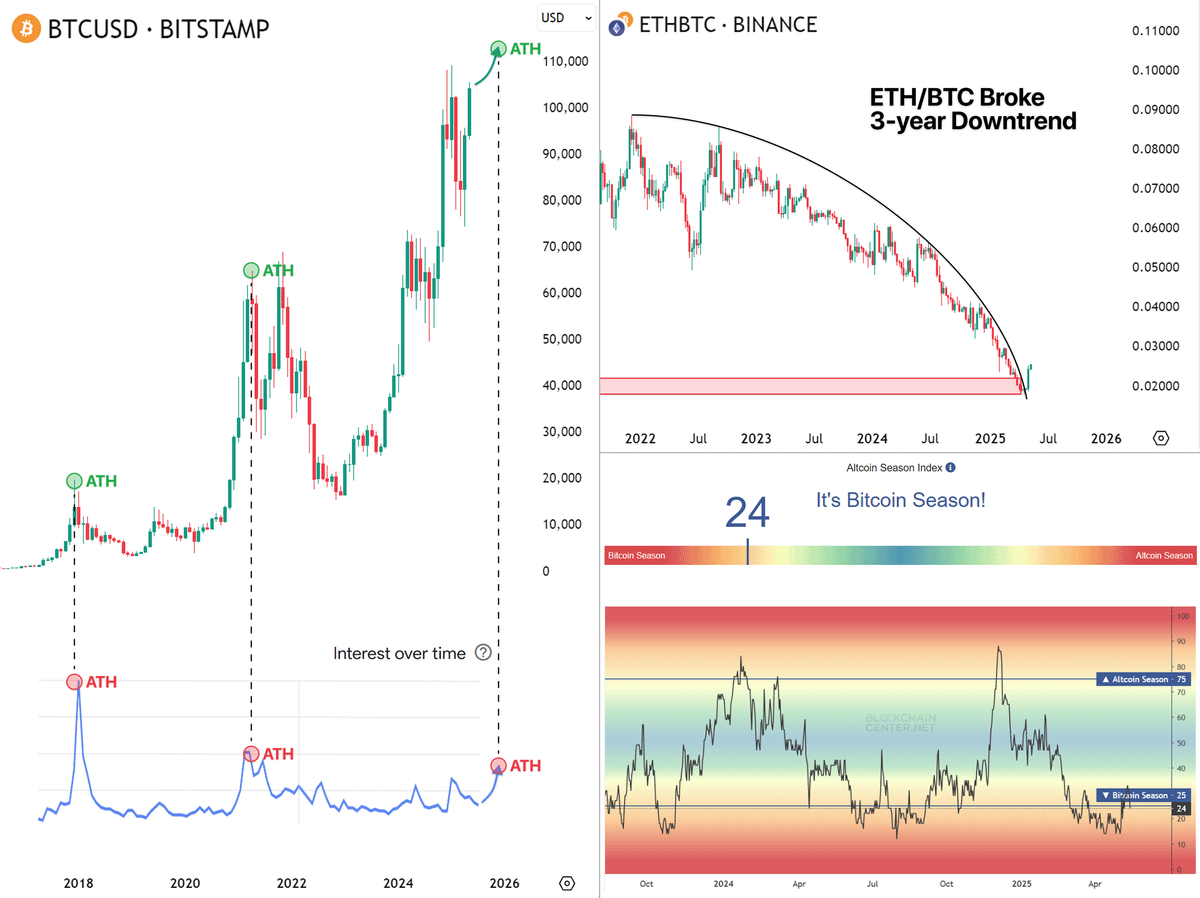

Altcoin seasonExpectations for the ceiling again. Trader and Melek Investor “Cyclop”, which has seven -year market experience, announced on May 15 that he saw the Most Clear Bull Institution so far. Bitcoin (BTC) $103,805.78 While one step away from the summit of all-time, individual investor interest is at the bottom level. On the other hand, ETH/BTC parity broke the three -year -old trend and Altcoin Index Bounces from strong support began to rise. In the past, each sign alone wick the rally, but this time they all burn at the same time.

Determining market signals for the Altcoin season become clear

Bitcoin It is no longer a speculative game, but as the presence of “macro value storing ği adopted by corporates. On the other hand, Big Layer-1 projects, especially Ethereum  $2,631.28 And people like Solana took on the identity of technology infrastructure instead of the label alternative to Bitcoin ”.

$2,631.28 And people like Solana took on the identity of technology infrastructure instead of the label alternative to Bitcoin ”.

The expansion of global liquidity increases the amount of circulating stablecoin and Coinmarketcap’s leap of Altcoin Index from 15 to 26 completes the classic combination in the previous Altcoin runs. Cryptorank data draws similar tables. The indicator climbed 27 from the middle levels of last week. In the past cycles, this data set is accompanied by hitting the individual investor interest. altcoin‘s was seen to rise with the multiplier effect.

Moreover, Google Trends reveals that the searches of “buy crypto currency” searches are at the lowest level of three years. This calm allows long -term investors to add a portfolio, while reminding the classical scenario in which the individual investor audience is late. On the other hand, the Altcoin Index’s Price-Momentum Discrimination (Bullish Divergence) signaled the trend change in previous cycles. The Taurus Front argues that a similar separation will trigger the chain rally in this summer.

So what does ETH/BTC parity and BTC.D data say?

ETH/BTC After the parity declined to 0.018 in March, it increased to 0.025 in the last two weeks. Thus, the three -year falling trend line was broken. This says the risk appetite in the market has increased. However, experts find it important that the total market value of Altcoins produces “gold intersection” in the daily graph. The same formation was seen in October 2024 and produced the “Mini Altcoin season”, albeit short -term. Nevertheless, analysts say that there may be a horizontal-raid jam for a while before triggering a large-based rally.

Showing Bitcoin’s dominance on the market Btc.d The indicator fell from 65.4 percent to 62 percent last week. The decline in BTD.D has shifted the capital in the market gradually shifted to the Altcoins. However, there is a mixed course throughout the market. While some investors receive early profits, others are busy collecting coins to get a position for the potential delayed rally.

If the harsh price mobility in the short term, even if the table is protected from the intact appearance in the lock indicators, analysts agree that a full -fledged subcoin season is now coming.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.